Could Macro Tailwinds Elevate the Investment Case for Himax (HIMX) Despite Sector Volatility?

- Last week, Himax Technologies participated in both the 6th Annual Needham Virtual Semiconductor & SemiCap 1x1 Conference and the Taiwan Tech Forum 2025, sharing company updates and industry insights with investors and peers.

- While these events provided visibility for Himax, broader optimism for semiconductor stocks was primarily fueled by Federal Reserve policy remarks and a strong Chinese market backdrop.

- We'll explore how the macro-driven boost to semiconductor sentiment may influence Himax Technologies' investment outlook and risk factors.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Himax Technologies Investment Narrative Recap

For investors considering Himax Technologies, belief in the company’s ability to capitalize on growth in automotive display ICs and emerging smart devices remains central. The recent spike in share price, driven by macroeconomic optimism about interest rates and the strength of Chinese semiconductor markets, delivered a short-term boost but does not directly change the key catalyst of expanding automotive applications, nor does it resolve persistent risks from sector-specific demand volatility or global trade policy uncertainty.

Among Himax’s recent announcements, the July launch of the bboni Ai endpoint AI sensing system for wearables stands out. As growth in ultra-low power AI and sensor applications is viewed as a long-term catalyst, this new product broadened Himax’s exposure to high-value, emerging technology segments, though the immediate impact on the company’s core revenue drivers remains limited for now.

However, despite rising sector sentiment, investors should be mindful that ongoing macroeconomic uncertainty and cautious customer buying patterns could still…

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' outlook anticipates $1.1 billion in revenue and $139.3 million in earnings by 2028. This scenario implies a 7.4% annual revenue growth and a $65.1 million increase in earnings from the current level of $74.2 million.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 19% upside to its current price.

Exploring Other Perspectives

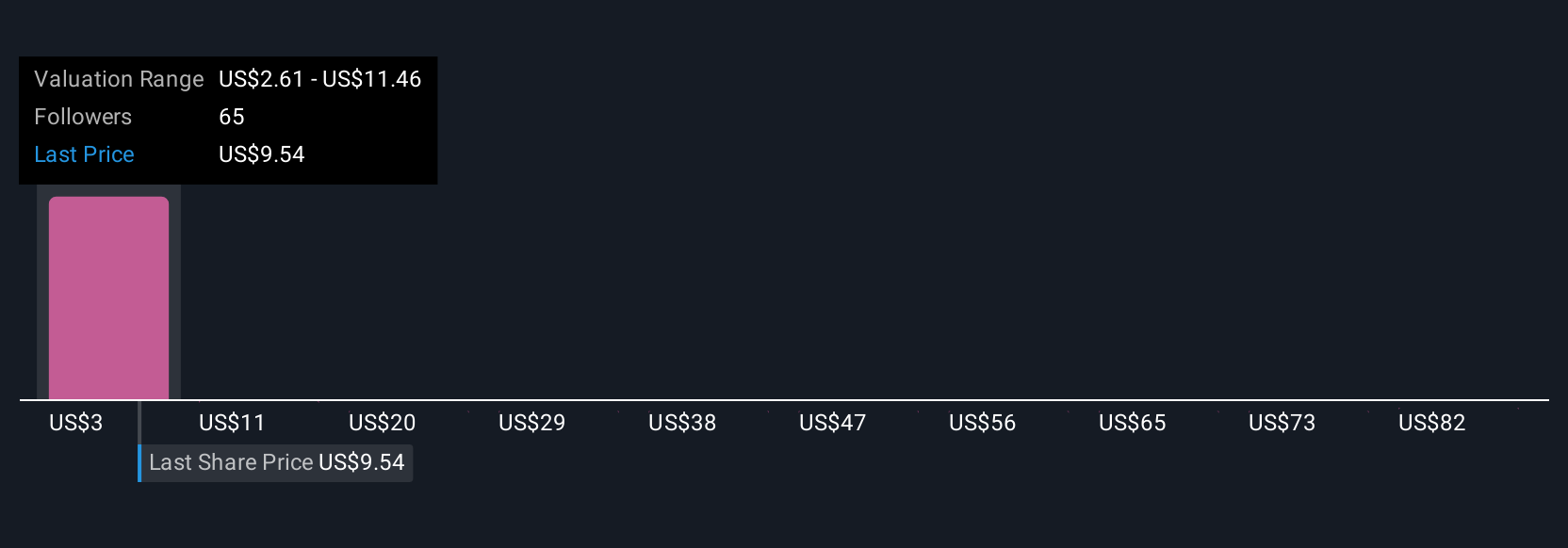

Eight individual fair value estimates from the Simply Wall St Community span a wide range, from US$1.51 to US$91.18. Against this backdrop, keep in mind that persistent order delays and weak near-term revenue visibility may weigh on any sustained business recovery, making it essential to consider several viewpoints before acting.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be a potential multi-bagger!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal