Green Brick Partners (GRBK): Evaluating Valuation After Strategic Houston Expansion and New Community Launch

Green Brick Partners (GRBK) is making headlines after breaking ground on its first Houston-area community, Riviera Pines. This expansion brings the company’s subsidiary, Trophy Signature Homes, into a fast-growing Texas market and signals determination to grow beyond its Dallas-Fort Worth roots. For investors, launching an all-new community in a competitive region like Houston is more than just a milestone. It marks a strategic attempt to capture new demand and diversify revenue streams at a time when many homebuilders are grappling with higher interest rates and shifting consumer sentiment.

This push into Houston comes after a year of mixed fortunes for Green Brick Partners. Despite a volatile housing market, shares are up nearly 28% year-to-date and have surged almost 18% in the past 3 months, suggesting that optimism has been building around the company’s growth prospects. However, this contrasts sharply with last year’s decline of over 10%, hinting at changing market views on Green Brick’s risk profile and earnings potential. Broader sector headwinds remain, even as management moves ahead with key initiatives and previous insider transactions draw some attention.

With all of these moves in play, the real question is whether the recent share price rally reflects genuine, long-term value or if the market is already building future success into today’s price. Is Green Brick Partners setting up for a buying opportunity, or has the growth story already been recognized by investors?

Most Popular Narrative: 14.6% Overvalued

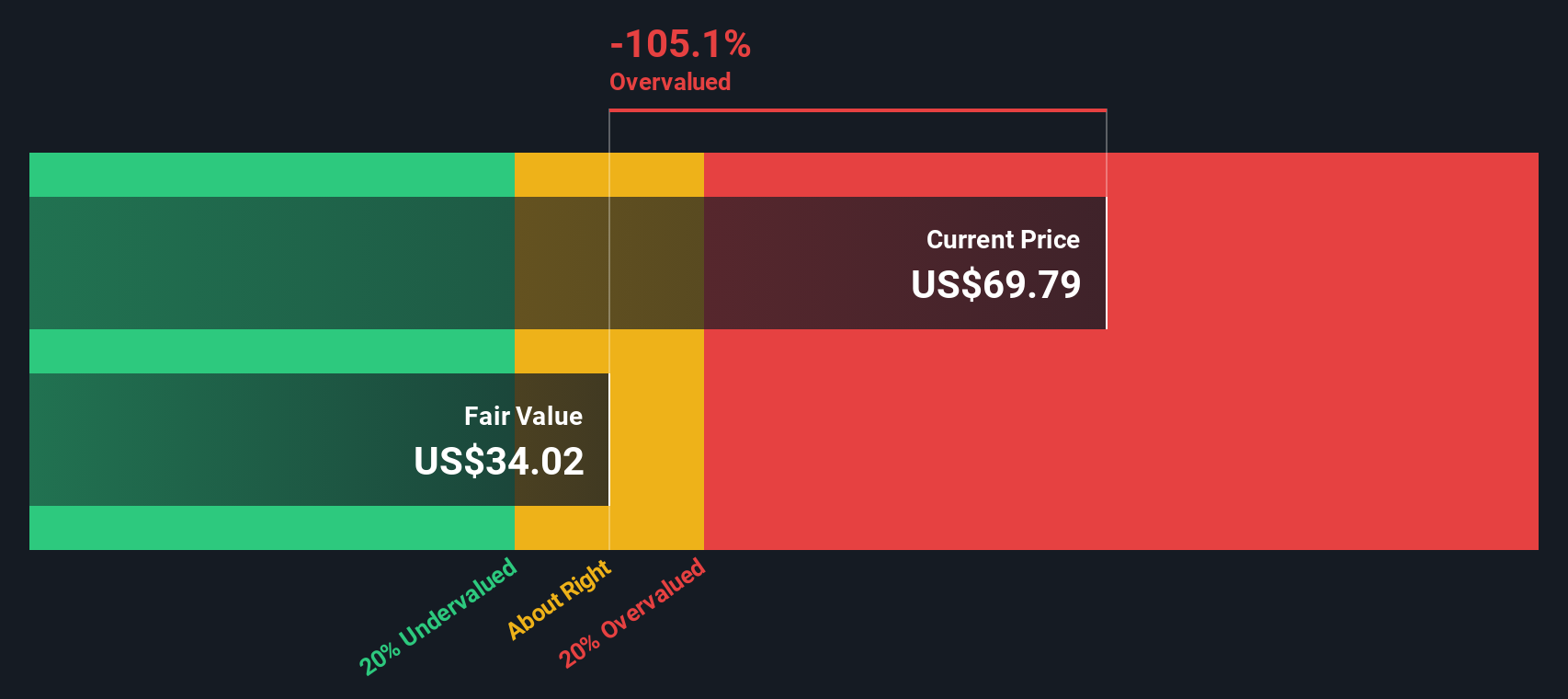

According to community narrative, Green Brick Partners is currently considered overvalued, trading at a premium compared to the fair value derived from projected earnings and margins.

Persistent underbuilding in US housing, combined with the millennial cohort entering prime homebuying years, supports a secular supply-demand imbalance that could buoy home prices and unit sales in the coming years. This trend may benefit Green Brick's revenue outlook. Green Brick's robust balance sheet (net debt/total capital just 9.4%, significant liquidity, low-cost fixed-rate debt) positions the company to capitalize on distressed opportunities and continue share repurchases. These factors could provide downside support to the share price and enhance earnings per share through buybacks.

Ever wonder what is powering this bold price target? Analyst models are factoring in future earnings that may be difficult to surpass, shifting profit margins, and a key financial ratio that could signal a changing industry landscape. What is the reason behind their numbers? Learn more about the story that could influence how this valuation is viewed.

Result: Fair Value of $62.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong home closings and resilient margins in core markets could counter the bearish view. These factors may offer possible upside if these trends continue.

Find out about the key risks to this Green Brick Partners narrative.Another View: Discounted Cash Flow Perspective

While the current valuation looks expensive based on standard earnings ratios, our DCF model presents a different perspective. It suggests the stock may be even further above its long-term intrinsic value. This raises the question of whether there is excessive optimism or if more growth lies ahead.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Green Brick Partners Narrative

If you have a different perspective or want to dive into the numbers on your own terms, you can quickly shape your own view and do it your way.

A great starting point for your Green Brick Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by targeting the market’s most promising trends. Don’t just settle for the usual picks. Staying ahead means seeking out opportunity where others overlook it. Level up your portfolio now and be the first among your peers to spot tomorrow’s winners.

- Tap into companies poised to benefit from healthcare innovation by checking out the latest healthcare advancements through healthcare AI stocks.

- Uncover income opportunities and boost your portfolio’s yield by reviewing a selection of stocks offering impressive payouts via dividend stocks with yields > 3%.

- Find real value in overlooked companies trading well below their worth by digging into stocks with favorable cash flow fundamentals using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal