Darling Ingredients (DAR): How Insider Moves and New Joint Venture Shape Its Valuation Outlook

Darling Ingredients (DAR) is back on investors’ radar this week after a flurry of activity. Chairman and CEO Randall Stuewe sold 62,500 shares, Piper Sandler trimmed its outlook for the stock, and in the same window, the company launched Nextida, a new joint venture intended to push into health and wellness. The insider sale and reduced price target both highlight the uncertainty surrounding renewable diesel margins given a shifting regulatory landscape, while management is actively seeking new growth avenues.

All this comes as Darling Ingredients’ stock has drifted in and out of favor this year. Shares are up just 1% since January and have gained 7% in the past three months, but the long-term trend is harder to ignore: the stock is down 13% in the past year and has lost over half its value in three years. Despite positive revenue and net income growth, momentum remains mixed as investors weigh near-term headwinds against the company’s efforts to adapt and reposition for the future.

After this string of insider moves and high-profile strategy shifts, is Darling Ingredients trading at a bargain, or is the market already anticipating whatever comes next?

Most Popular Narrative: 26.7% Undervalued

According to community narrative, Darling Ingredients is considered significantly undervalued based on analyst consensus, which forecasts a strong recovery and growth over the next few years.

Ongoing expansion into high-growth, high-margin specialty ingredients through the Nextida JV and rising global demand for health and wellness products (such as collagen and functional peptides), supported by scientific validation and early repeat orders, is expected to broaden Darling's product portfolio, diversify revenues, and contribute to Food segment EBITDA growth beginning in 2026.

Want to know what’s powering this bullish outlook? The key factors include a combination of margin expansion and accelerated earnings growth. Consider valuation benchmarks that could redefine your expectations. Interested in which forecasted trends are behind analysts' optimistic outlook? The story may be more significant than it appears.

Result: Fair Value of $47.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty and potential weakness in renewable fuel margins could quickly change Darling’s outlook if there are shifts in policy or if demand falls short of expectations.

Find out about the key risks to this Darling Ingredients narrative.Another View: Earnings Multiple Signals a Different Story

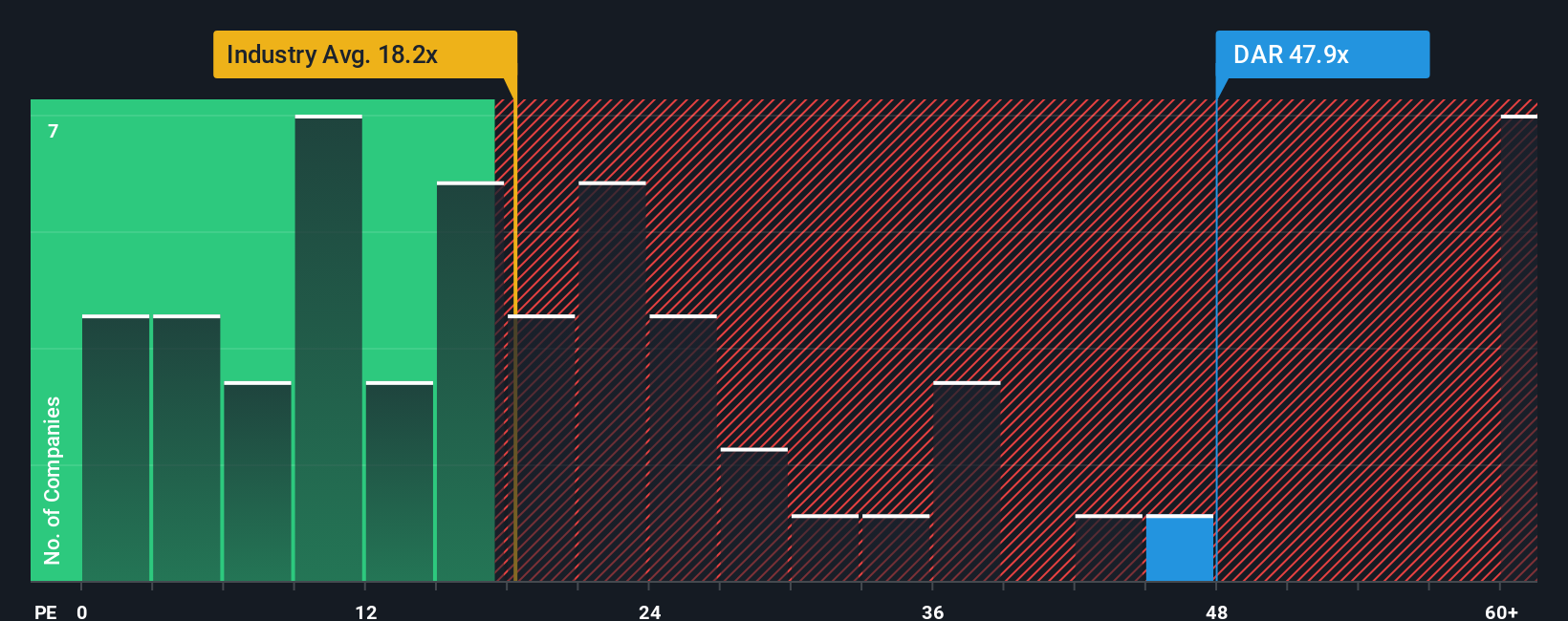

While analysts see upside ahead, a look at the company's price compared to its profits suggests Darling Ingredients is trading at a much higher valuation than others in its industry. This raises the question of whether the optimism in growth forecasts is justified.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If you are not convinced by these takes or want to dig deeper, you can start building your own perspective on Darling Ingredients in just a few minutes, do it your way.

A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Take your investing strategy to the next level with fresh ideas that could shape your portfolio’s future. Don’t let valuable opportunities slip by. Seize these handpicked selections powered by Simply Wall Street’s research tools:

- Grow your passive income and secure steady cash flow by checking out dividend stocks with yields over 3% through dividend stocks with yields > 3%.

- Spot the next wave of technological disruption when you investigate top companies pioneering advancements in quantum computing via quantum computing stocks.

- Capitalize on cutting-edge breakthroughs in healthcare by exploring promising companies harnessing artificial intelligence in the medical field with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal