Does Semilab Deal and Conference Activity Signal a Strategic Shift for Onto Innovation (ONTO)?

- Onto Innovation recently participated in the 6th Annual Needham Virtual Semiconductor & SemiCap 1x1 Conference and the Oppenheimer 28th Annual Technology, Internet & Communications Conference, showcasing its latest developments and strategic direction.

- These events came shortly after the announcement that Onto Innovation is acquiring Semilab International’s materials analysis unit, a move expected to significantly enhance its revenue and margin profile by the second half of 2025.

- We'll explore how the anticipated boost from the Semilab acquisition and mixed analyst signals may reshape Onto Innovation's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Onto Innovation Investment Narrative Recap

To own Onto Innovation, an investor needs to believe that demand for advanced packaging and AI-driven chip technologies will rebound, fueling growth for Onto's metrology and inspection solutions. The company's recent participation in key industry conferences supports its technology leadership but does not directly affect its most pressing catalyst, the successful integration and impact of the Semilab acquisition, nor does it materially reduce the primary risk of delayed customer spending in core end markets.

Among recent announcements, the expected acquisition of Semilab International’s materials analysis unit stands out. This move is set to expand Onto's product offering and is projected to lift both revenue and profit margins, serving as a central driver for potential earnings growth and reinforcing Onto’s role in next-generation chip production.

Yet, despite these growth opportunities, investors should be aware that a slower than expected recovery in AI packaging demand or delays in customer spending could...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.4 billion revenue and $311.2 million earnings by 2028. This requires 11.0% yearly revenue growth and a $111.3 million increase in earnings from $199.9 million today.

Uncover how Onto Innovation's forecasts yield a $125.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

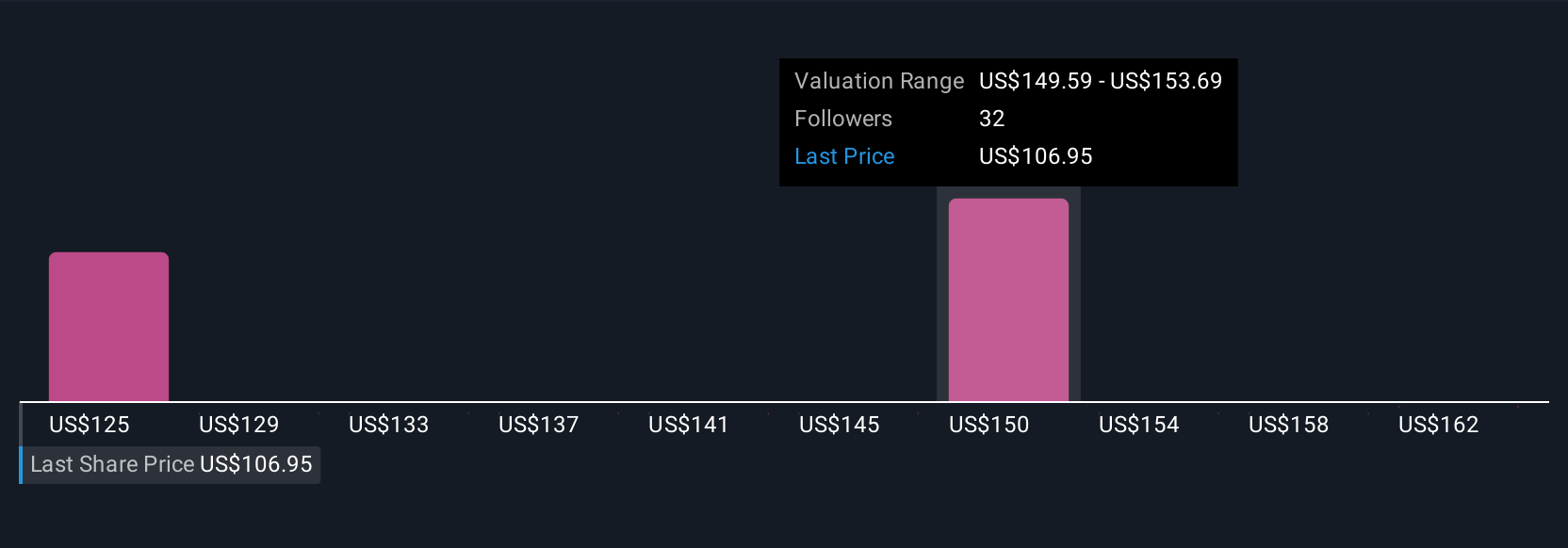

Three members of the Simply Wall St Community put Onto Innovation’s fair value between US$125 and US$165.99 per share. While opinions vary, many continue to watch the risk from customer demand cycles, reminding you that outlooks can differ sharply and are well worth comparing.

Explore 3 other fair value estimates on Onto Innovation - why the stock might be worth as much as 53% more than the current price!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal