Qorvo (QRVO) Valuation in Focus After $649 Million Shelf Registration Announcement

If you have been watching Qorvo (QRVO) lately, you might have noticed the company just filed a shelf registration for over $649 million in common stock, sparking conversations among investors. This move could be a signal that Qorvo is preparing to raise fresh capital, which companies sometimes use for funding new projects, acquisitions, or to bolster their balance sheets. Naturally, these kinds of filings make people curious about what management has planned next and whether new shares could impact the value of existing holdings.

Over the past year, Qorvo’s stock hasn’t given holders much to celebrate, ending down by 17%. Yet the momentum over the past month and past 3 months has been upbeat: shares are up 9% and 21%, respectively, suggesting some traders are warming up to the company’s prospects. Alongside the fresh shelf filing, Qorvo also reported shareholder votes from its annual meeting, with routine board changes and proposals making headlines but not driving major surprises. There is a sense that investors might be positioning ahead of something bigger, or that market expectations are shifting as 2025 unfolds.

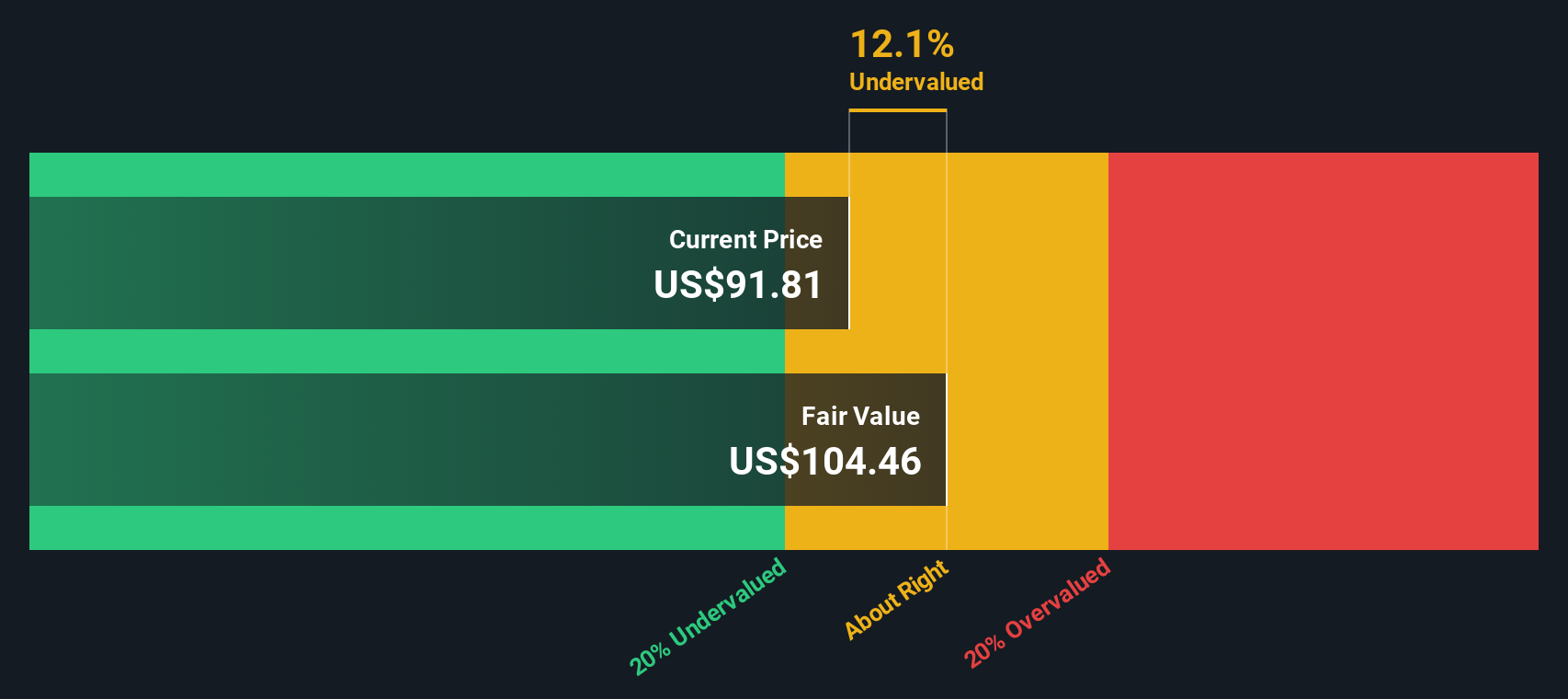

With this new shelf registration on the table and the stock rallying off its lows, the question remains whether Qorvo is trading at a discount ahead of stronger growth, or if the potential is already factored into the price.

Most Popular Narrative: 4.5% Undervalued

According to community narrative, Qorvo is currently seen as modestly undervalued, with the company’s shares trading just below its consensus fair value.

The proliferation of connected devices in automotive, industrial, and consumer IoT, as shown by new automotive ultra-wideband wins, AR/VR design victories, and enterprise network content gains, positions Qorvo to capture growing semiconductor demand and diversify revenue streams. This reduces dependence on cyclical end-markets and smooths earnings.

Wondering what’s powering these bold projections? The most popular narrative highlights game-changing shifts in Qorvo's end-markets, along with a sharp rise in profit margins and earnings that defy sector averages. Curious which assumptions are fueling this valuation? Explore the underlying analyst math and discover the unexpected drivers pushing Qorvo’s estimated fair value higher.

Result: Fair Value of $97.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a single customer and slower growth in new market segments could quickly challenge this positive outlook.

Find out about the key risks to this Qorvo narrative.Another View: Our DCF Model's Take

Looking at Qorvo through our DCF model provides a different perspective compared to multiples-based analysis. The DCF suggests that Qorvo is still trading below its fair value, which adds another layer to the debate. Is this a sign of opportunity, or does it hint at hidden risks that may not be immediately apparent in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Qorvo Narrative

If this perspective doesn’t quite fit your outlook or you’re eager for a hands-on approach, dive into the numbers yourself and craft a personalized take in just a few minutes. do it your way.

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Great Investment Ideas?

Smart investors always keep an eye out for fresh opportunities. When you’re ready to expand your watchlist beyond Qorvo, explore these hand-picked stock shortlists to stay ahead of the trends shaping tomorrow’s market winners.

- Target steady income with dividend stocks with yields > 3% and put cash-generating businesses at the core of your strategy.

- Uncover game-changers in healthcare by checking out healthcare AI stocks, which highlights the intersection of science and AI innovation.

- Get ahead of the next wave in technology by researching quantum computing stocks to learn more about companies at the forefront of the quantum revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal