Organogenesis Holdings And 2 Other Penny Stocks To Consider For Your Portfolio

With the recent surge in U.S. stock markets, driven by expectations of possible interest rate cuts, investors are increasingly exploring various opportunities to optimize their portfolios. Penny stocks, a term that often refers to smaller or newer companies with shares trading at lower price points, continue to capture attention due to their potential for growth and value. By focusing on those with solid financial health and promising fundamentals, investors can uncover hidden gems that might offer stability alongside potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.30 | $492.9M | ✅ 5 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.55 | $1.02B | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.85 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.38 | $253.73M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.12 | $191.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.92 | $23.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.37 | $20.27M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.01 | $90.86M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.47 | $595.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 382 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Organogenesis Holdings (ORGO)

Simply Wall St Financial Health Rating: ★★★★★☆

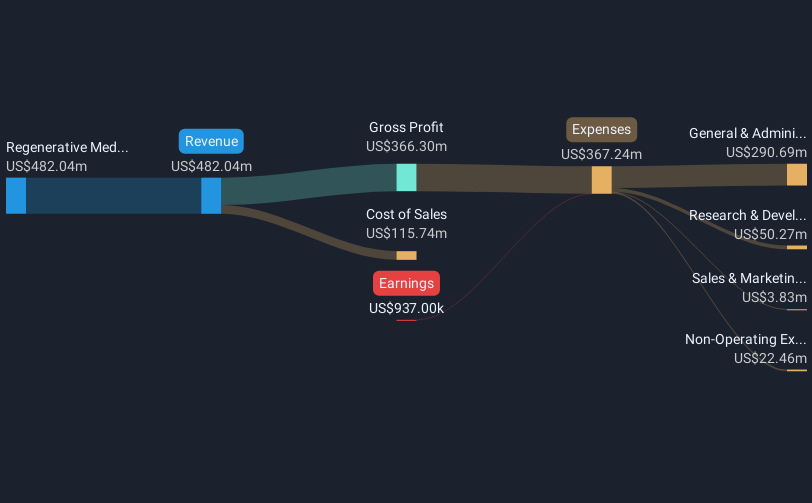

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of approximately $620.33 million.

Operations: The company's revenue is generated entirely from its Regenerative Medicine segment, which reported $429.53 million.

Market Cap: $620.33M

Organogenesis Holdings Inc., with a market cap of US$620.33 million, faces challenges as it navigates the penny stock landscape. Despite being debt-free and having seasoned management, the company is currently unprofitable with a negative return on equity of -2.28%. Recent earnings revealed a decline in revenue to US$101.01 million for Q2 2025 compared to the previous year, alongside net losses narrowing slightly to US$9.39 million. The company has updated its full-year guidance, expecting flat to modest revenue growth and potential profitability by year's end while managing less than one year of cash runway if growth continues at historical rates.

- Jump into the full analysis health report here for a deeper understanding of Organogenesis Holdings.

- Understand Organogenesis Holdings' earnings outlook by examining our growth report.

Conduent (CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of approximately $442.33 million.

Operations: The company's revenue is derived from three primary segments: Commercial ($1.57 billion), Government ($935 million), and Transportation ($585 million).

Market Cap: $442.33M

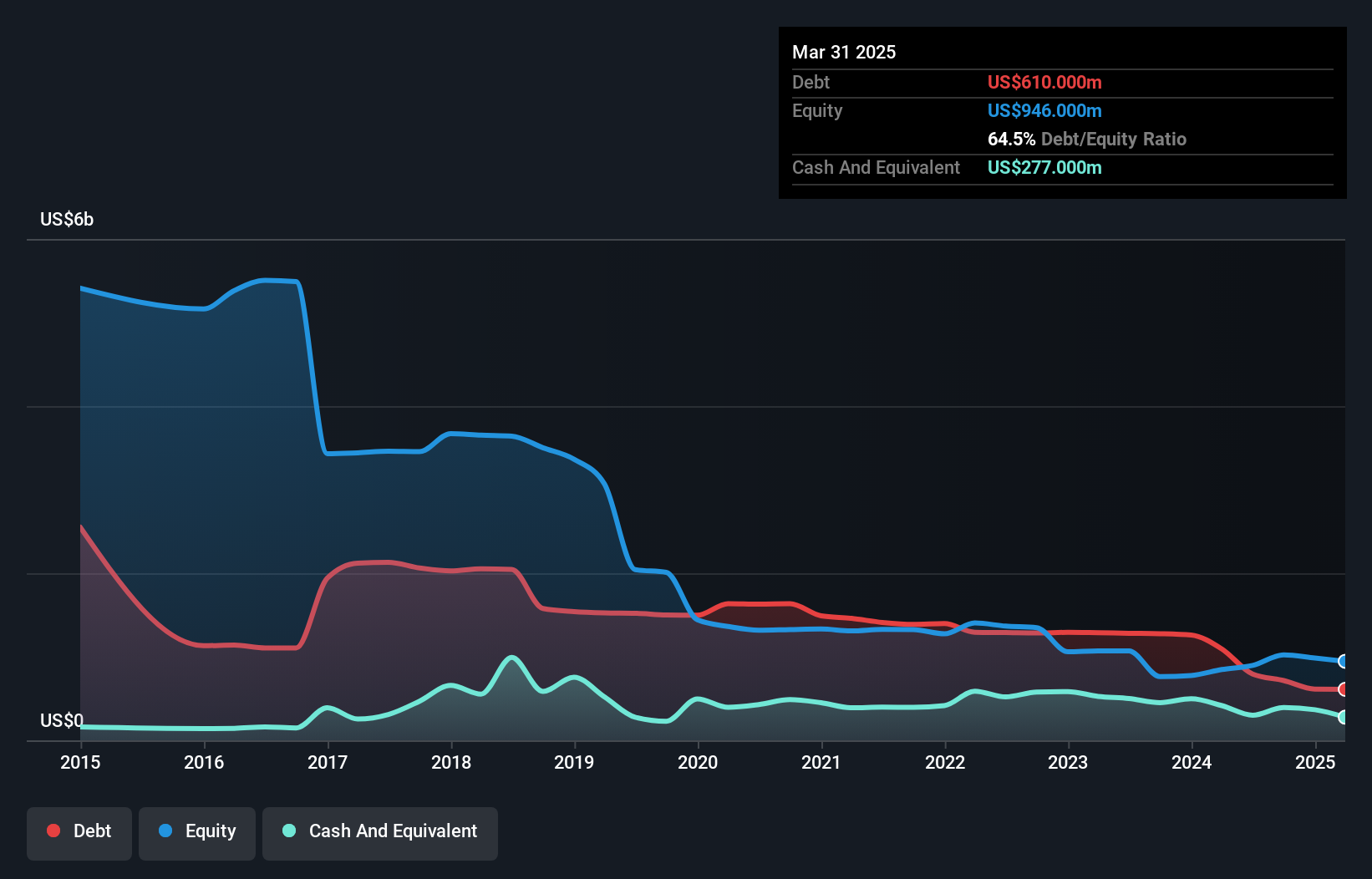

Conduent Incorporated, with a market cap of US$442.33 million, is navigating challenges typical of penny stocks. The company has seen declining sales, reporting US$754 million for Q2 2025 compared to US$828 million the previous year, resulting in a net loss of US$40 million. Despite this, Conduent's debt management shows progress with its net debt to equity ratio at a satisfactory 36.7%. Recent strategic collaborations and product innovations aim to enhance operational efficiency and cost savings for clients. Additionally, the company announced a share buyback program up to US$50 million over three years, reflecting confidence in its long-term prospects.

- Dive into the specifics of Conduent here with our thorough balance sheet health report.

- Gain insights into Conduent's future direction by reviewing our growth report.

RPC (RES)

Simply Wall St Financial Health Rating: ★★★★★☆

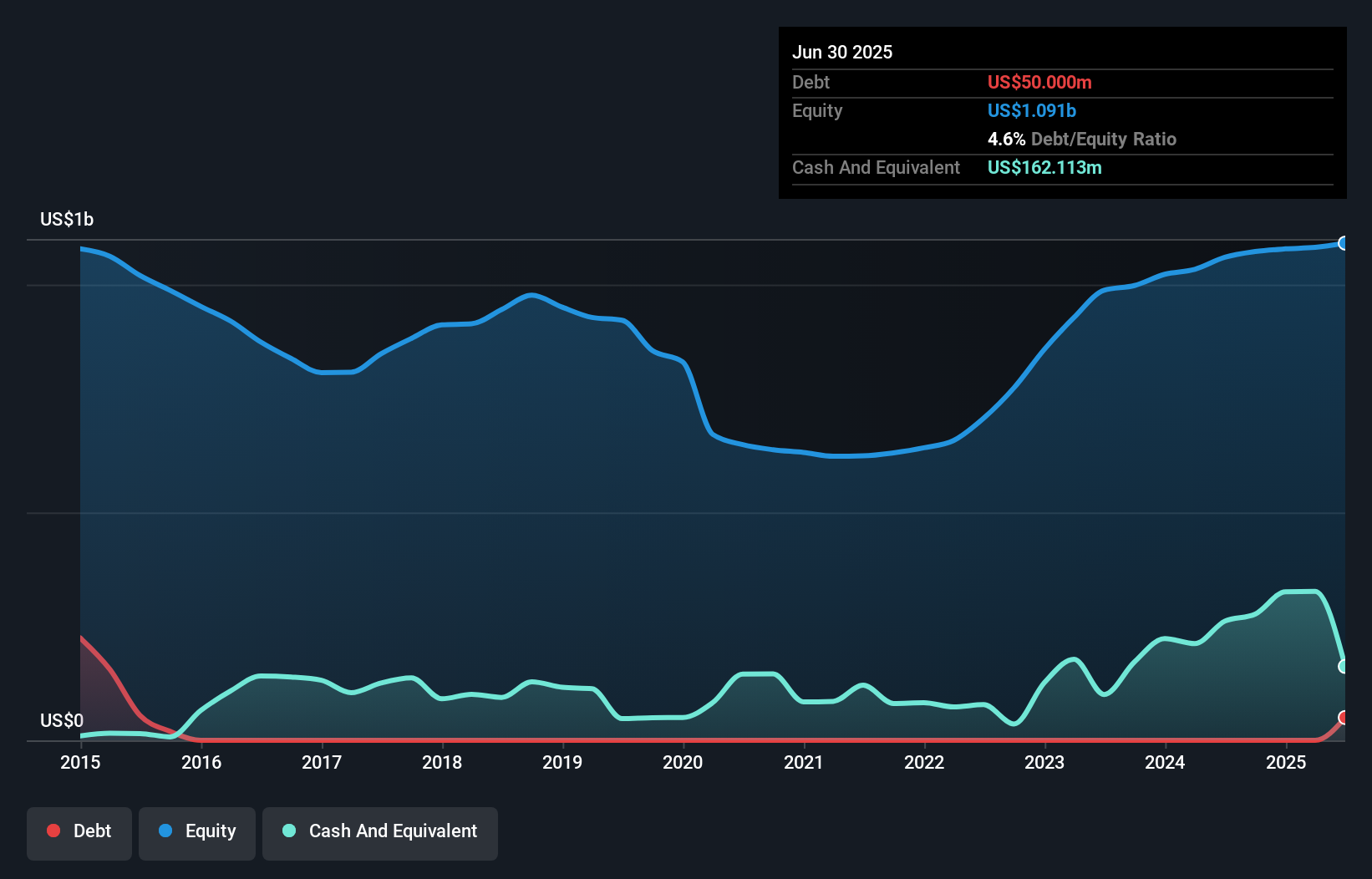

Overview: RPC, Inc. provides a variety of oilfield services and equipment to oil and gas companies involved in exploration, production, and development, with a market cap of approximately $1.03 billion.

Operations: RPC's revenue is primarily derived from Technical Services, contributing $1.34 billion, with additional income from Support Services totaling $89.97 million.

Market Cap: $1.03B

RPC, Inc., with a market cap of US$1.03 billion, is experiencing mixed financial performance typical of penny stocks. The company's revenue is driven by Technical Services at US$1.34 billion and Support Services at US$89.97 million. Although RPC's earnings are forecast to grow annually by 12.44%, recent results show a decline in net income from US$32.42 million to US$10.15 million year-over-year for Q2 2025, impacting profit margins which fell from 7.9% to 3.7%. Despite these challenges, RPC maintains strong liquidity with short-term assets exceeding liabilities and has not diluted shareholders recently, suggesting prudent financial management amidst volatility in the oilfield services sector.

- Click to explore a detailed breakdown of our findings in RPC's financial health report.

- Learn about RPC's future growth trajectory here.

Make It Happen

- Take a closer look at our US Penny Stocks list of 382 companies by clicking here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal