How Investors Are Reacting To M/I Homes (MHO) Amid Analyst Disagreement on Future Outlook

- In recent days, a stark divergence emerged for M/I Homes as most Wall Street analysts maintained upbeat recommendations, while the Zacks Rank assigned a Strong Sell rating due to declining earnings estimates and increased analyst caution.

- This split in sentiment highlights real uncertainty about M/I Homes’ future performance and may prompt investors to reconsider prior optimism about the company.

- We'll review how the clash between bullish brokerage views and deteriorating earnings expectations could affect M/I Homes' investment narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

M/I Homes Investment Narrative Recap

To invest in M/I Homes, you have to believe that long-term housing demand and the company’s aggressive community expansion will eventually outweigh current margin pressures and softening contracts. The recent divergence between upbeat Wall Street ratings and a bearish Zacks Rank reflects how slipping earnings and mixed analyst sentiment could challenge confidence in any near-term rebound. For now, this split does not materially change the main short-term catalyst, housing demand recovery, or the key risk of eroding margins from rate buydowns and inventory exposure.

The latest share repurchase update, reporting over US$100 million in buybacks since February 2025, stands out as a relevant move. While buybacks can bolster EPS and may signal management's confidence, their impact hinges on the company’s ability to sustain earnings growth as industry headwinds persist.

By contrast, investors should be aware that persistent inventory risks could lead to more price discounting and margin pressure if...

Read the full narrative on M/I Homes (it's free!)

M/I Homes' outlook anticipates $4.9 billion in revenue and $470.5 million in earnings by 2028. This reflects a 2.8% annual revenue growth rate but a decrease of $40.9 million in earnings from the current $511.4 million.

Uncover how M/I Homes' forecasts yield a $162.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

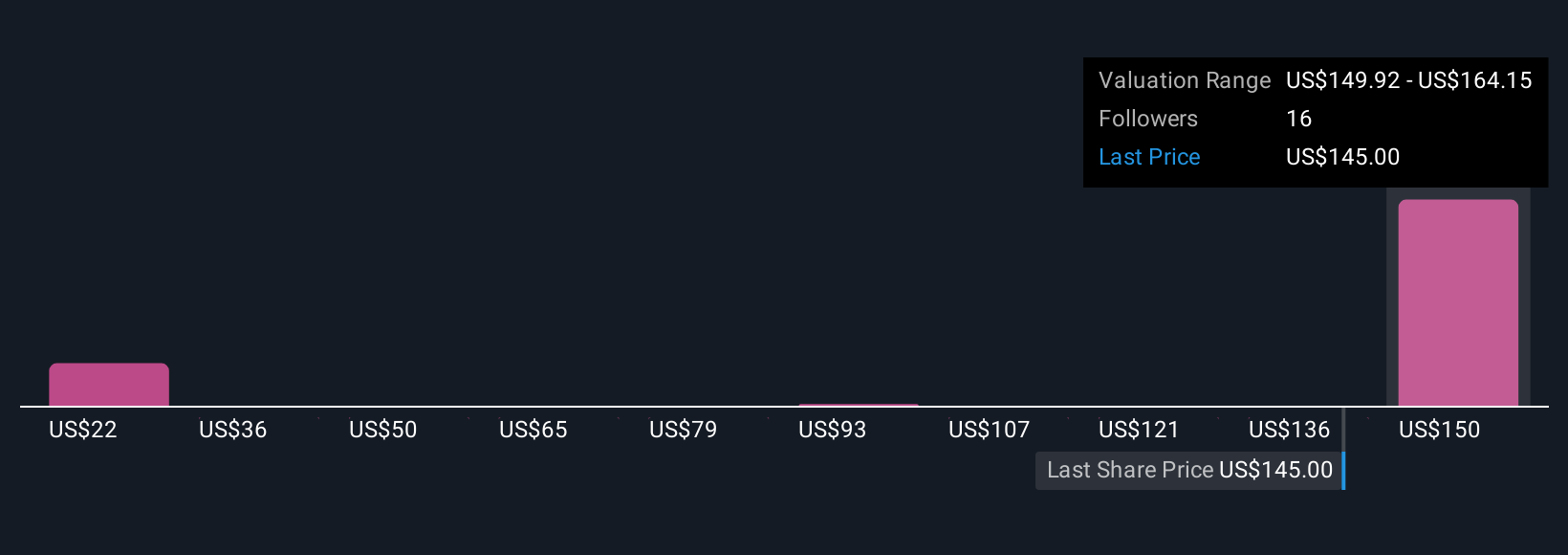

Fair value estimates for M/I Homes from four Simply Wall St Community members range from US$22.01 to US$164.15. While investor views vary widely, slowing profit growth remains a central concern for the company’s future performance.

Explore 4 other fair value estimates on M/I Homes - why the stock might be worth as much as 12% more than the current price!

Build Your Own M/I Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M/I Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free M/I Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M/I Homes' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal