Will QuidelOrtho’s (QDEL) New $3B Credit Deal Reshape Its Long-Term Profitability Narrative?

- Earlier this month, QuidelOrtho entered a new credit agreement providing over US$3 billion in senior secured term loans and revolving credit facilities, replacing its prior credit agreement and introducing new financial covenants tied to leverage and interest coverage ratios.

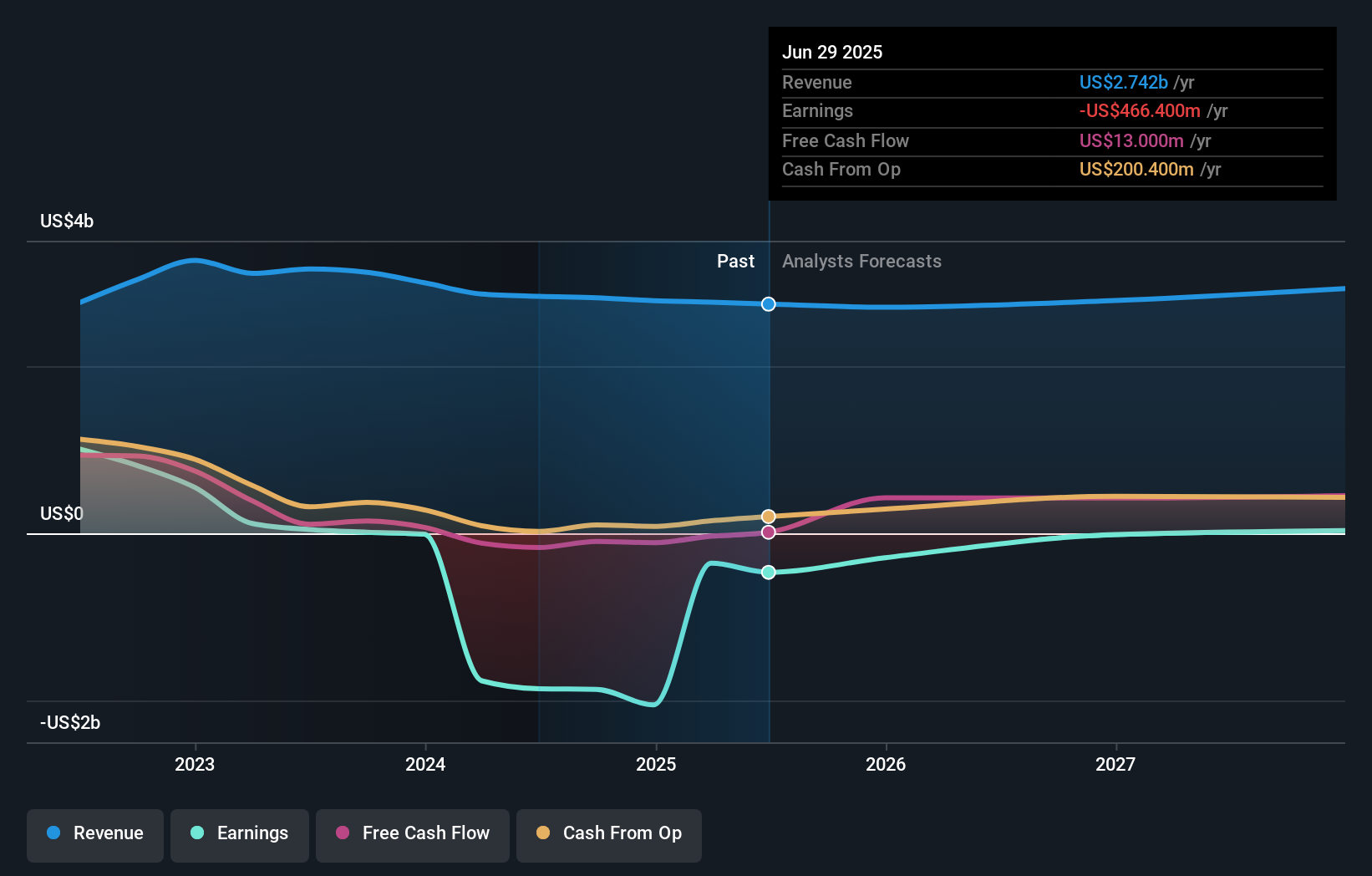

- This substantial debt financing comes as the company faces declining constant currency revenue and reduced free cash flow margin, raising ongoing questions about its profitability outlook and capacity for future growth.

- We'll explore how this large-scale debt refinancing impacts QuidelOrtho’s investment narrative amid concerns about sustained profitability and leverage.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

QuidelOrtho Investment Narrative Recap

To be a QuidelOrtho shareholder today, you need confidence that its core diagnostics platforms and international expansion can deliver growth despite falling pandemic revenues, declining free cash flow, and persistent net losses. The recent US$3 billion debt refinancing shores up liquidity but introduces stricter financial covenants, magnifying both the urgency and the importance of returning to consistent profitability, making improved free cash flow and execution on cost savings the most pressing catalyst, while elevated leverage remains the critical risk. While this refinancing may stabilize near-term operations, it does not directly offset fundamental challenges in margin recovery or secure new revenue streams, so its impact on near-term upside appears limited.

Among recent announcements, the launch of the Certified Analyzer Program stands out, aiming to grow QuidelOrtho’s presence in smaller hospitals and underserved rural areas. This aligns with the primary catalyst of expanding non-pandemic revenues but is not expected to deliver immediate large-scale revenue replacement for the high-margin COVID testing declines, underlining the need for further innovation and penetration of new markets.

By contrast, investors should be aware that the company’s leverage covenants now require disciplined execution with little room for error if margins do not rebound as expected...

Read the full narrative on QuidelOrtho (it's free!)

QuidelOrtho's narrative projects $3.0 billion revenue and $17.2 million earnings by 2028. This requires 2.6% yearly revenue growth and a $483.6 million increase in earnings from -$466.4 million.

Uncover how QuidelOrtho's forecasts yield a $43.14 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published three fair value estimates for QuidelOrtho that range from US$43.14 to US$82.80 per share. While recent refinancing targets stability, slower revenue growth and margin pressure could weigh on future returns, so consider these varied outlooks as you assess your own stance.

Explore 3 other fair value estimates on QuidelOrtho - why the stock might be worth just $43.14!

Build Your Own QuidelOrtho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QuidelOrtho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QuidelOrtho's overall financial health at a glance.

No Opportunity In QuidelOrtho?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal