Could St. Joe's (JOE) Dividend Timing Reveal Shifts in Its Capital Allocation Approach?

- St. Joe is set to go ex-dividend on August 22nd, 2025, with shareholders of record on that date eligible for a dividend payment on September 19th, 2025.

- This upcoming ex-dividend date often prompts investors to reposition their holdings, reflecting the importance of dividend events in trading activity.

- We'll explore how the ex-dividend event plays a central role in shaping St. Joe's current investment narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is St. Joe's Investment Narrative?

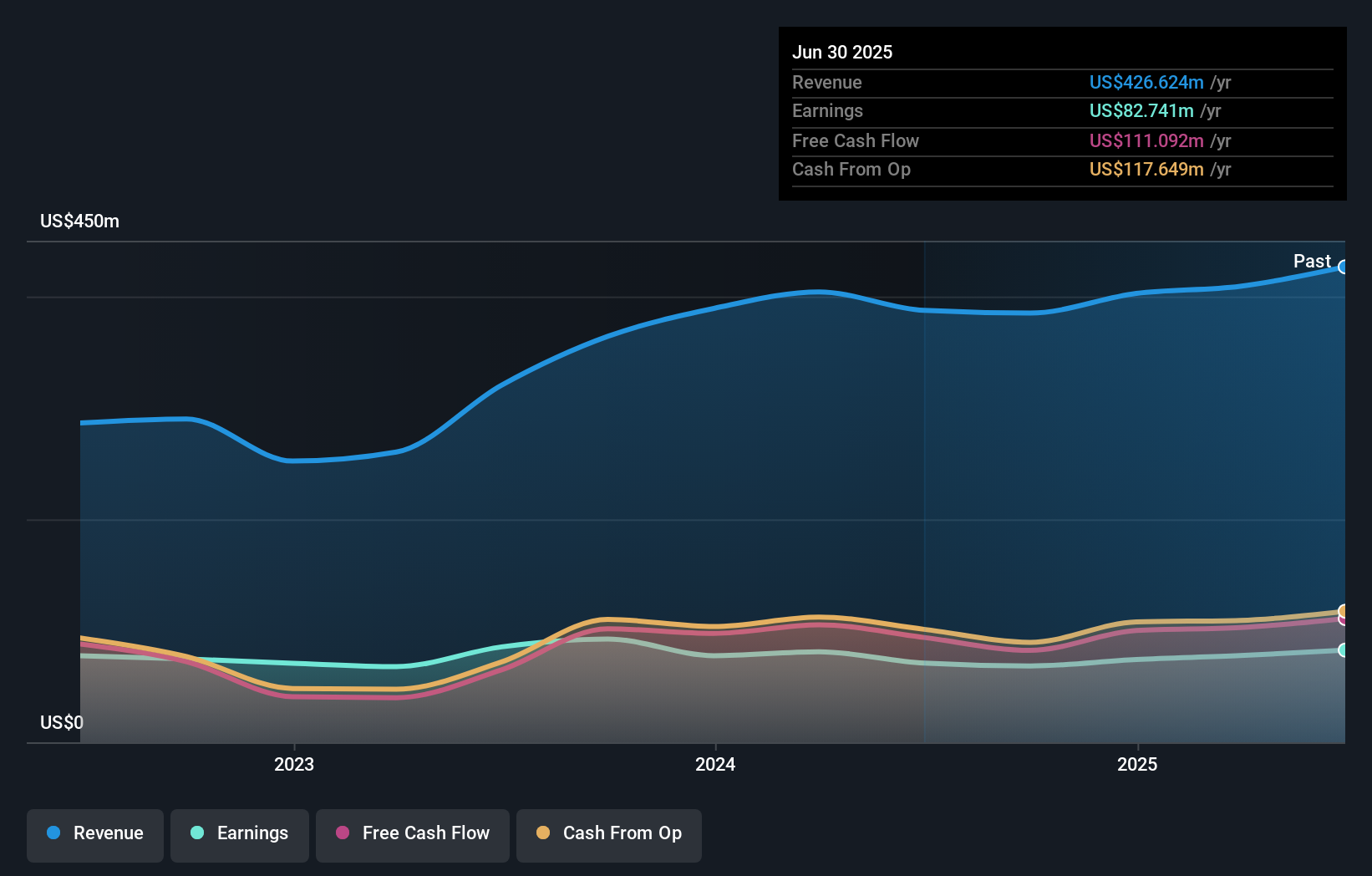

Being a St. Joe shareholder often requires confidence in the company’s long-term vision of leveraging its real estate holdings for future growth, while keeping an eye on cash flow and capital allocation. The recent ex-dividend news is unlikely to change the big picture for investors who are focused on St. Joe’s property development pipeline, quarterly earnings, or its recently expanded projects, such as the Topgolf opening and continued growth at Latitude Margaritaville. The announced dividend keeps the company on trend with recent shareholder return policies but does little to move the immediate needle on risks or short-term catalysts. The more immediate attention for investors still centers on St. Joe’s valuation, now considered high versus industry peers, and ongoing concerns around cash flow relative to debt levels, especially as large-scale developments can tie up significant capital. For most, the news simply ensures predictable dividend timing without altering the risk-reward calculus considerably. Yet, the company’s debt coverage by operating cash flow remains a key concern for investors curious about future stability.

St. Joe's shares are on the way up, but they could be overextended by 22%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth 18% less than the current price!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal