Did Matson’s (MATX) Q2 Beat and Southeast Asia Launch Just Shift Its Investment Narrative?

- Earlier this week, Matson reported second quarter results that exceeded analyst revenue expectations by 8.1%, even as revenues declined 2% year-on-year, and the company announced a new expedited service from Ho Chi Minh as well as an improved full-year outlook.

- An important insight is that Matson’s rebound in Transpacific demand followed a temporary reduction in U.S.-China tariffs, illustrating how policy shifts can quickly influence shipping volumes.

- We'll examine how Matson's newly launched Southeast Asia service and robust Q2 highlight its evolving investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Matson Investment Narrative Recap

To be a Matson shareholder, you need to believe the company can adapt and grow as global trade shifts, especially with supply chain changes moving demand from China toward Southeast Asia. The recent Q2 beat and improved outlook show management delivering in a volatile market, but the key short-term catalyst remains Matson’s ability to sustain stable volumes despite competitive and pricing pressures; the biggest immediate risk, prolonged freight rate declines and muted demand, remains material, as reflected in lower Q3 guidance.

Among recent announcements, Matson’s launch of a new expedited service from Ho Chi Minh stands out as directly tied to the company’s efforts to capture Southeast Asia growth, supporting the core catalyst of diversifying trade lanes beyond China. This initiative helps balance risks in the China segment by building a presence along new, fast-growing routes where transpacific shipping demand is evolving.

Yet, despite the company’s positive recent moves, investors should remain mindful of the contrasting risk of concentrated exposure to a few regional routes and the ongoing threat from...

Read the full narrative on Matson (it's free!)

Matson's outlook projects $3.3 billion in revenue and $280.4 million in earnings by 2028. This implies a -1.1% annual revenue decline and a $213.7 million decrease in earnings from $494.1 million today.

Uncover how Matson's forecasts yield a $137.50 fair value, a 29% upside to its current price.

Exploring Other Perspectives

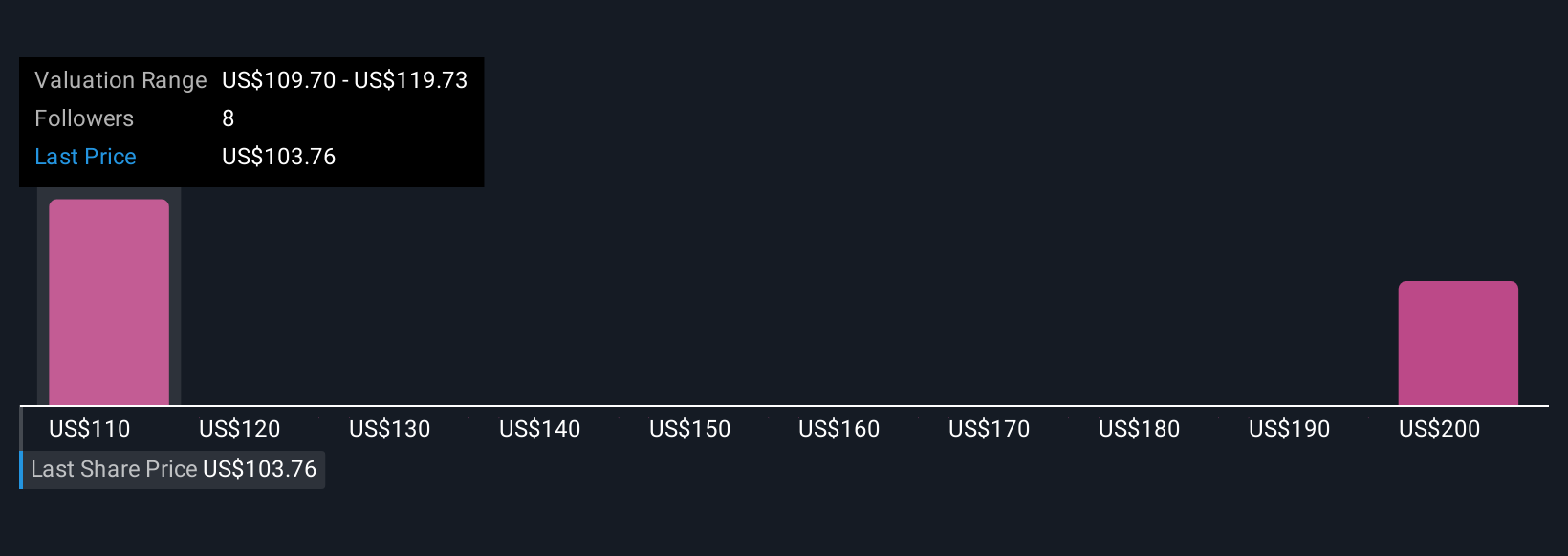

Five members of the Simply Wall St Community placed fair value for Matson between US$115 and US$210 per share, with the widest gap in estimates at US$95. Persistent freight volatility and trade uncertainty are key factors that could shift long-term earnings, so it is important to consider how your outlook aligns with this range.

Explore 5 other fair value estimates on Matson - why the stock might be worth as much as 98% more than the current price!

Build Your Own Matson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Matson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matson's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal