Will Green Brick Partners' (GRBK) Houston Debut with Riviera Pines Alter Its Texas Growth Narrative?

- Green Brick Partners, Inc. recently broke ground on Riviera Pines, its first Houston-area community, officially introducing subsidiary Trophy Signature Homes to the region and expanding its Texas presence.

- This move marks the company's first foray into Houston, highlighting an ongoing push to access new high-growth markets and broaden its customer base.

- We'll explore how Green Brick's entry into Houston with Riviera Pines could influence its investment narrative in light of current industry pressures.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Green Brick Partners Investment Narrative Recap

To hold Green Brick Partners stock, an investor needs conviction in the long-term growth of high-demand Sunbelt markets and the resilience of the company's cost discipline, even as interest rate pressures compress margins in the near term. The recent groundbreaking in Houston reinforces the strategy to access new buyers, but this expansion does not meaningfully offset the immediate risks from lower average sales prices and increased incentives, which remain the primary catalyst and concern for financial performance right now.

Among recent announcements, Green Brick's Q2 2025 results stand out: while it delivered record home volumes, margins were pressured by greater use of incentives and price concessions to attract buyers. This interaction between margin pressure and new market entries like Houston will be key in shaping near-term results, as the company balances volume growth with profitability targets.

But unlike the expected benefits from entering Houston, the persistent margin compression highlighted in recent quarters is something investors should watch for...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners' outlook anticipates $2.0 billion in revenue and $252.1 million in earnings by 2028. This projection is based on a 2.1% annual revenue decline and a decrease in earnings of $95 million from current earnings of $347.1 million.

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, a 13% downside to its current price.

Exploring Other Perspectives

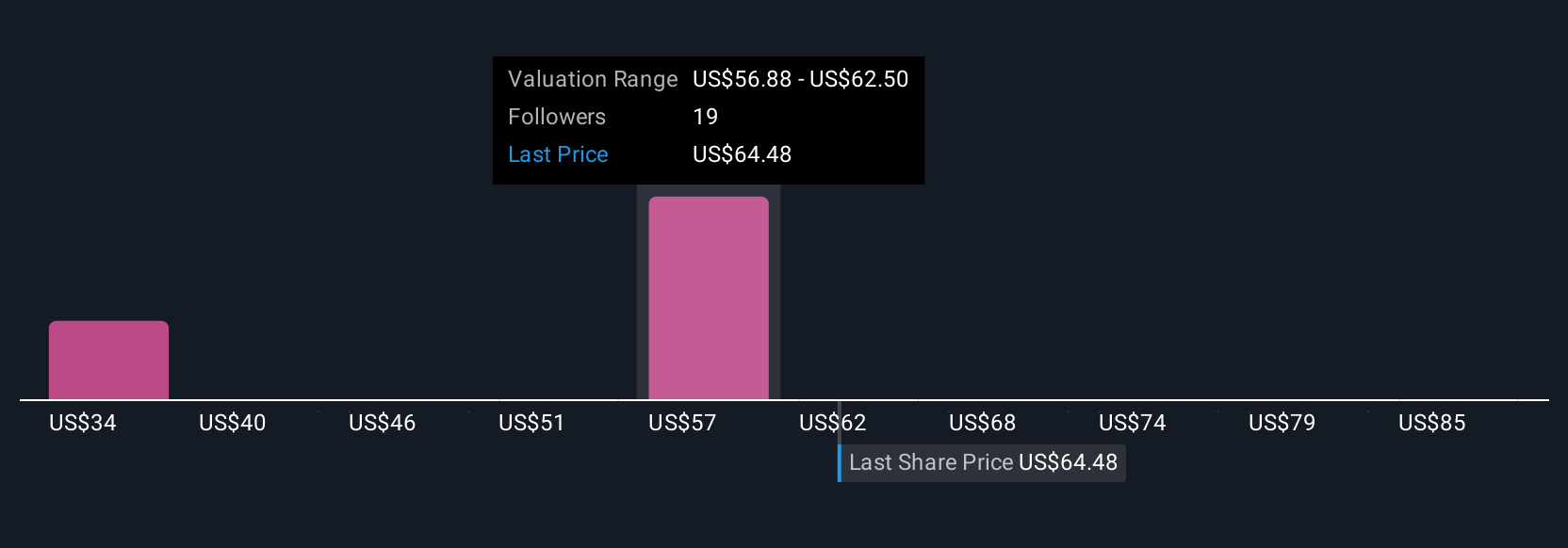

Six community valuations for Green Brick Partners put fair value between US$34.28 and US$90.58. While some expect robust expansion, others see margin risk shaping results ahead, so consider a range of opinions before acting.

Explore 6 other fair value estimates on Green Brick Partners - why the stock might be worth as much as 28% more than the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal