Will Record Fund ABS Issuance in 2025 Reshape PJT Partners' (PJT) Fund Finance Narrative?

- In the first half of 2025, PJT Partners reported that fund asset-backed securities (ABS) issuance reached a record high, highlighting a surge in activity within the fund finance sector.

- This momentum reflects growing enthusiasm among asset managers for fund ABS, underscoring the expanding significance of fund finance advisory services.

- We'll examine how heightened demand for fund ABS is shaping PJT Partners' investment narrative in the current fund finance landscape.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is PJT Partners' Investment Narrative?

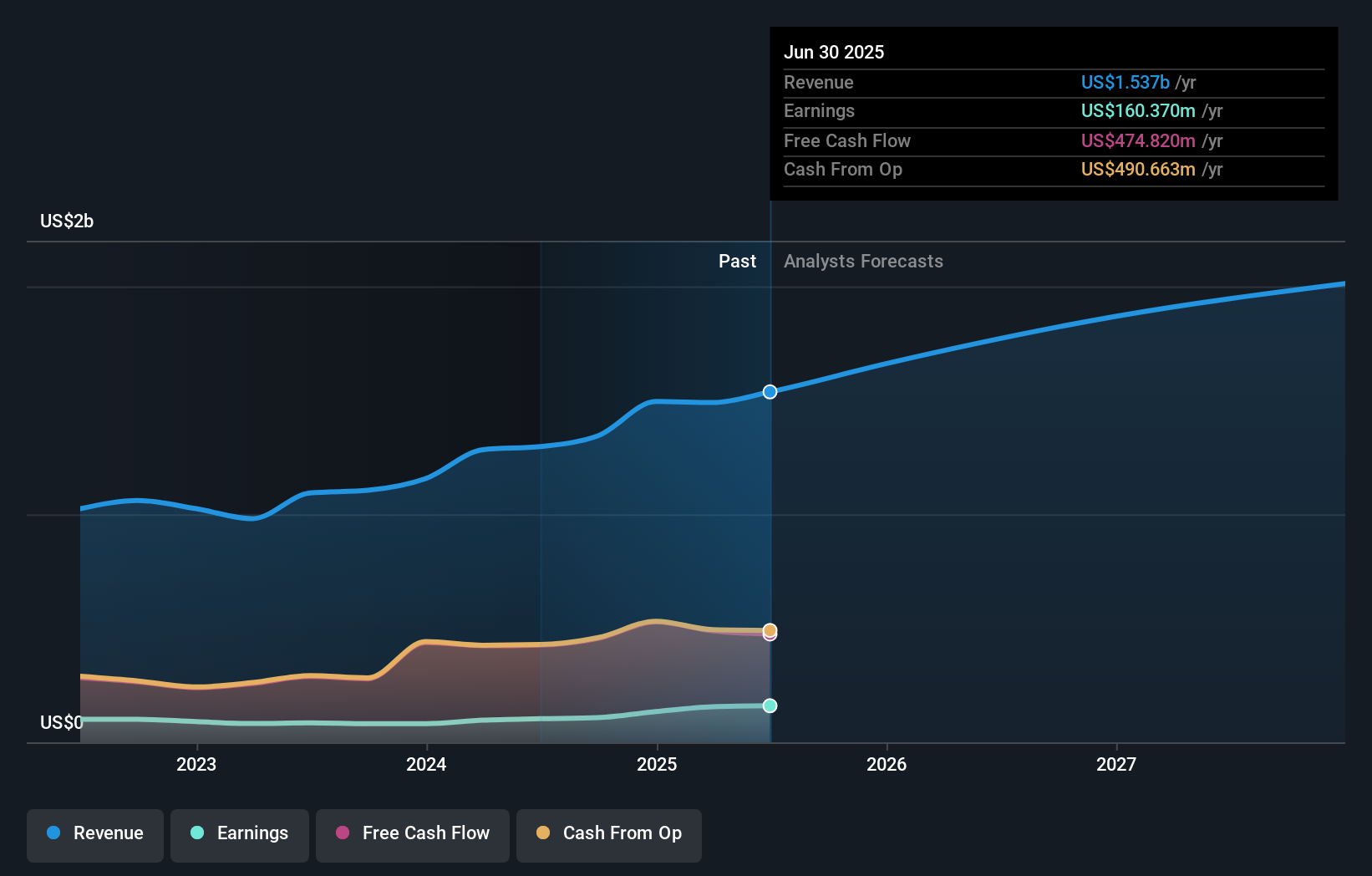

To get behind PJT Partners as a shareholder right now, you’d need to believe in the durability of its fee-based advisory model and its ability to seize new pockets of growth such as fund asset-backed securities (ABS), which just reached a record high issuance in early 2025. This news could be a meaningful short-term catalyst, particularly as it highlights increased demand from asset managers and positions PJT as a vital player in fund finance. While earlier analysis put earnings strength and capital returns (like share buybacks and dividends) at the forefront, the spike in ABS activity could bring more near-term deal flow and incremental fee income, potentially shifting both the growth story and risk profile. Still, PJT’s higher valuation compared to peers, and signs of significant insider selling, may moderate the upside if the ABS trend proves short-lived or if broader market enthusiasm fades.

But on the flip side, insider selling is worth keeping on your radar. PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth as much as $173.00!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal