Is H&R Block's (HRB) Earnings Growth and Executive Shake-Up Shaping Its Investment Appeal?

- H&R Block reported fourth quarter results showing increases in revenue and net income, announced a higher quarterly dividend for the eighth consecutive year, and issued guidance for fiscal 2026; the company also revealed that CEO Jeffrey J. Jones II and Chief Accounting Officer Kellie J. Logerwell will retire at the end of 2025, with successors named for both positions.

- The combination of financial performance and leadership transitions highlights the company's continued focus on shareholder returns while aiming for stability during executive changes.

- We’ll examine how H&R Block’s earnings, dividend increase, and CEO transition collectively influence the company's investment outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

H&R Block Investment Narrative Recap

To be a shareholder in H&R Block, you need to believe the company can defend its market position against ongoing competitive pressures while continuing to generate stable cash flows and attractive shareholder returns, even as digital-first challengers reshape the tax preparation industry. The recent executive transition news, including the CEO and Chief Accounting Officer retirements, does not appear to materially change the immediate outlook for the biggest near-term catalyst, client conversion to higher-value digital and assisted offerings, or the key risk of persistent market share loss.

The eighth consecutive annual dividend increase, with a new rate of US$0.42 per share, stands out as most relevant to the catalyst of sustaining shareholder value and maintaining investor confidence through leadership changes. Regular dividend growth signals ongoing financial discipline, which may be particularly reassuring while new leadership is integrated and as H&R Block continues adapting to a shifting tax services market.

In contrast, investors should be aware that the unresolved challenge of sustained market share erosion remains front and center for H&R Block, especially as...

Read the full narrative on H&R Block (it's free!)

H&R Block's outlook anticipates $4.1 billion in revenue and $653.0 million in earnings by 2028. This is based on a projected 3.0% annual revenue growth rate and a $46.3 million earnings increase from the current earnings of $606.7 million.

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

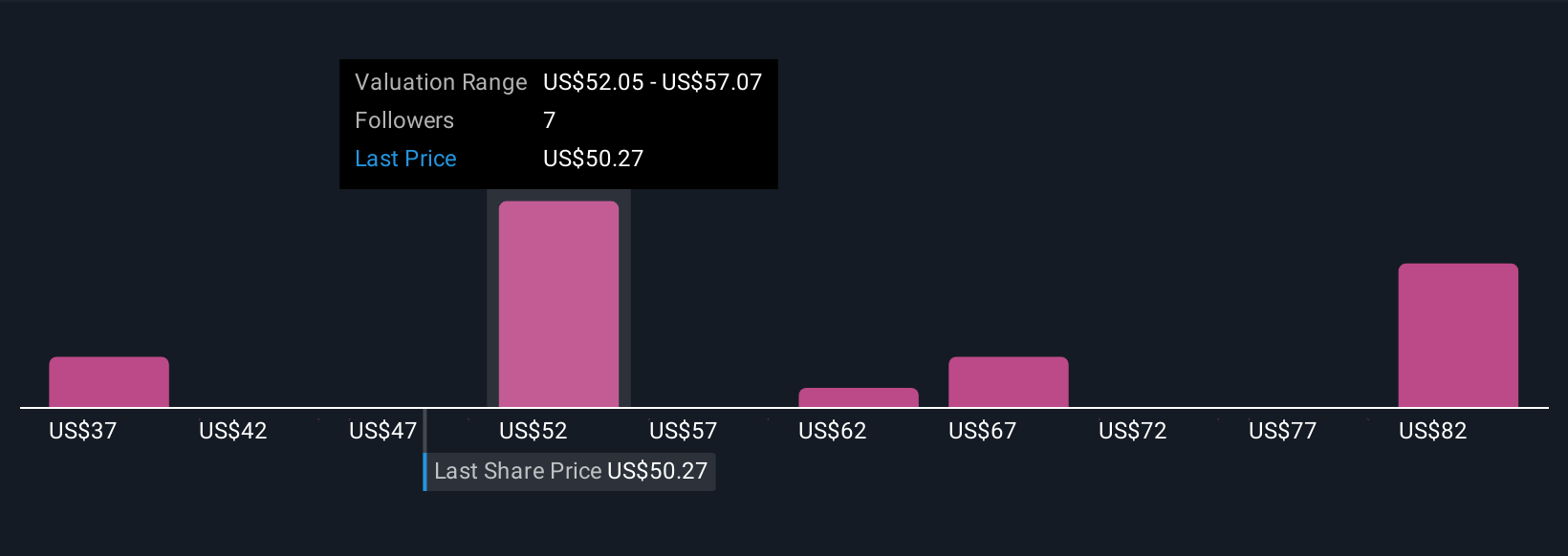

Seven members of the Simply Wall St Community estimate H&R Block’s fair value between US$37 and US$84, highlighting a wide range of opinions. While consensus recognizes consistent dividend growth, ongoing competition from digital-first tax solutions could shape future outcomes, explore these diverse viewpoints for a fuller picture.

Explore 7 other fair value estimates on H&R Block - why the stock might be worth as much as 61% more than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal