How Insider Alignment and Earnings Growth Will Impact Valmont Industries (VMI) Investors

- Valmont Industries recently reported that its earnings per share increased by 35% over the last year, driven by strong profitability gains.

- Insider ownership remains significant and CEO pay is below peers, highlighting management's alignment with shareholders and an ongoing focus on value creation.

- To understand how robust insider alignment and earnings growth may reshape Valmont Industries' investment case, let’s explore the latest developments.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Valmont Industries Investment Narrative Recap

To be a shareholder in Valmont Industries, you need confidence in the company’s ability to capitalize on long-term infrastructure and agricultural demand, despite exposure to economic cycles and shifting material trends. The recent jump in earnings per share is a positive signal, but short-term catalysts like infrastructure spending remain more heavily influenced by external demand and policy settings, the impact of this news doesn’t materially alter the biggest current risk, which remains cyclical spending volatility.

Among the company’s recent updates, the reaffirmation of full-year guidance is particularly relevant. Even with significant EPS growth, leadership has maintained expectations for sales of US$4.0 billion to US$4.2 billion and EPS of US$17.20 to US$18.80, supporting the catalyst that strong operational discipline and a robust backlog could help sustain earnings, if demand tailwinds persist.

However, investors should also weigh ongoing risks, such as what could happen in periods when infrastructure and agriculture investment falter or if...

Read the full narrative on Valmont Industries (it's free!)

Valmont Industries' outlook suggests revenue of $4.5 billion and earnings of $462.5 million by 2028. This is based on a projected annual revenue growth rate of 3.5% and an earnings increase of $244.8 million from current earnings of $217.7 million.

Uncover how Valmont Industries' forecasts yield a $393.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

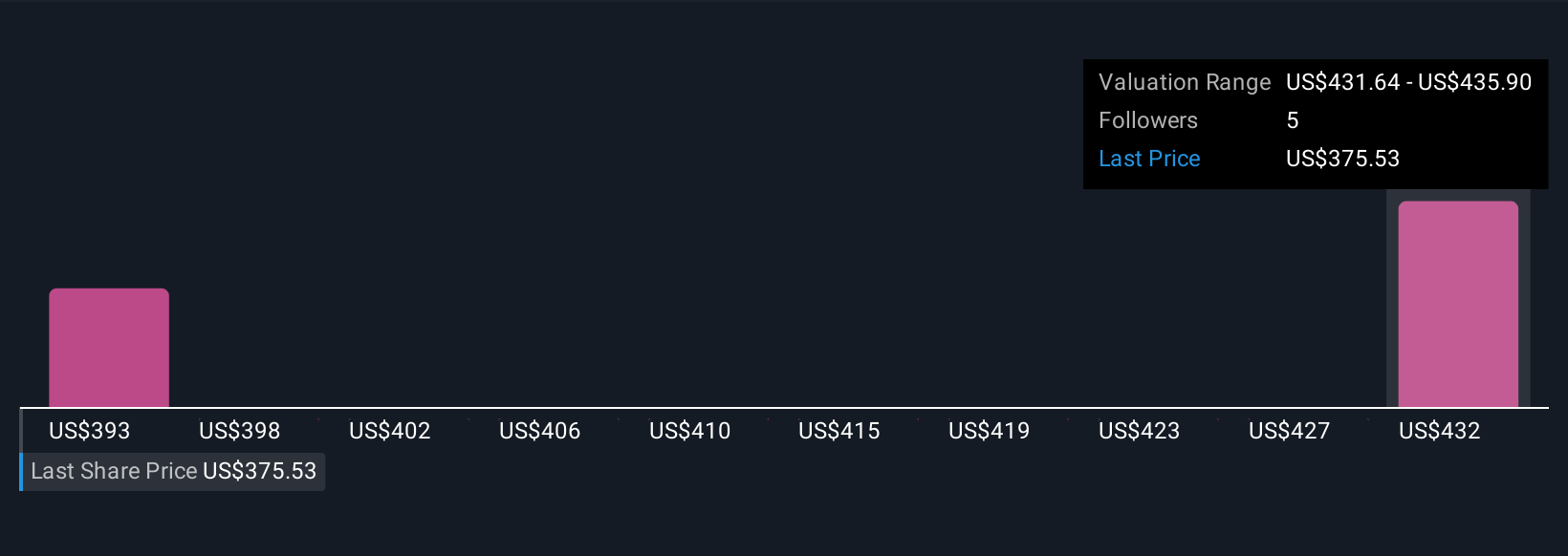

Simply Wall St Community members have set fair value estimates for Valmont Industries between US$393.33 and US$432.71, reflecting two distinct perspectives. With infrastructure investment still a primary catalyst in mainstream analysis, you may want to compare these views to wider industry or policy shifts.

Explore 2 other fair value estimates on Valmont Industries - why the stock might be worth as much as 15% more than the current price!

Build Your Own Valmont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Valmont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmont Industries' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal