Could CEO Share Sale and Wellness Pivot Reveal a New Chapter for Darling Ingredients (DAR) Strategy?

- In recent days, Chairman & CEO Randall Stuewe sold 62,500 shares of Darling Ingredients, and the company launched Nextida, a joint venture focused on health and wellness markets.

- This activity unfolds as analysts express caution over regulatory uncertainty impacting renewable diesel margins, highlighting shifts in both leadership actions and business strategy.

- We’ll explore how the CEO’s share sale may influence confidence in Darling Ingredients’ evolving investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Darling Ingredients Investment Narrative Recap

To be a shareholder in Darling Ingredients, you need conviction in its plan to transform animal byproducts into higher-value products like renewable diesel and specialty ingredients, even as regulatory changes and margin volatility in renewable fuels add uncertainty. The recent CEO share sale and launch of Nextida have not materially changed the short-term catalyst, regulatory clarity and margin recovery in renewable fuels, and the biggest risk remains persistent policy uncertainty and margin pressure in the Fuel segment. Among the latest developments, the Nextida joint venture stands out as the most relevant. This move could diversify revenue streams and strengthen the Food segment, offering some balance as renewable diesel faces margin constraints. Investors watching Darling Ingredients’ evolving investment narrative will want to weigh both the opportunities and near-term risks that come with a push into health and wellness, particularly given the ongoing uncertainty in biofuels. In sharp contrast, regulatory risk around Renewable Identification Numbers and other fuel policies remains information every investor should be aware of...

Read the full narrative on Darling Ingredients (it's free!)

Darling Ingredients' outlook projects $6.5 billion in revenue and $701.1 million in earnings by 2028. This is based on an expected 4.4% annual revenue growth rate and a $595.7 million increase in earnings from the current $105.4 million.

Uncover how Darling Ingredients' forecasts yield a $47.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

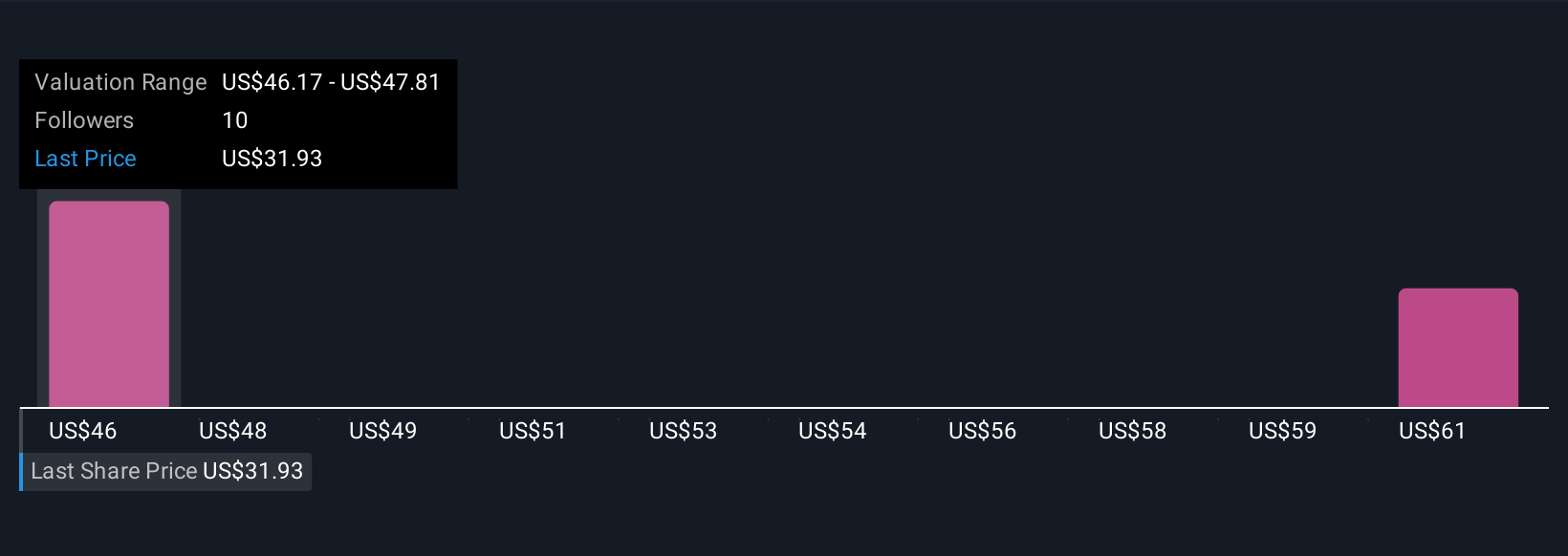

Two community members on Simply Wall St placed fair value for Darling Ingredients between US$47.50 and US$62.62, a wide span versus the latest market price. Consider how ongoing regulatory uncertainty may further impact profitability before drawing your own conclusions.

Explore 2 other fair value estimates on Darling Ingredients - why the stock might be worth just $47.50!

Build Your Own Darling Ingredients Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Darling Ingredients research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Darling Ingredients' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal