Is Euronet Worldwide’s (EEFT) US$850 Million Convertible Offering Reshaping Its Digital Growth Strategy?

- Euronet Worldwide recently completed an US$850 million offering of 0.625% senior unsecured convertible notes due October 2030, issued under Rule 144A and priced at par.

- This sizable convertible bond issuance introduces potential future equity dilution and reflects Euronet’s appetite to access capital for ongoing digital payments growth initiatives.

- We’ll now examine what Euronet’s US$850 million convertible notes could mean for its long-term digital strategy and investment narrative.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Euronet Worldwide Investment Narrative Recap

To be a shareholder in Euronet Worldwide, you need to believe in the company’s ability to transform and grow its digital payments and money transfer businesses, even as legacy cash-based operations face secular decline. The recent US$850 million convertible note offering does not appear to materially shift the near-term catalyst of digital platform growth, but it does introduce the risk of future dilution, which investors will want to weigh against the capital flexibility it provides.

Among recent company developments, Euronet’s partnership with Visa stands out, enabling near-instant transfers to over 4 billion debit cards. This directly aligns with the core catalyst of digital payment services expansion, further reinforcing Euronet’s focus on scaling high-margin, software-powered platforms in response to evolving global payment trends.

However, it is important to remember that while growth in digital is promising, the accelerating move away from cash could expose legacy revenue streams to much steeper pressure than some investors may expect...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's outlook anticipates $5.2 billion in revenue and $477.0 million in earnings by 2028. This scenario assumes 8.2% annual revenue growth and a $144.3 million increase in earnings from the current $332.7 million.

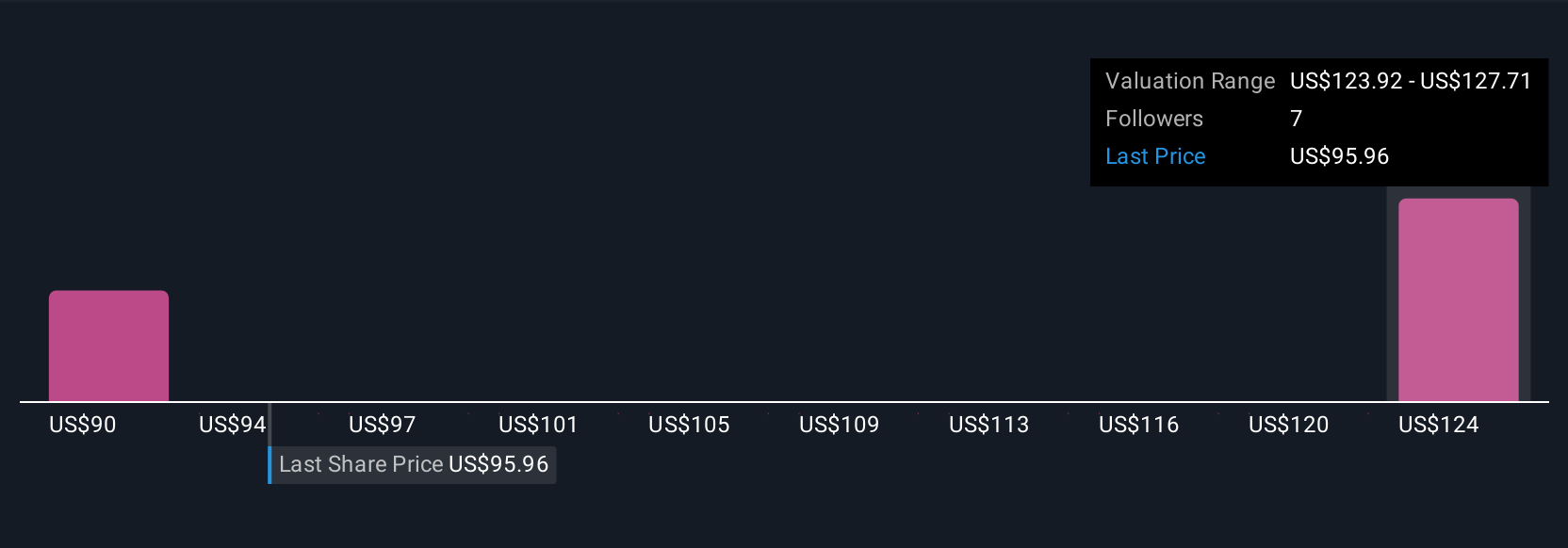

Uncover how Euronet Worldwide's forecasts yield a $127.71 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$89.49 to US$127.71, reflecting two distinct outlooks on Euronet Worldwide. As digital transformation remains a central catalyst for the business, consider how community and consensus viewpoints may differ on what that means for future resilience.

Explore 2 other fair value estimates on Euronet Worldwide - why the stock might be worth 9% less than the current price!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

No Opportunity In Euronet Worldwide?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal