Why Heidrick & Struggles (HSII) Is Up 8.6% After Beating Q2 Estimates and Raising Growth Outlook

- Heidrick & Struggles International recently reported stronger-than-expected Q2 financial results, driven by significant revenue growth across all business segments and a positive outlook from management.

- Analysts responded to the performance with renewed optimism, highlighting management’s confidence, robust demand for executive services, and plans for further growth despite broader economic uncertainties.

- We'll explore how management’s optimistic revenue outlook, reinforced by Q2 results, may shift Heidrick & Struggles' investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Heidrick & Struggles International Investment Narrative Recap

To own Heidrick & Struggles International, an investor needs to believe that rising global demand for executive leadership and ongoing digital transformation will drive sustained growth in executive search and consulting services. The company’s robust Q2 results and management’s optimistic revenue guidance may help sustain momentum as a near-term catalyst, but they do not fully mitigate the risk of client project delays prompted by persistent economic uncertainty, a factor that remains the most important risk in the current environment.

Among recent company announcements, the positive Q3 2025 revenue guidance stands out as most relevant. Management’s expectations for continued growth, even as economic headwinds persist, align directly with analyst commentary describing strong demand resilience and renewed optimism about the company’s outlook, a perspective that could influence the risk-reward balance in the months ahead.

However, when clients hesitate on executive search projects in unpredictable markets, investors should be aware of the risk that...

Read the full narrative on Heidrick & Struggles International (it's free!)

Heidrick & Struggles International's outlook anticipates $1.3 billion in revenue and $95.9 million in earnings by 2028. This is based on an assumed 3.9% annual revenue growth rate and an increase in earnings of $61.7 million from the current $34.2 million.

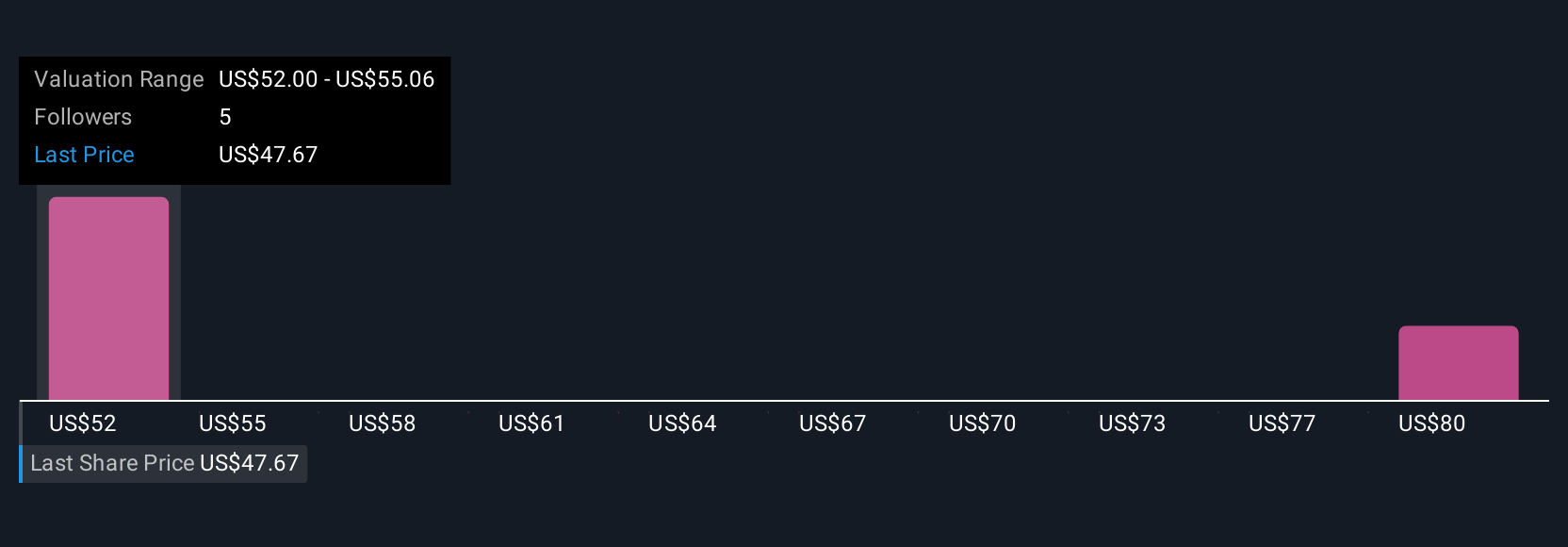

Uncover how Heidrick & Struggles International's forecasts yield a $52.00 fair value, in line with its current price.

Exploring Other Perspectives

Fair value opinions from two Simply Wall St Community members range from US$52 to US$82.92, showing significant differences in outlooks. A key catalyst fueling these valuations is the multi-year global demand surge for experienced executive leadership, with implications for the company’s revenue consistency and future growth, explore how your view compares.

Explore 2 other fair value estimates on Heidrick & Struggles International - why the stock might be worth as much as 60% more than the current price!

Build Your Own Heidrick & Struggles International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Heidrick & Struggles International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heidrick & Struggles International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal