Did Qorvo's (QRVO) $650M Share Offering Just Reshape Its Capital Structure and Investment Narrative?

- At its annual meeting on August 13, 2025, Qorvo elected Peter A. Feld to the board for a one-year term and filed a shelf registration for an ESOP-related offering of 7,240,000 common shares, totaling about US$649.93 million.

- An interesting aspect of these developments is the sizable stock offering, which could have implications for Qorvo’s capital structure and may raise questions around potential dilution or future use of proceeds.

- Given the scope of this potential share issuance, we'll examine how it might affect Qorvo’s investment narrative and future growth assumptions.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Qorvo Investment Narrative Recap

To own Qorvo, you need to be confident in demand growth tied to 5G, Wi-Fi, and RF semiconductor innovation, alongside management’s ability to diversify away from major customer concentration. The recent ESOP-related share offering, though meaningful in size, does not appear to materially alter near-term catalysts, such as content expansion in flagship mobile and automotive design wins, or heighten the most pressing risk, which remains the reliance on one large customer for a substantial portion of revenue.

Of the latest announcements, the ongoing share repurchase program is particularly relevant in the context of the ESOP-related offering. While this new issuance raises the potential for short-term dilution, the company’s ongoing buybacks suggest a commitment to return capital to shareholders and manage its overall share count, which could help offset dilution and support investor confidence in upcoming growth drivers.

By contrast, what many investors might miss is how concentration risk could interact with new share issuances if demand from that key customer changes abruptly...

Read the full narrative on Qorvo (it's free!)

Qorvo's outlook anticipates $4.1 billion in revenue and $480.9 million in earnings by 2028. This implies a 4.4% annual revenue growth rate and an earnings increase of $400 million from the current $80.8 million.

Uncover how Qorvo's forecasts yield a $97.29 fair value, a 5% upside to its current price.

Exploring Other Perspectives

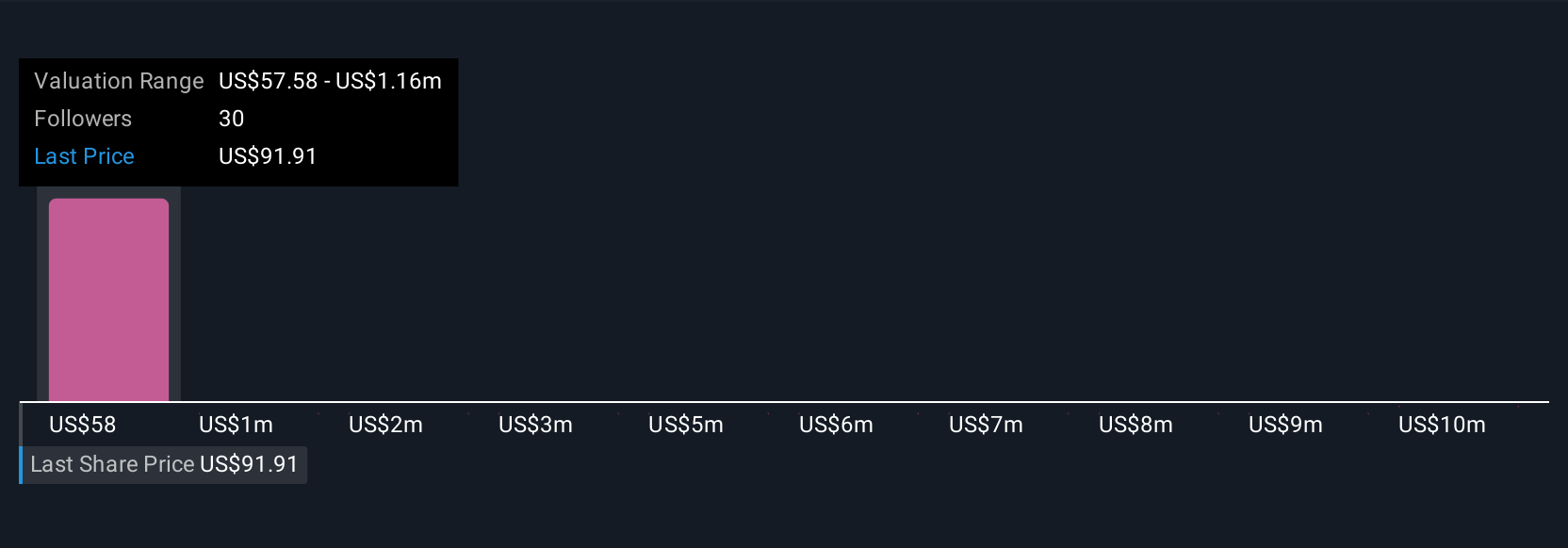

Five different fair value estimates from the Simply Wall St Community span from US$57.58 to above US$11,561,842.06. While perspectives vary widely, customer concentration risk remains a primary concern that could weigh heavily on Qorvo’s financial trajectory, review multiple viewpoints to form your opinion.

Explore 5 other fair value estimates on Qorvo - why the stock might be a potential multi-bagger!

Build Your Own Qorvo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qorvo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qorvo's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal