Navios Maritime Partners (NYSE:NMM): Assessing Valuation After Q2 Earnings Decline and Major Share Buyback

If you have been following Navios Maritime Partners (NYSE:NMM), you probably noticed the latest earnings report paired with an update on its share buyback. The company posted second quarter sales of $327 million, down from the prior year, with net income stepping back as well. Following this softer performance, management revealed it completed a sizeable repurchase, retiring over 5% of its shares in less than eight months. This is notable given industry headwinds.

These two pieces of news pushed the stock into the spotlight. After trailing for much of the past year, with shares down around 9%, the stock is up 14% in the past month and has gained 20% across the past three months. This may indicate that sentiment is shifting. Meanwhile, earnings expectations for 2025 and 2026 have actually increased over the summer, despite the recent decline in results. In short, momentum might be building just as investors debate the company’s true value versus its long-term prospects.

So what does this mean for anyone sizing up Navios Maritime Partners today? Has the dust from this quarter’s dip and the buyback finally created an opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 28.7% Undervalued

According to community narrative, Navios Maritime Partners is seen as substantially undervalued compared to its fair value estimate. The narrative points to significant operational developments and forward-looking strategies that fuel this assessment.

"Navios Maritime Partners is taking advantage of a diversified fleet and significant contracted revenue of $3.6 billion, which provides stability and cushions against market volatility. This forward-looking strategy supports consistent revenue streams and mitigates risks associated with geopolitical and economic disruptions."

What is powering this bold undervaluation thesis? The story lies in the combination of aggressive buybacks, portfolio upgrades, and a revenue outlook that could surprise many skeptics. Want to unravel the financial assumptions and learn which future projections are fundamental to this notable price target? The real drivers may not be what you expect. Find out what is behind the narrative’s conviction.

Result: Fair Value of $65.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, key risks remain. Geopolitical turmoil or a slowdown in China could quickly shift demand and challenge the current bullish view.

Find out about the key risks to this Navios Maritime Partners narrative.Another View: Caution from Our DCF Model

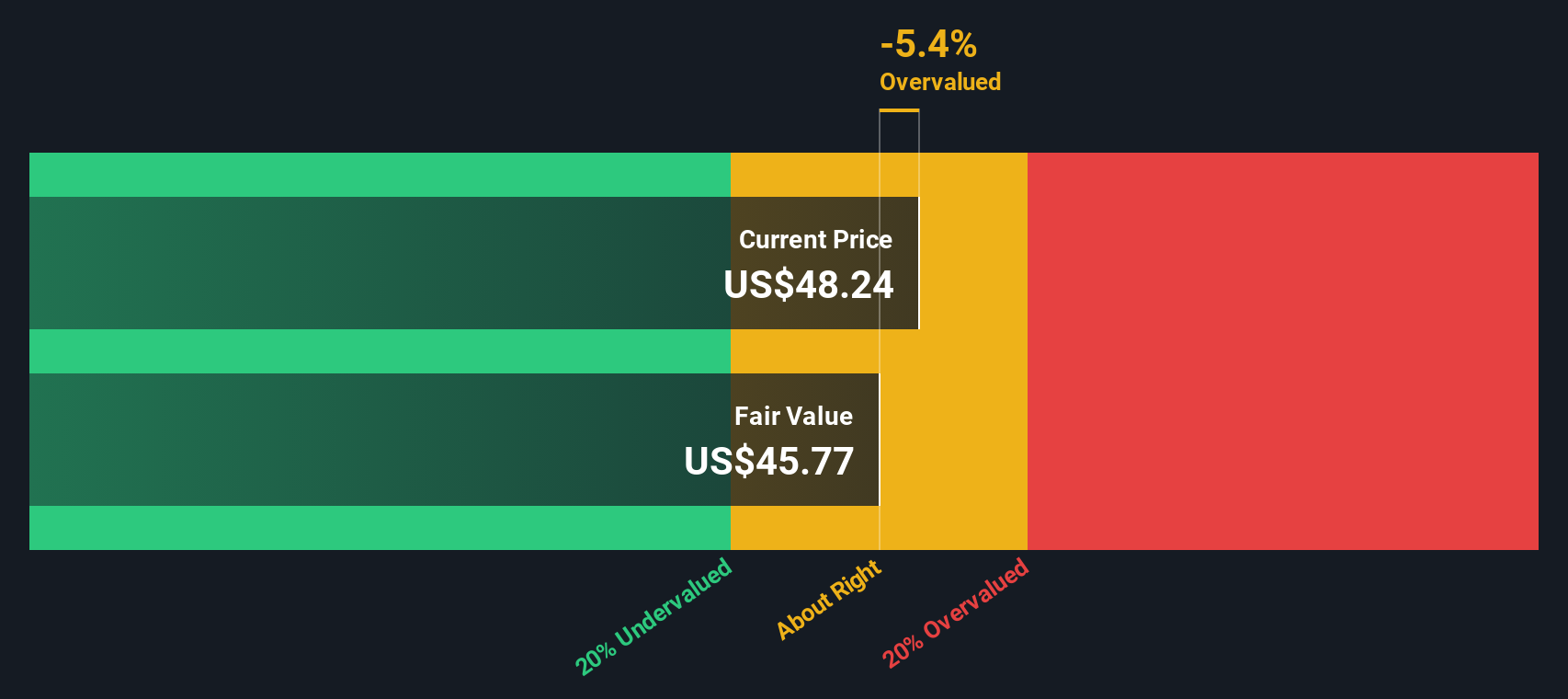

While analysts see Navios as undervalued, our DCF model tells a different story. It suggests the shares may actually be overvalued based on projected future cash flows. What explains the gap between these two approaches?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Navios Maritime Partners Narrative

If you are keen to dig deeper or have different insights, you can easily analyze the data yourself and develop a personal perspective in just a few minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Navios Maritime Partners.

Looking for More Compelling Investment Opportunities?

Smart investors know that broadening their horizons unlocks new growth stories and untapped value. Don’t let exciting market moves pass you by. Use the power of Simply Wall Street’s tools to zero in on stocks poised for tomorrow’s headlines. Check out these hand-picked ideas to get ahead now:

- Unearth hidden value as you browse undervalued stocks based on cash flows that smart money is watching for growth driven by strong cash flows and solid fundamentals.

- Tap into the revolution in medicine by accessing healthcare AI stocks shaping the future with advanced diagnostics, personalized therapies, and AI-driven solutions.

- Strengthen your income strategy when you secure dividend stocks with yields > 3% offering reliable yields above 3% for steady returns and resilience in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal