Do Weis Markets' Mixed Profits Reveal a Turning Point in Its WMK Investment Story?

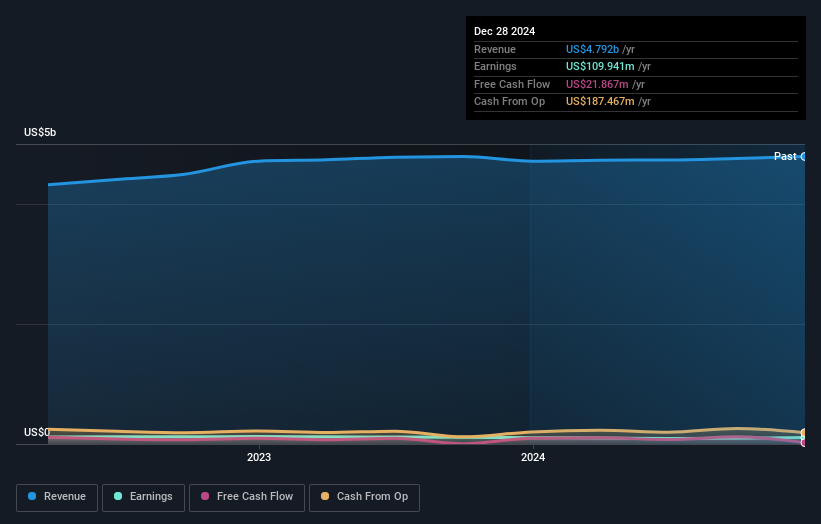

- Weis Markets reported its second quarter and half-year 2025 earnings, highlighting sales of US$1.21 billion for the quarter and net income of US$26.53 million, both up slightly versus the same period last year.

- While quarterly profits saw a modest rise, half-year net income dipped compared to 2024, signaling mixed operating results despite continued revenue growth.

- We’ll examine how the divergence between rising sales and mixed net income shapes Weis Markets’ investment narrative this quarter.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Weis Markets' Investment Narrative?

Weis Markets’ big picture rests on the belief that disciplined regional growth and reliable dividend payments can offset pressures like competitive pricing and margin volatility. The latest earnings report brings nuance to this outlook, with steadily rising sales but a flat trend in profit, especially as first-half net income decreased compared to last year. For those following short-term catalysts, consistent revenue growth and a freshly affirmed dividend are positive indicators. However, the persistent challenge remains: translating sales momentum into lasting profitability, especially in a sector sensitive to costs and competitive shifts. The recent news underscores this divergence, and while it doesn’t appear to dramatically alter near-term risks or catalysts, it does reinforce ongoing concerns over profit margins. For investors, it’s a familiar balance between the appeal of stability and the realities of thin operating margins.

But unlike sales, margins have not shown the same sense of certainty, something investors should watch closely. Weis Markets' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Weis Markets - why the stock might be worth as much as $64.42!

Build Your Own Weis Markets Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weis Markets research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weis Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weis Markets' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal