Can Gibraltar Industries’ (ROCK) Lower EPS Guidance Reveal a Shift in Profitability Strategy?

- Gibraltar Industries recently announced its second-quarter 2025 results, reporting increased sales of US$309.52 million but a decrease in net income to US$26 million compared to the previous year, along with updated full-year guidance projecting lower earnings per share for 2025.

- While sales growth continued, the company's forecast for reduced annual earnings per share compared to 2024 signals shifting profitability dynamics that may influence expectations for the rest of the year.

- We'll now explore how the updated full-year earnings outlook may prompt a reassessment of Gibraltar Industries' investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Gibraltar Industries Investment Narrative Recap

To be a Gibraltar Industries shareholder, you need to believe in the company’s ability to drive growth from its core building products and structures businesses despite becoming more exposed to cyclical construction markets following the exit from renewables. The recent guidance cut, with lower projected earnings per share for 2025, subtly tempers optimism around short-term earnings momentum; however, it does not alter the long-term catalyst of potential infrastructure demand, nor does it lessen the current risk from ongoing weakness in residential construction.

The company’s recent update, narrowing full-year net sales guidance to US$1.15–1.20 billion and lowering its expected 2025 earnings per share, stands out for its immediate relevance. This announcement heightens focus on how Gibraltar will manage slower earnings growth while addressing profit margin pressures in its largest segments.

By contrast, investors should not overlook ongoing margin compression in residential construction, as this risk could further …

Read the full narrative on Gibraltar Industries (it's free!)

Gibraltar Industries' narrative projects $1.1 billion revenue and $135.8 million earnings by 2028. This requires a 6.0% yearly revenue decline and a $0.2 million decrease in earnings from the current $136.0 million.

Uncover how Gibraltar Industries' forecasts yield a $85.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

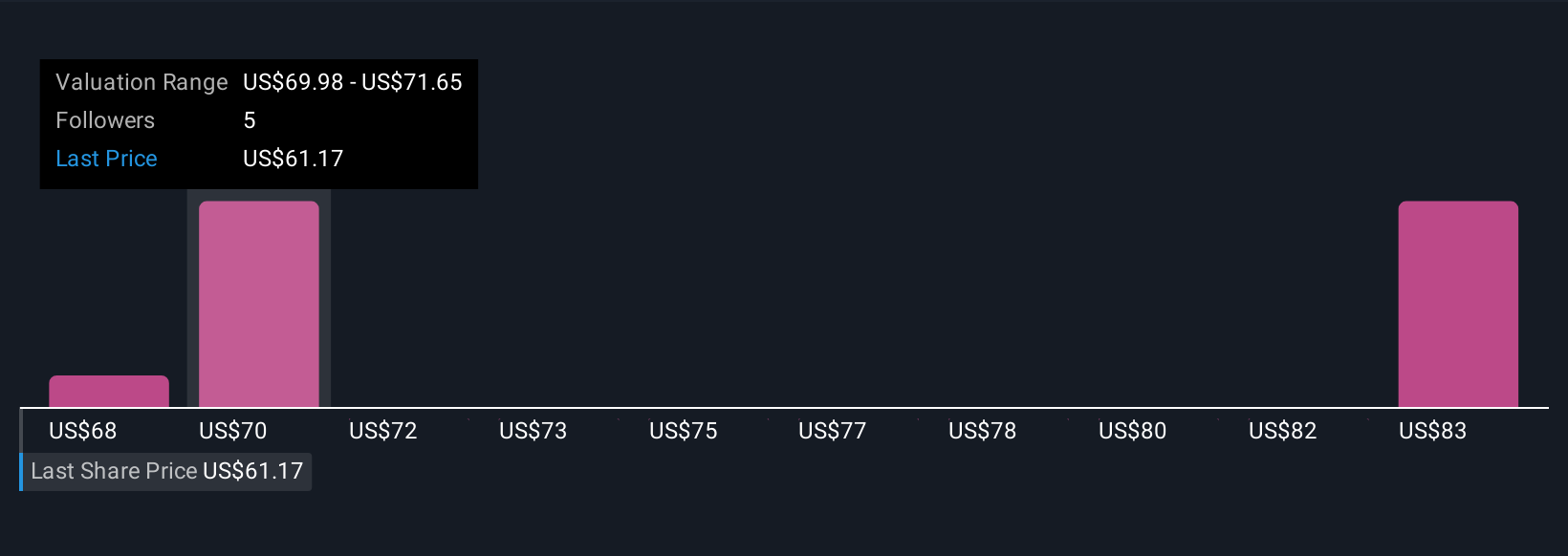

Three members of the Simply Wall St Community assigned fair value estimates for Gibraltar Industries ranging from US$68.31 to US$85 per share. This spread in retail investor views sits alongside the current company pivot away from renewables, signaling varied expectations about revenue growth and the company’s future focus.

Explore 3 other fair value estimates on Gibraltar Industries - why the stock might be worth as much as 37% more than the current price!

Build Your Own Gibraltar Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gibraltar Industries research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Gibraltar Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gibraltar Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal