Why Constellation Software (TSX:CSU) Is Down 5.4% After Strong Revenue Gains but Profit Decline

- Constellation Software reported its second quarter and half-year 2025 results, showing revenue growth to US$2.84 billion and US$5.50 billion, respectively, but with a sharp drop in net income compared to the prior year.

- Despite higher sales and the continuation of its US$1.00 per share quarterly dividend, profitability pressures emerged, as net income and earnings per share both declined markedly.

- We’ll explore what declining profitability, despite sizable revenue gains, means for Constellation Software’s current investment story.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Constellation Software's Investment Narrative?

Constellation Software’s appeal has always been rooted in its steady expansion through acquisitions and its ability to turn top-line growth into long-term shareholder value. For investors to stay confident in the story, the belief must be that revenue growth eventually translates into sustainably higher profits, even as competition and acquisition costs rise. The latest quarterly results complicate that narrative, with revenue hitting US$2.84 billion but net income dropping sharply to US$56 million. This sudden slump in profitability comes despite continued dividend payments and ongoing expansion efforts, raising questions about near-term execution. Previously, analysts pointed to accelerating profit growth and healthy earnings forecasts as important short-term catalysts. However, these results flag that cost management and margin stability might now outweigh sales momentum as key risks, potentially shifting how investors weigh the stock’s expensive valuation against its prospects. If profitability doesn’t rebound swiftly, the current risks could become more immediate for shareholders.

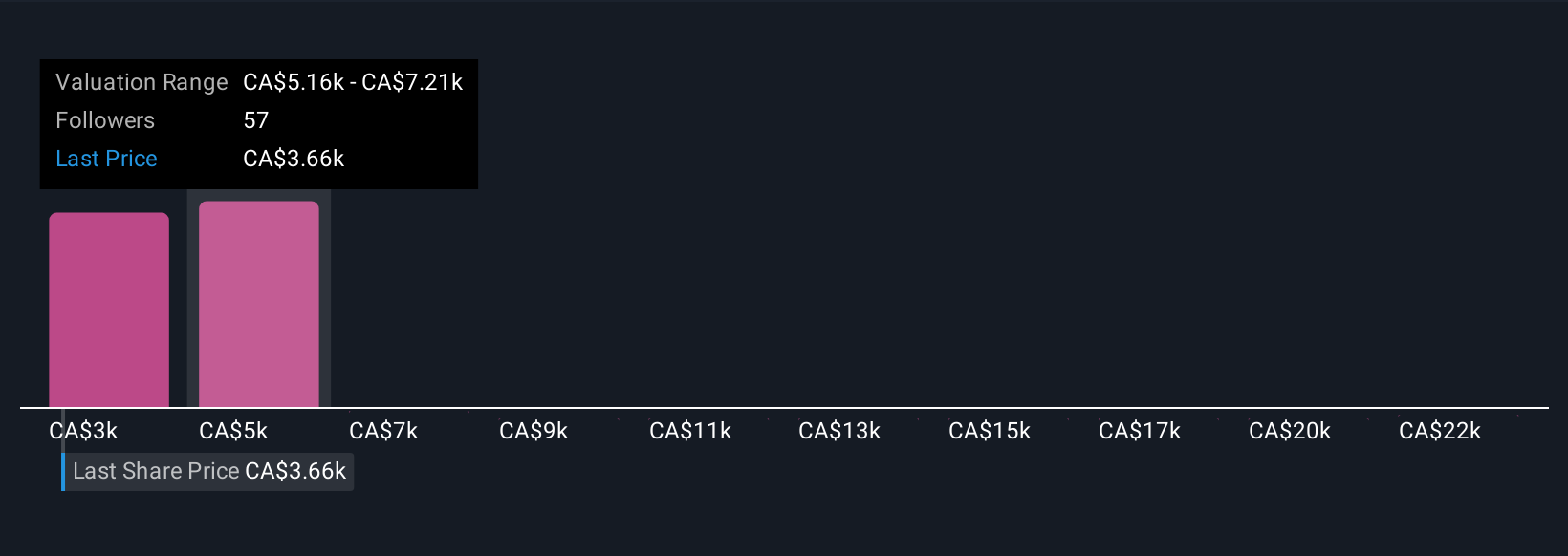

But while revenue growth has impressed, shrinking margins could change the risk calculus for investors. Despite retreating, Constellation Software's shares might still be trading 13% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 16 other fair value estimates on Constellation Software - why the stock might be worth as much as 81% more than the current price!

Build Your Own Constellation Software Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Software's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal