Will H&R Block’s Executive Shift and Dividend Hike Reveal More About Its Capital Priorities? (HRB)

- H&R Block reported higher fourth quarter revenue and net income year-over-year, confirmed its outlook for fiscal 2026 revenue between US$3.88 billion and US$3.90 billion, and announced a 12% quarterly dividend increase payable in October 2025.

- The company also detailed executive leadership changes effective late 2025, including the retirement of CEO Jeffrey J. Jones II and the appointment of Curtis A. Campbell as his successor, alongside new senior technology and operations appointments.

- We’ll explore how the dividend increase, signaling management’s confidence, shapes the outlook for H&R Block’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

H&R Block Investment Narrative Recap

To be an H&R Block shareholder, you typically need to believe the company can offset competitive threats from digital-first and low-cost tax solutions by capturing value from growing tax complexity and small business opportunities. The latest quarterly report showed higher revenue and earnings, but this doesn’t appear to have changed the most important short term catalyst: H&R Block’s ability to stabilize or regain market share. The biggest risk, further declines in market share as digital competitors grow, remains, and the new executive appointments do not materially reduce this pressure in the near term.

Of the recent announcements, the 12% increase in the quarterly dividend stands out, continuing a streak of annual raises. This is particularly relevant as it signals the board’s ongoing confidence in future cash flows, which could help temper concerns about declining share performance. Such moves may encourage income-oriented investors but do not directly address the core challenge of defending and expanding H&R Block’s customer base in a changing industry.

But while the dividend outlook appears reassuring, investors should be aware of the potential risks if digital competitors accelerate their gains in market share and ...

Read the full narrative on H&R Block (it's free!)

H&R Block's outlook anticipates $4.1 billion in revenue and $639.8 million in earnings by 2028. This scenario assumes a 3.2% annual revenue growth rate and a $74.8 million increase in earnings from the current $565.0 million level.

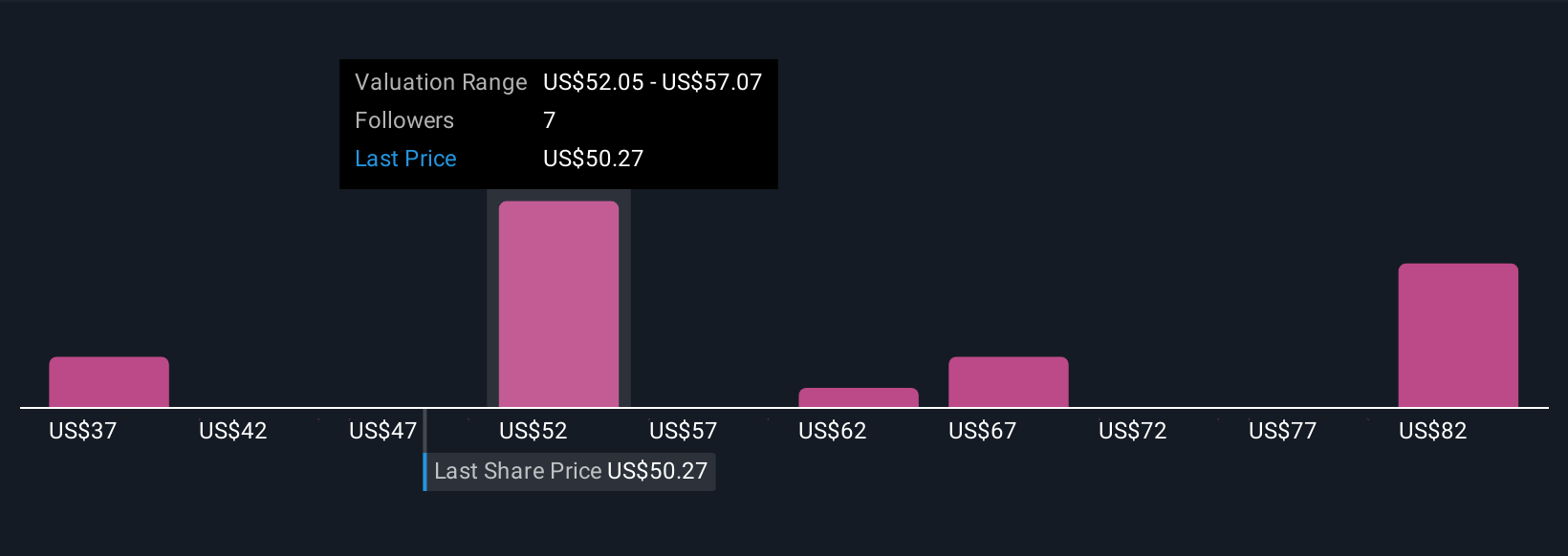

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$37 to US$99, with 5 different investor perspectives. Even as some estimate significant upside, the persistent risk of market share losses could influence both future returns and sentiment in unexpected ways.

Explore 5 other fair value estimates on H&R Block - why the stock might be worth 26% less than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal