How Investors May Respond To LexinFintech (LX) Doubling Net Income and Declaring a New Dividend

- LexinFintech Holdings recently reported that its second quarter 2025 net income more than doubled year-over-year despite a slight decrease in revenue, and declared a dividend of US$0.097 per share (US$0.194 per ADS) to be paid in September 2025.

- The company also maintained its full-year 2025 earnings guidance and announced the resignation of Chief Technology Officer Erwin Yong Lu, effective at the end of September 2025, citing family and personal reasons.

- Given the sharp jump in net income and a fresh dividend, let’s explore the impact on LexinFintech’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LexinFintech Holdings Investment Narrative Recap

To be a LexinFintech shareholder, you need to believe in the company’s ability to balance regulatory headwinds with strong earnings momentum and disciplined capital management. The recent earnings surge and dividend declaration reinforce confidence in near-term profitability, while CTO Erwin Yong Lu’s resignation is unlikely to materially affect the key catalyst of profit growth, nor does it heighten the existing regulatory and credit risks that are central to the investment case right now. Of the latest company announcements, the increase in the dividend payout ratio stands out as most relevant. It directly links management’s confidence in sustained earnings with tangible capital returns, and supports the investment narrative emphasizing capital discipline and ongoing profit generation, even as regulatory and credit risks remain closely monitored by investors. Yet, in contrast to this optimism, investors should keep in mind that increasing regulatory scrutiny and evolving loan facilitation rules remain a persistent risk to...

Read the full narrative on LexinFintech Holdings (it's free!)

LexinFintech Holdings is projected to achieve CN¥20.8 billion in revenue and CN¥4.5 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 14.1% and an earnings increase of CN¥2.9 billion from current earnings of CN¥1.6 billion.

Uncover how LexinFintech Holdings' forecasts yield a $11.50 fair value, a 72% upside to its current price.

Exploring Other Perspectives

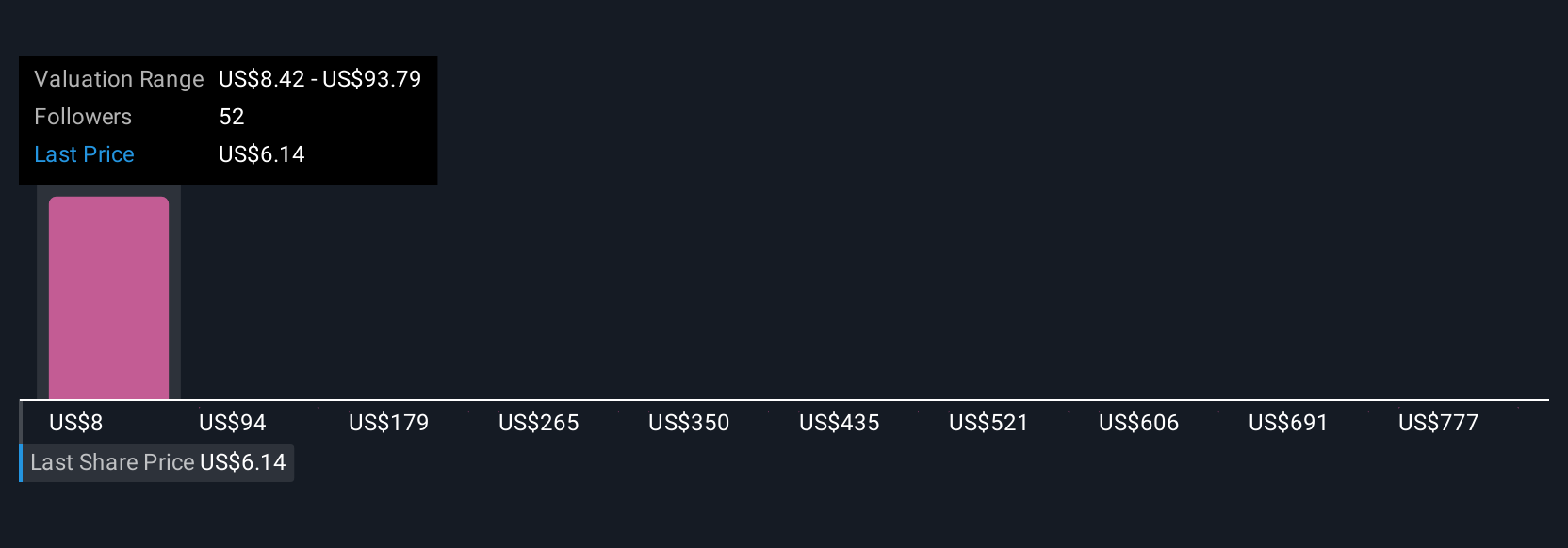

Seven Simply Wall St Community members offered fair value estimates for LexinFintech ranging from US$8.42 to US$862.11 per share. Opinions vary, especially as strong recent profit growth faces the ongoing challenge of stricter lending regulations.

Explore 7 other fair value estimates on LexinFintech Holdings - why the stock might be worth just $8.42!

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal