What FTI Consulting (FCN)'s CFO Succession Plan Means For Shareholders

- FTI Consulting recently announced that Chief Financial Officer Ajay Sabherwal will leave the company on September 12, 2025, with Paul Linton, Chief Strategy and Transformation Officer, to serve as interim CFO while a search for a permanent replacement is underway.

- This leadership transition has prompted discussion about the impact of CFO stability on investor confidence and the company’s long-term financial direction.

- We’ll explore how the appointment of an interim CFO could affect FTI Consulting’s investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

FTI Consulting Investment Narrative Recap

To be a shareholder in FTI Consulting, you need to believe in the firm’s ability to capture ongoing demand for regulatory, forensic, and crisis advisory services as global complexity rises. The recent CFO departure and interim appointment is sparking some volatility but does not appear likely to change the company’s most important near-term catalyst, new regulatory-driven demand, nor does it substantially increase the key risk around talent integration and cost management for now. While leadership stability is always important, the immediate impact on business fundamentals seems limited.

A closely related announcement is the recent appointment of Martin Tupila as Senior Managing Director in Singapore to strengthen FTI’s forensic and investigations offering in Asia. This reinforces FTI’s ongoing expansion into international markets, which aligns with catalysts like rising compliance demand and the need to diversify revenue streams, and may help smooth out risk from earnings volatility in cyclical segments.

However, in contrast, investors should be aware that uncertainty around key executive transitions can create...

Read the full narrative on FTI Consulting (it's free!)

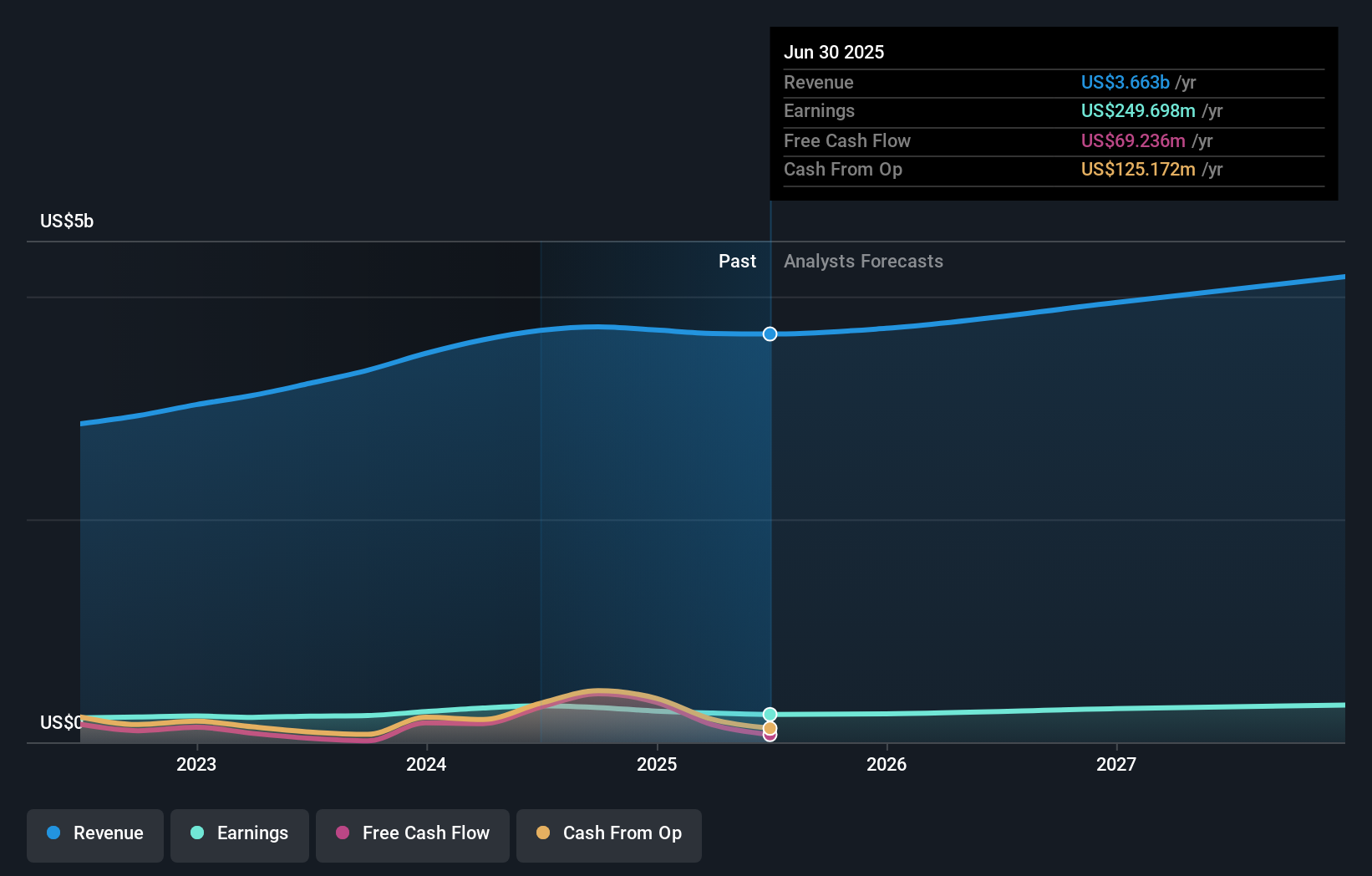

FTI Consulting's narrative projects $4.3 billion in revenue and $358.3 million in earnings by 2028. This requires 5.3% yearly revenue growth and a $108.6 million earnings increase from the current $249.7 million.

Uncover how FTI Consulting's forecasts yield a $185.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value opinions total just one, clustering at US$185 with no range, suggesting consensus on current valuation. Yet the open question of leadership continuity and its effect on integrating new talent highlights why your view on FTI’s management stability could drive very different conclusions.

Explore another fair value estimate on FTI Consulting - why the stock might be worth as much as 9% more than the current price!

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal