Is Kulicke and Soffa's (KLIC) Buyback Amid Losses a Signal of Management Confidence or Caution?

- Kulicke and Soffa Industries recently released its third quarter results, reporting a decrease in sales to US$148.41 million and a net loss of US$3.29 million, along with new fourth quarter guidance anticipating net revenue of around US$170 million and diluted EPS of approximately US$0.08.

- Over the same period, the company completed a share buyback of 668,000 shares for US$21.63 million, representing around 1.26% of its shares outstanding.

- We’ll examine how the company’s decision to provide updated quarterly guidance amid weaker results affects its current investment narrative.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

What Is Kulicke and Soffa Industries' Investment Narrative?

To own shares of Kulicke and Soffa Industries right now, investors need to believe in a recovery and eventual growth in the semiconductor equipment sector, as well as the company's ability to navigate through recent earnings volatility. The latest results, showing a net loss in the third quarter paired with a cautious return to profitability in the fourth quarter guidance, signal a bumpy near-term path. While the buyback shows management’s confidence and attempts to support share value, the immediate catalyst remains a turnaround in quarterly performance, particularly supported by partnerships like the new smart manufacturing solutions announced in July. Meanwhile, persistent risks include inconsistent earnings, recent underperformance against peers, and dividend sustainability questions as profits remain lumpy. While these results may not enlarge existing risks, they draw attention to the business's short-term unpredictability. Yet, dividend stability remains a concern investors should be aware of.

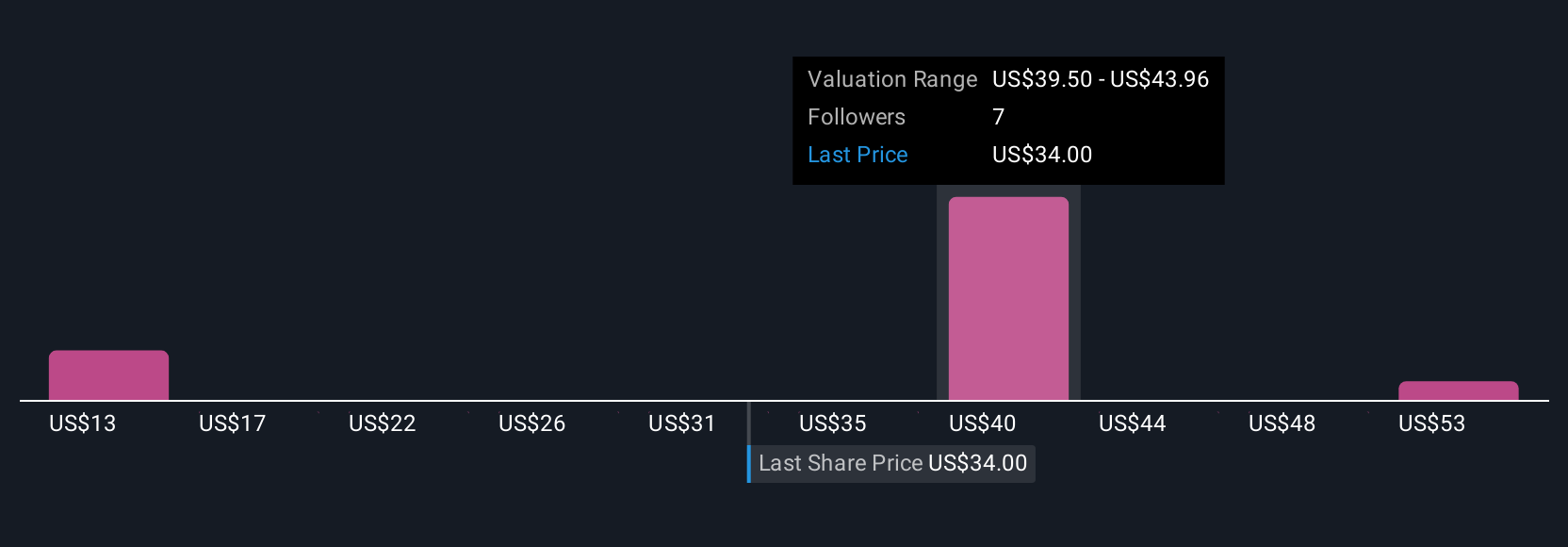

Kulicke and Soffa Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth as much as 52% more than the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal