Strong Q2 Results and Upbeat 2025 Guidance Might Change the Case for Investing in BFAM

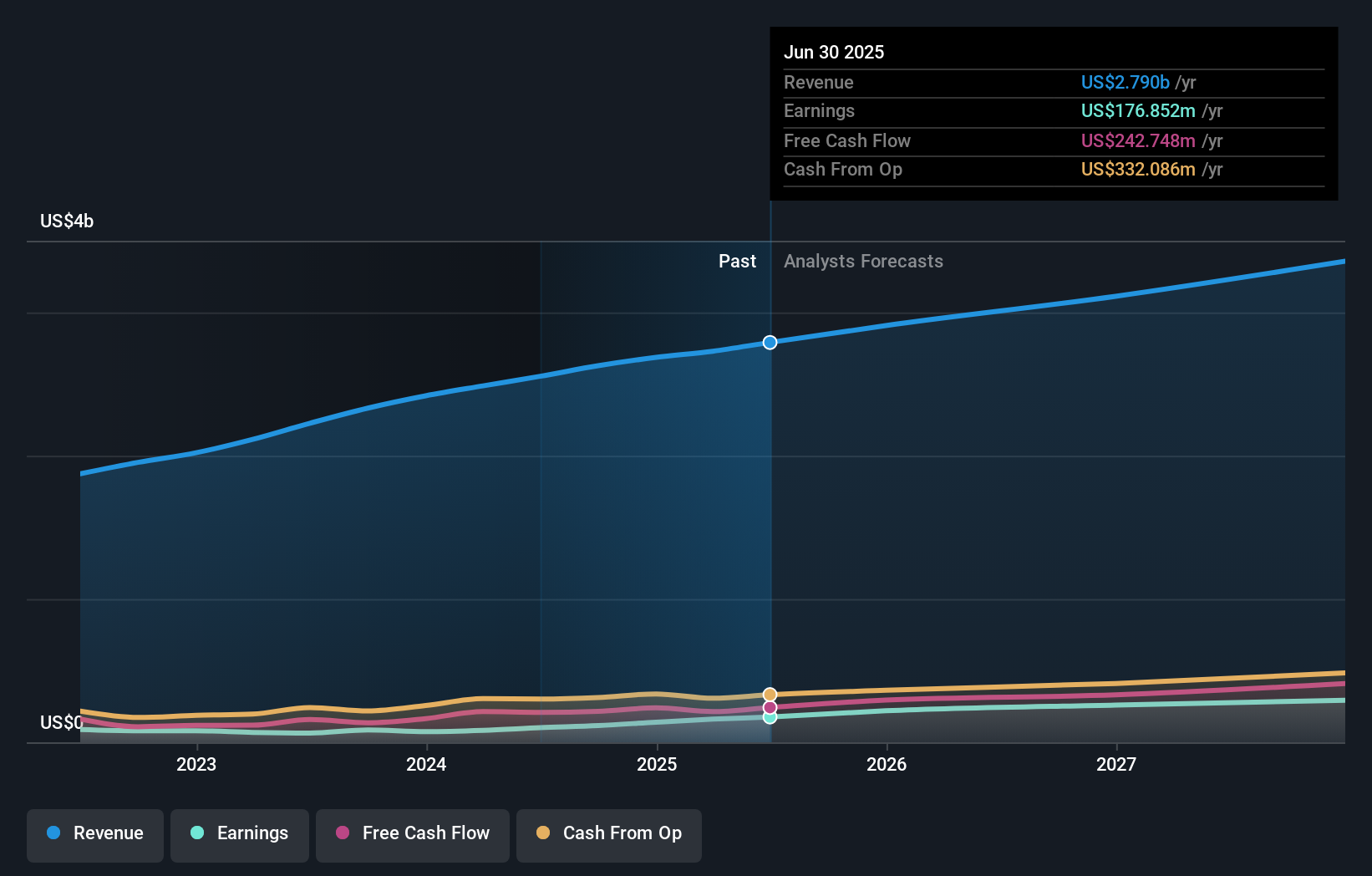

- Bright Horizons Family Solutions recently reported strong second quarter results, with revenue reaching US$731.57 million and net income growing to US$54.78 million, and also released updated 2025 revenue guidance of US$2.9 billion to US$2.92 billion.

- The company’s confident outlook and improved earnings followed the completion of a US$5.89 million share buyback, signaling ongoing efforts to return capital to shareholders while benefiting from demand in employer-sponsored childcare.

- We’ll assess how this improved financial performance and guidance reinforces the case for Bright Horizons’ anticipated earnings and margin recovery.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Bright Horizons Family Solutions Investment Narrative Recap

To be a shareholder of Bright Horizons, you have to believe in the long-term growth of employer-sponsored childcare and persistent demand from corporate clients. While the recent strong quarterly results and lifted 2025 revenue guidance reinforce expectations for margin recovery, the lack of acceleration in net center openings and continued closures highlight that topline growth risk remains present; these developments are relevant but have not materially changed the primary catalyst or risk in the near term.

The updated 2025 revenue guidance to US$2.9 billion to US$2.92 billion is particularly relevant, as it reflects management's ongoing confidence in operational improvement and demand across core offerings. This guidance supports the narrative that enrollment and margin trends are recovering, though operational consistency remains a key focus for further upside.

However, it is important for investors not to overlook the possibility that, despite positive earnings, ongoing net center closures could signal...

Read the full narrative on Bright Horizons Family Solutions (it's free!)

Bright Horizons Family Solutions is projected to reach $3.5 billion in revenue and $329.7 million in earnings by 2028. This outlook is based on expected annual revenue growth of 7.5% and an earnings increase of $152.8 million from current earnings of $176.9 million.

Uncover how Bright Horizons Family Solutions' forecasts yield a $140.89 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community put fair value for Bright Horizons between US$88.59 and US$207.55, across four distinct analyses. Despite this wide span, operational challenges around net center closures remain central in how future performance could unfold, so consider multiple viewpoints as you form your own conclusion.

Explore 4 other fair value estimates on Bright Horizons Family Solutions - why the stock might be worth 26% less than the current price!

Build Your Own Bright Horizons Family Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bright Horizons Family Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Horizons Family Solutions' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal