Did Praetorian Capital’s Focus on Florida Panhandle Growth Just Shift St. Joe's (JOE) Investment Narrative?

- Praetorian Capital recently highlighted The St. Joe Company in its Q2 investor letter, pointing to the firm's substantial 167,000-acre land portfolio in the Florida Panhandle and its potential for significant growth fueled by population expansion in the region.

- The fund emphasized JOE's combination of an attractive valuation and embedded asset value as a key opportunity, which is drawing increased attention from investors.

- We will explore how the focus on Florida Panhandle population growth as an earnings catalyst shapes St. Joe's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is St. Joe's Investment Narrative?

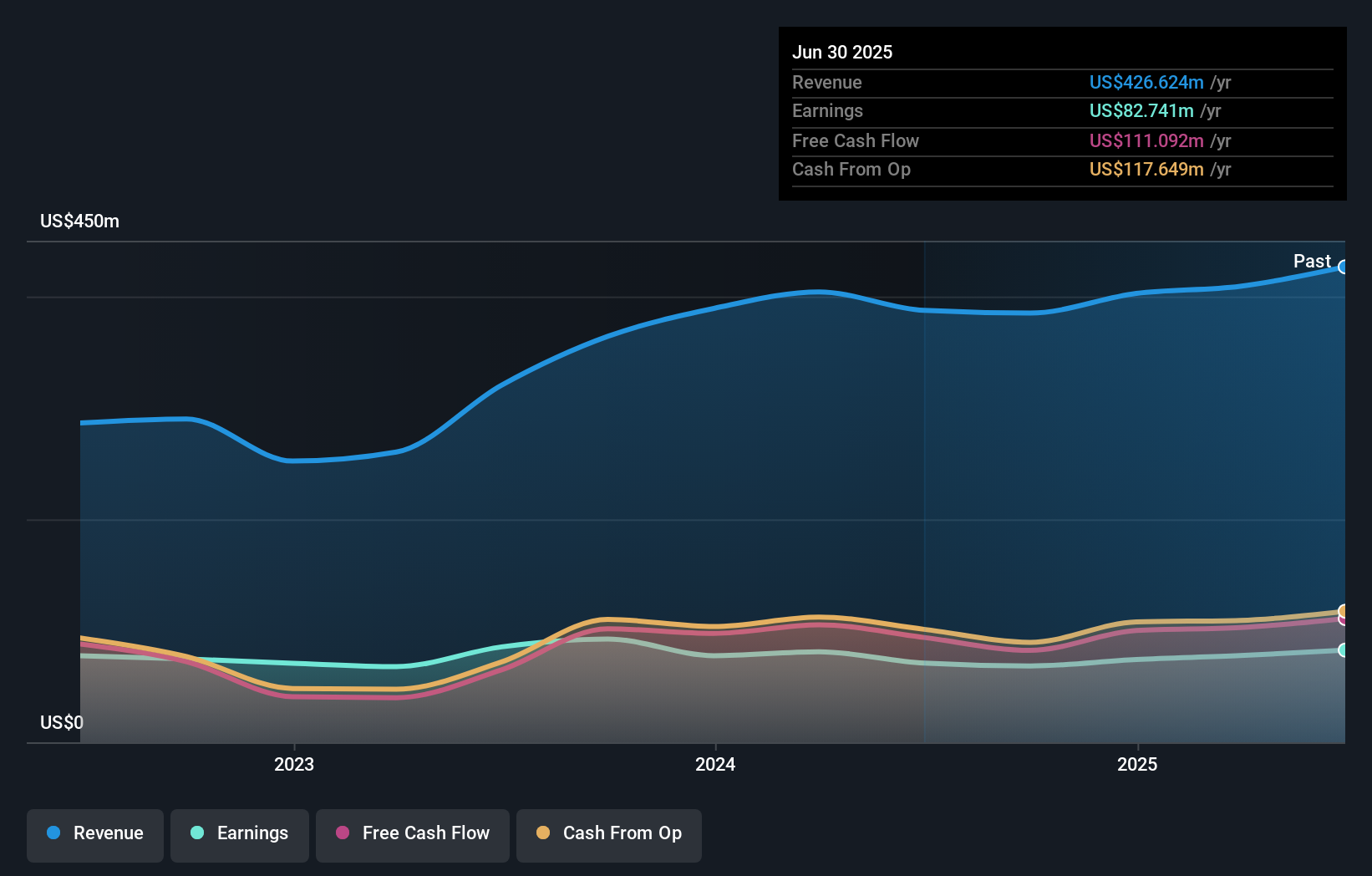

To be a St. Joe shareholder, you really have to believe in the continued transformation of Florida’s Panhandle and the company’s ability to unlock value from its vast land holdings as the region attracts more residents. Recent quarterly results have shown healthy revenue and net income increases, with management focused on growing development projects and expanding amenities. While catalysts like new community openings and transportation links appear solid in the near term, it’s just as important to keep an eye on broader risks. The latest news, such as index removal and market underperformance, has not shifted the trajectory of these key drivers, nor does it materially affect the long-term story centered on population growth and asset development. Investors still face the same concerns around valuation and returns, especially given the company’s premium price-to-earnings ratio relative to peers and recent lag behind industry benchmarks.

But while optimism persists, higher-than-average valuation remains an issue investors should be aware of. St. Joe's shares are on the way up, but they could be overextended by 22%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth as much as $42.37!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal