American Vanguard Corporation (NYSE:AVD) Held Back By Insufficient Growth Even After Shares Climb 29%

American Vanguard Corporation (NYSE:AVD) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.4% over the last year.

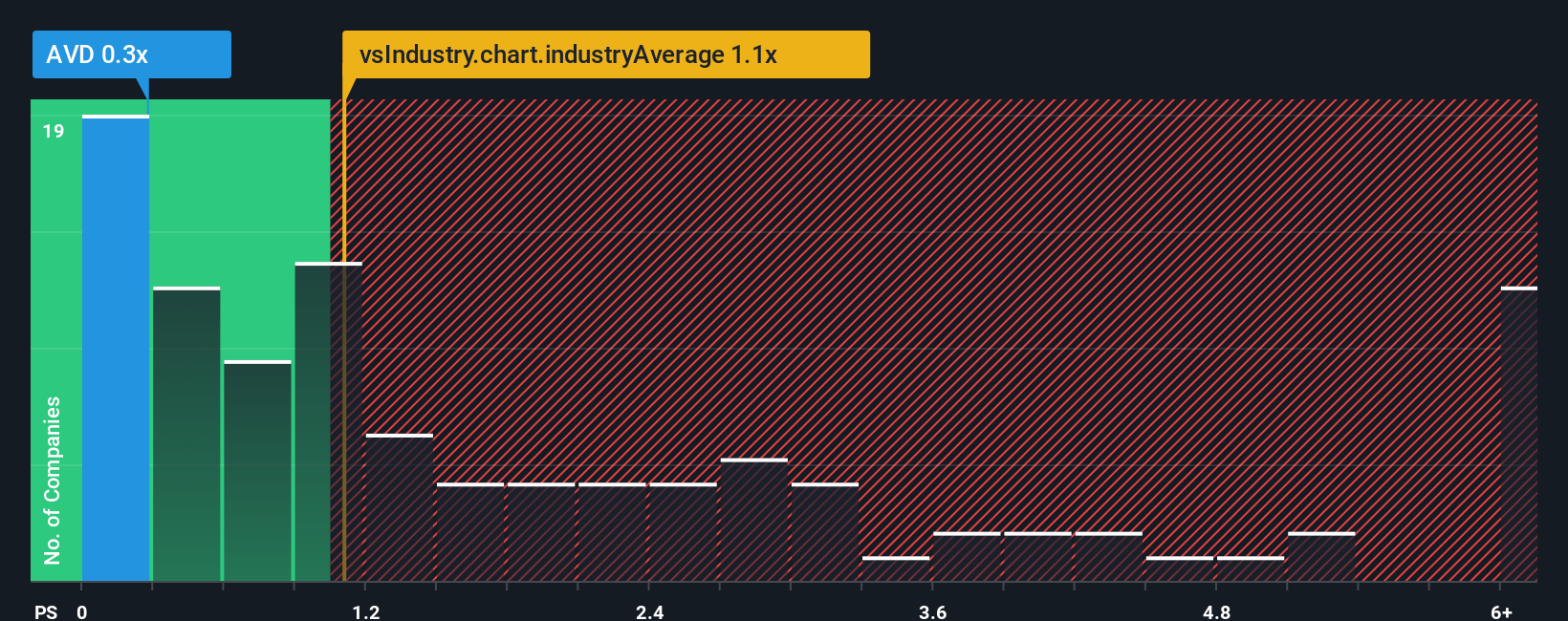

Although its price has surged higher, given about half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider American Vanguard as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for American Vanguard

What Does American Vanguard's P/S Mean For Shareholders?

American Vanguard could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on American Vanguard.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, American Vanguard would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 3.1% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 11% growth forecast for the broader industry.

In light of this, it's understandable that American Vanguard's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From American Vanguard's P/S?

American Vanguard's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of American Vanguard's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for American Vanguard that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal