How Investors Are Reacting To Nelnet (NNI) Surging Profits, Raised Dividend and New EdTech Platform

- Nelnet reported a very large year-over-year increase in second-quarter net income to US$181.46 million and raised its cash dividend, while also completing a US$20.61 million share buyback.

- The company unveiled Notify, a new platform designed to help higher education institutions automate communications and streamline payment processes, highlighting investments in innovation alongside strong financial performance.

- We'll examine how Nelnet's substantial profit growth and the introduction of its Notify platform shape the company's investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nelnet's Investment Narrative?

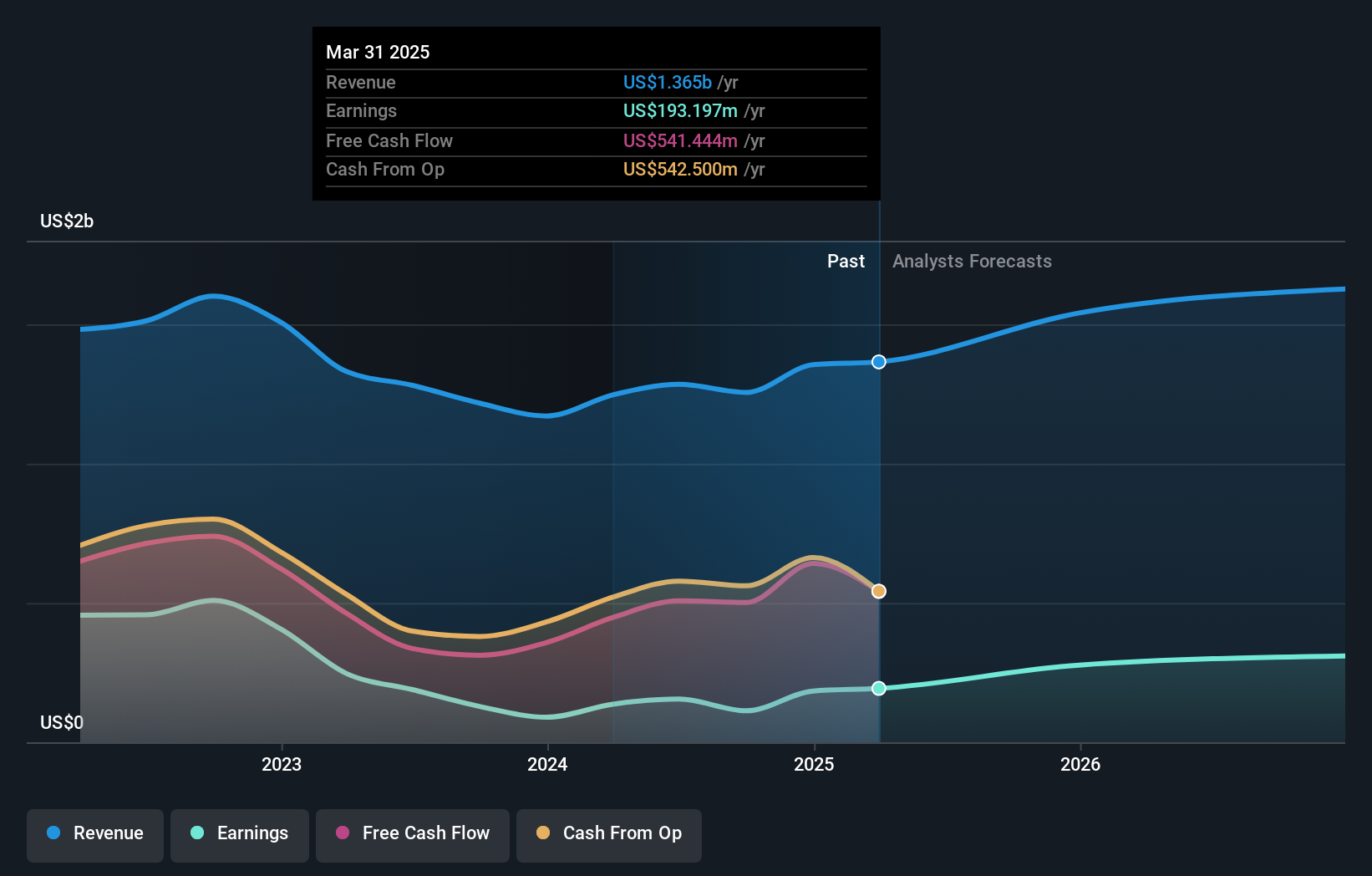

To be a Nelnet shareholder, you need to believe in the company's ability to create value through both operational performance and strategic investment in technology. The recent surge in second-quarter net income to US$181.46 million, supported by a dividend hike and steady buybacks, signals meaningful short-term catalysts for shareholder returns. The unveiling of Notify, a platform to streamline higher education communications, also positions Nelnet to broaden its service footprint, potentially opening new revenue streams and bolstering its competitive edge. These moves could reshape previously identified risks. Earlier analysis pointed to sluggish revenue growth and a premium valuation as key concerns, but strong earnings and innovation may shift investor focus to how sustainable these gains are and if technology launches deliver real adoption or face execution risk. Overall, these recent events look material to the company’s near-term outlook. Yet, with these opportunities, execution missteps in tech launches remain a risk investors should watch closely.

Nelnet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth as much as $130.00!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal