Are Modest Sales Gains at Weis Markets (WMK) Enough to Sustain Its Profitability Story?

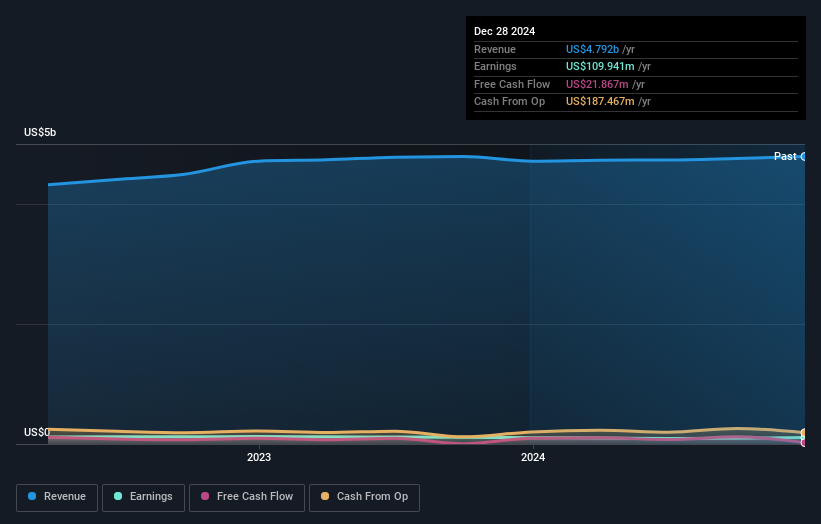

- Weis Markets recently reported its second-quarter and first-half 2025 earnings, with sales and revenue experiencing modest year-over-year growth while net income remained largely steady.

- An interesting aspect is that, despite higher revenue, the company's net income for the first half decreased slightly compared to the same period in the previous year.

- We'll examine how consistent sales gains alongside stable profitability shape the investment narrative for Weis Markets following the latest results.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Weis Markets' Investment Narrative?

At its core, investing in Weis Markets is about believing in the durability of its business model and the company’s ability to translate steady revenue gains into consistent shareholder value, even as profit margins fluctuate. The latest results reinforce this theme, with higher sales and almost flat net income for the second quarter, but a modest drop over the first half of the year despite earlier expectations for more robust earnings. This news might slightly lessen optimism around near-term earnings momentum, yet the company’s continued dividend commitment and measured expansion signal operational stability. Risks, however, may now tilt more toward margin pressures, especially if cost increases persist without corresponding growth in profitability. The news doesn’t appear to materially shift the primary catalysts or concerns surrounding the stock, but it does refocus attention on how the business manages cost controls and competitive challenges ahead.

However, margin pressures and modest profit trends are factors investors should pay close attention to.

Exploring Other Perspectives

Explore 3 other fair value estimates on Weis Markets - why the stock might be worth less than half the current price!

Build Your Own Weis Markets Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weis Markets research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weis Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weis Markets' overall financial health at a glance.

No Opportunity In Weis Markets?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal