Can Cheniere (CQP) Sustain Distributions as LNG Costs Rise and Profit Margins Narrow?

- Cheniere Energy Partners, L.P. recently reported second-quarter 2025 earnings, with revenue rising to US$2.46 billion but net income falling to US$553 million compared to the previous year.

- Although the company reaffirmed its full-year distribution guidance of US$3.25–US$3.35 per common unit, lower LNG volumes and higher operating costs contributed to a decline in profits.

- We’ll assess how increased operating costs impact Cheniere’s investment narrative amid steady distribution guidance and shifting LNG market conditions.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Cheniere Energy Partners' Investment Narrative?

To own shares in Cheniere Energy Partners, you have to believe in the long-term demand for US liquefied natural gas exports and the company's ability to deliver stable cash flows despite near-term fluctuations in LNG volumes and operating costs. The latest earnings report shows revenue rising but net income dipping due to higher expenses and reduced LNG volumes. However, the company reaffirmed its 2025 distribution targets, which signals management’s confidence in their cash generation. This should limit the immediate impact of weaker earnings on the stock’s investment thesis, keeping short-term catalysts, like capacity contracts and export demand, mostly intact. Still, higher debt levels and increased costs may put pressure on margins and limit financial flexibility, which could influence both risks and future distribution policy more than previously anticipated given the recent news.

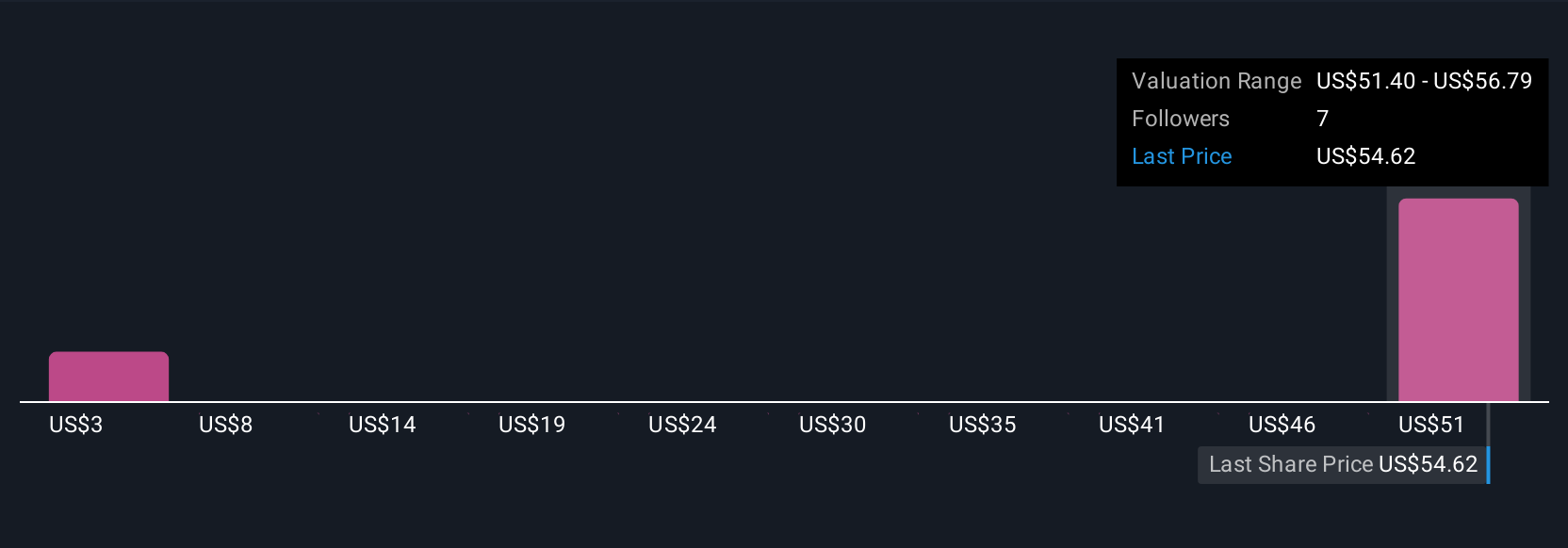

But, growing debt and costs present a real risk investors should not ignore. Cheniere Energy Partners' share price has been on the slide but might be up to 18% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth as much as 5% more than the current price!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal