Can Himax (HIMX) Balance Near-Term Pressures With Its Long-Term Tech Strategy?

- Himax Technologies recently reported its second-quarter 2025 results, highlighting a sequential revenue decline to US$214.8 million and a net income reduction to US$16.54 million, with management issuing cautious third-quarter guidance citing a potential 12% to 17% quarter-over-quarter revenue decrease and a loss per diluted ADS of 2.0 to 4.0 cents.

- While near-term profitability is expected to be pressured by trade tensions and tariff uncertainties, the company remains focused on long-term growth opportunities in automotive display ICs, WiseEye AI, and co-package optics technology.

- We'll explore how Himax's newly announced cautious outlook, particularly connected to trade and employee cost headwinds, shapes its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Himax Technologies Investment Narrative Recap

Anyone considering Himax Technologies needs to believe in the company's vision for growth in automotive display ICs and emerging technologies like WiseEye AI, despite ongoing sector volatility. The latest earnings report and cautious third-quarter outlook highlight persistent demand headwinds and higher costs, which sharpen attention on the risk that ongoing trade tensions and slower customer orders may disrupt the recovery in display driver revenue; this is the most important short-term catalyst, and the news impacts it materially.

The recent corporate guidance issued on August 7, 2025, is especially relevant, pointing to a projected 12% to 17% sequential revenue drop and a potential loss per diluted ADS, underlining how near-term profitability faces pressure largely from rising employee costs and external trade risks. As a result, the company's pursuit of longer-term opportunities in automotive and CPO technology becomes more central to its investment story, with investor attention increasingly focused on when these new streams might offset current challenges.

Yet, given stiff price competition and customer destocking, there's a real risk that Himax’s revenue could...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' outlook anticipates $1.1 billion in revenue and $126.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.7% and a $38.9 million increase in earnings from the current $87.2 million.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 26% upside to its current price.

Exploring Other Perspectives

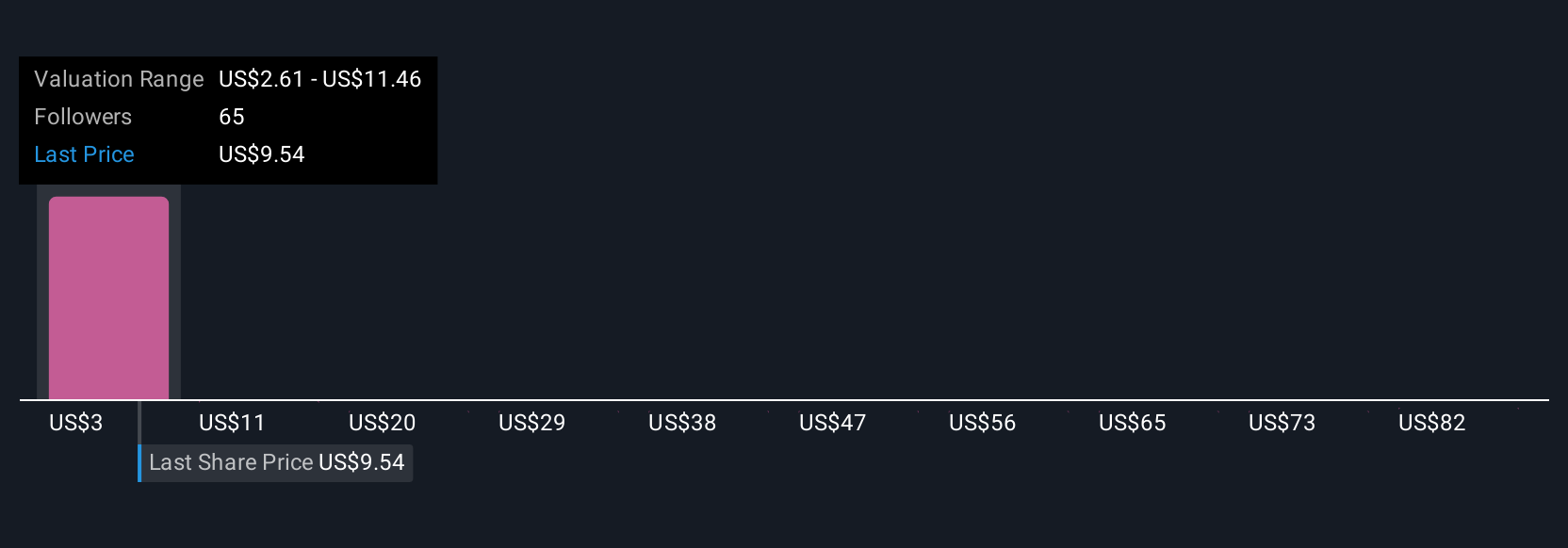

Eight Simply Wall St Community members set fair value estimates for Himax Technologies ranging from US$1.82 to US$91.18 per share. With panel customer uncertainty still pressing on short-term growth, you can find broad and sharply contrasting views about what comes next for the business.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth less than half the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal