Should Caesars Entertainment's (CZR) Digital and Resort Expansions Shift Investor Focus to Recurring Revenue Potential?

- In August 2025, Caesars Entertainment announced several key developments: the launch of its third proprietary online casino game, Signature American Roulette; becoming the first to debut IGT's Kitty Glitter Grand™ both online and in physical casinos; and breaking ground with Dry Creek Rancheria on the Caesars Republic Sonoma County integrated resort project.

- These moves reflect Caesars' ongoing focus on proprietary digital content, exclusive partnerships, and property expansions, each tightly integrated with their Caesars Rewards loyalty program to drive customer engagement across both online and traditional channels.

- We'll explore how Caesars' continued investment in exclusive digital gaming content may influence its investment narrative and support its push for long-term recurring revenue.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Caesars Entertainment Investment Narrative Recap

Staying invested in Caesars Entertainment today means believing in the company's ability to expand recurring digital revenue streams and grow its customer base, while successfully managing challenges in its core Las Vegas and hospitality businesses. While the August 2025 launches of exclusive casino content and a new integrated resort highlight continued digital and physical expansion, these initiatives have not materially changed the near-term importance of stabilizing Las Vegas leisure trends, nor have they eased the persistent risk surrounding customer acquisition costs and fluctuating promotional spend.

Among the latest announcements, the debut of in-house developed Signature American Roulette is closely tied to Caesars’ push to diversify revenue via digital gaming. This move stands out as it directly addresses the key catalyst of expanding higher-margin digital business, tapping into growing consumer adoption and cross-channel engagement, all closely tied to Caesars Rewards and recurring revenue initiatives.

Yet, it’s important to remember that even with exciting new products, mounting promotional expenses and customer acquisition outlays could start to...

Read the full narrative on Caesars Entertainment (it's free!)

Caesars Entertainment's outlook anticipates $12.6 billion in revenue and $541.3 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 3.4% and an earnings increase of $736.3 million from the current earnings of -$195.0 million.

Uncover how Caesars Entertainment's forecasts yield a $41.76 fair value, a 69% upside to its current price.

Exploring Other Perspectives

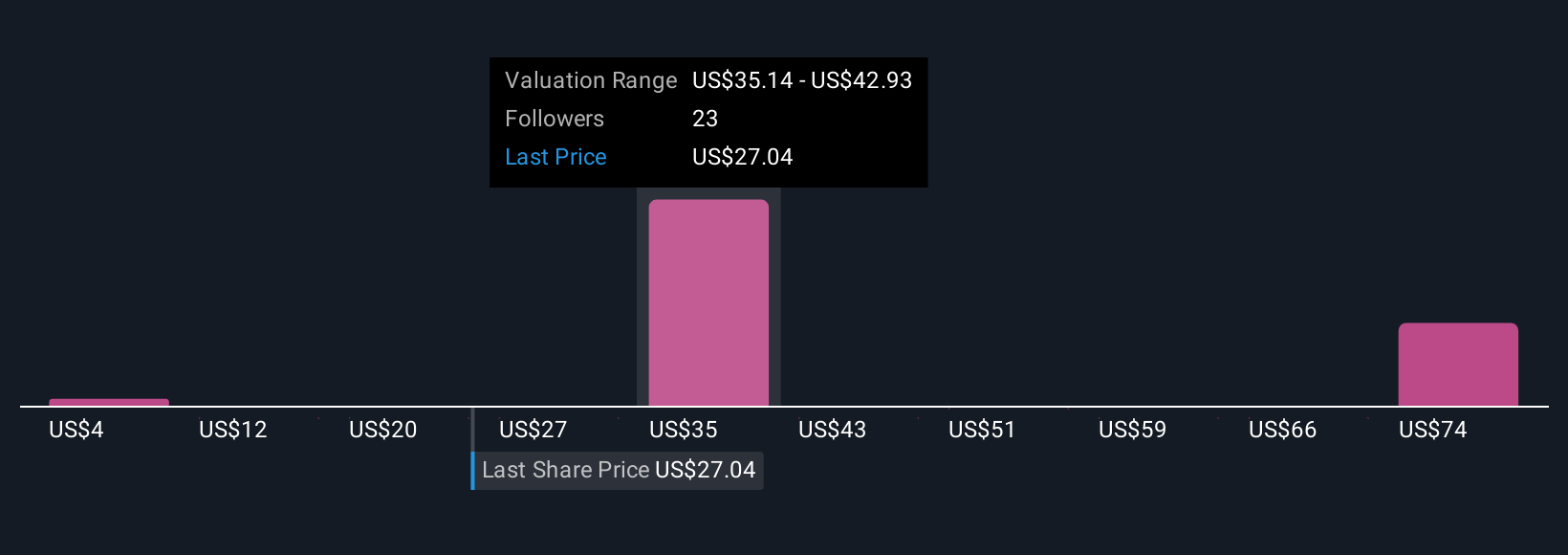

Six members of our Simply Wall St Community value Caesars from as little as US$4 to as much as US$83.67 per share. While digital growth is seen as a major catalyst, opinions vary wildly on future outcomes, consider reviewing several perspectives before forming your own view.

Explore 6 other fair value estimates on Caesars Entertainment - why the stock might be worth less than half the current price!

Build Your Own Caesars Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caesars Entertainment research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Caesars Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caesars Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal