Champion Homes (SKY) Is Up 5.9% After Strong Q1 Earnings and Major Share Buyback – What's Changed

- Champion Homes, Inc. recently announced first quarter results, reporting US$701.32 million in sales and US$64.69 million in net income, reflecting growth from the prior year, and completed a share buyback of 1,684,456 shares for US$122.33 million.

- The combination of improved earnings and completion of a significant buyback highlights increased operational performance and management’s ongoing commitment to returning value to shareholders.

- We'll explore how Champion's strong year-over-year earnings growth shapes its investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Champion Homes Investment Narrative Recap

To be a shareholder in Champion Homes, you need confidence in the expanding role of manufactured housing as a solution to affordability challenges, a trend supported by the company's strong earnings and recent share buyback. While improved profits and the completed buyback support short-term optimism, the main risk remains a potential moderation in order rates and softening demand, which this news does not materially change in the near term.

The most relevant recent announcement is Champion's completion of its share repurchase program, totaling nearly 3% of outstanding shares. This signals management’s continued focus on shareholder returns, even as the market assesses the sustainability of recent sales and earnings growth amid evolving demand trends.

By contrast, investors should also keep a close eye on how softening in the community and independent sales channels could eventually impact...

Read the full narrative on Champion Homes (it's free!)

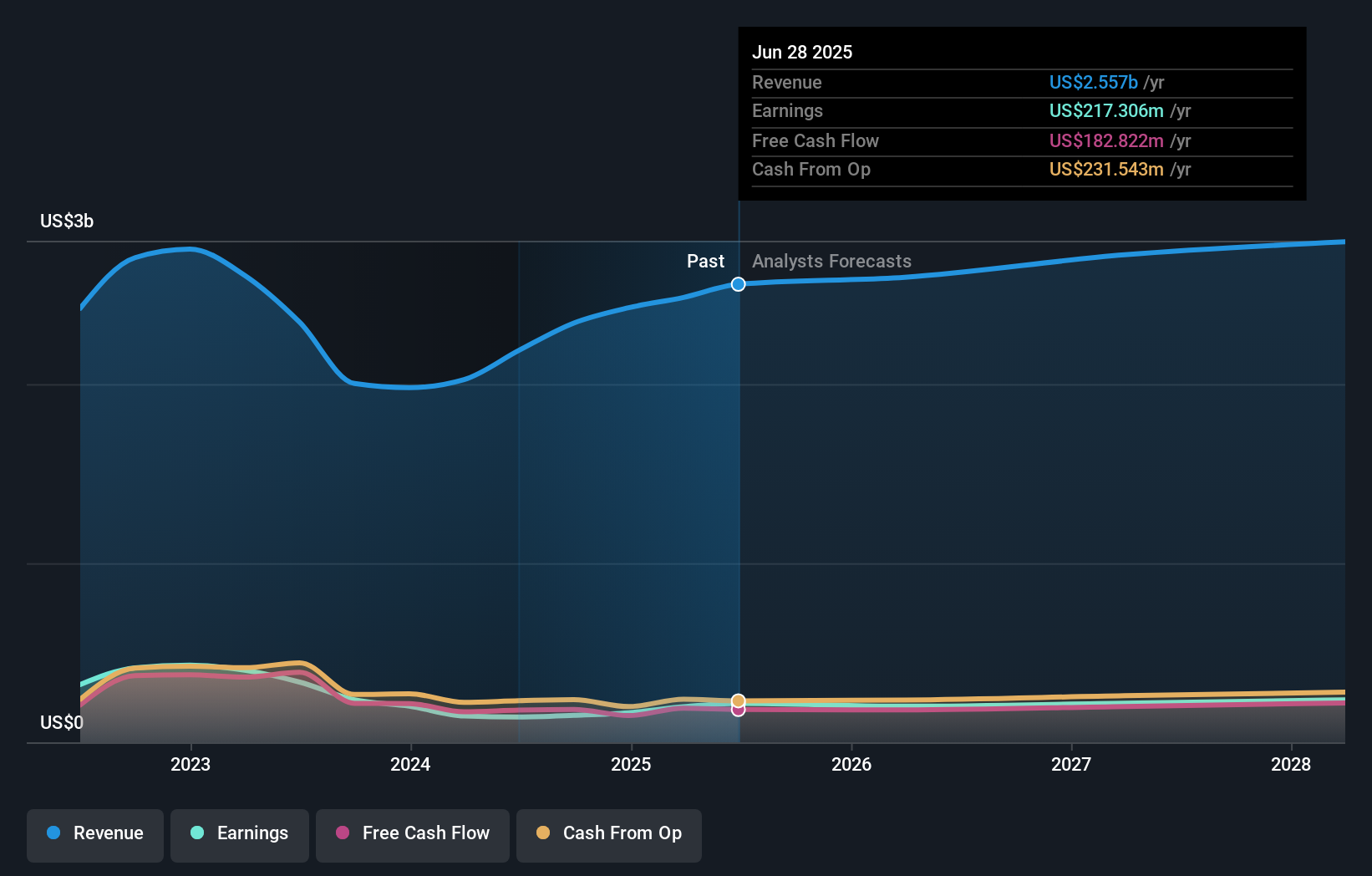

Champion Homes' narrative projects $2.9 billion in revenue and $203.6 million in earnings by 2028. This outlook assumes a 4.1% annual revenue growth and a $13.7 million decrease in earnings from the current $217.3 million.

Uncover how Champion Homes' forecasts yield a $81.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates between US$65.12 and US$81.67, reflecting a wide span of views on Champion’s worth. With recent earnings growth highlighted as a catalyst, you may want to consider how these differing valuations stack up against the company’s ability to sustain top-line momentum.

Explore 2 other fair value estimates on Champion Homes - why the stock might be worth 7% less than the current price!

Build Your Own Champion Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Champion Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Champion Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Champion Homes' overall financial health at a glance.

No Opportunity In Champion Homes?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal