Did Star Bulk Carriers’ (SBLK) Earnings Drop and Modest Dividend Just Shift Its Investment Narrative?

- On August 6, 2025, Star Bulk Carriers Corp. reported second-quarter revenue of US$247.41 million and net income of US$39,000, both showing substantial declines compared to the previous year, and announced a quarterly cash dividend of US$0.05 per share payable in September.

- This combination of lower financial results and a continued but modest dividend highlights both recent business challenges and the company’s commitment to maintaining shareholder distributions.

- We will next explore how the significantly lower earnings and revenue impact Star Bulk Carriers’ investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Star Bulk Carriers Investment Narrative Recap

For someone to own Star Bulk Carriers today, they need to believe that the company’s sizable dry bulk fleet and operational upgrades can offset tough market conditions and persistent industry risks. The company’s recent weak revenue and earnings numbers materially increase uncertainty around the most important short-term catalyst, the benefits of its fleet modernization, and place extra emphasis on the risk from its substantial debt obligations, especially if rates rise or profit margins remain tight.

Among recent events, the resumption of a quarterly cash dividend at US$0.05 per share following a sharp earnings drop is particularly relevant, as it signals Star Bulk's intent to maintain returns to shareholders even during challenging quarters. This dividend policy, against a backdrop of contracting profits, frames the ongoing tension between shareholder rewards and the company’s need to safeguard liquidity for operational needs and upcoming dry dock expenses.

Yet, investors should also be aware of the implications if debt-servicing pressures combine with weaker profits to create…

Read the full narrative on Star Bulk Carriers (it's free!)

Star Bulk Carriers' narrative projects $1.0 billion revenue and $424.1 million earnings by 2028. This requires a 5.9% annual revenue decline and a $193.8 million earnings increase from $230.3 million today.

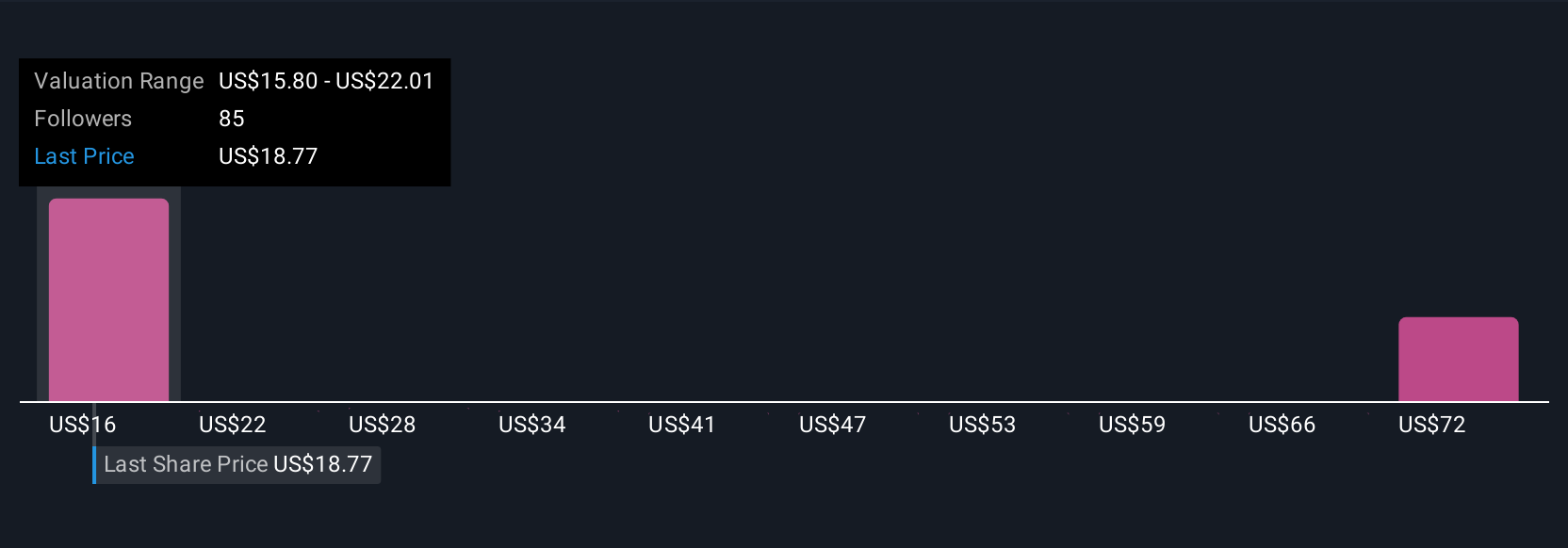

Uncover how Star Bulk Carriers' forecasts yield a $20.82 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 9 fair value estimates for Star Bulk, spanning from US$17.50 to US$98.28, showing significant diversity in outlook. Against this broad range, many are weighing the impact of rising dry dock and fleet renewal costs on the company’s ability to sustain margins and future payouts, take a closer look at several viewpoints to decide what matters most for you.

Explore 9 other fair value estimates on Star Bulk Carriers - why the stock might be worth over 5x more than the current price!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal