Does PJT Partners' (PJT) Leadership Shift Reveal Evolving Priorities Beneath the Surface?

- PJT Partners recently appointed Peter L.S. Currie, a veteran executive with significant board and audit committee experience, to its Board of Directors and Audit Committee as of July 30, 2025.

- Simultaneously, General Counsel David Travin sold all his shares in the company, highlighting a period of management transition and insider activity.

- We'll explore how insider selling, alongside the appointment of a seasoned board member, shapes PJT Partners' current investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is PJT Partners' Investment Narrative?

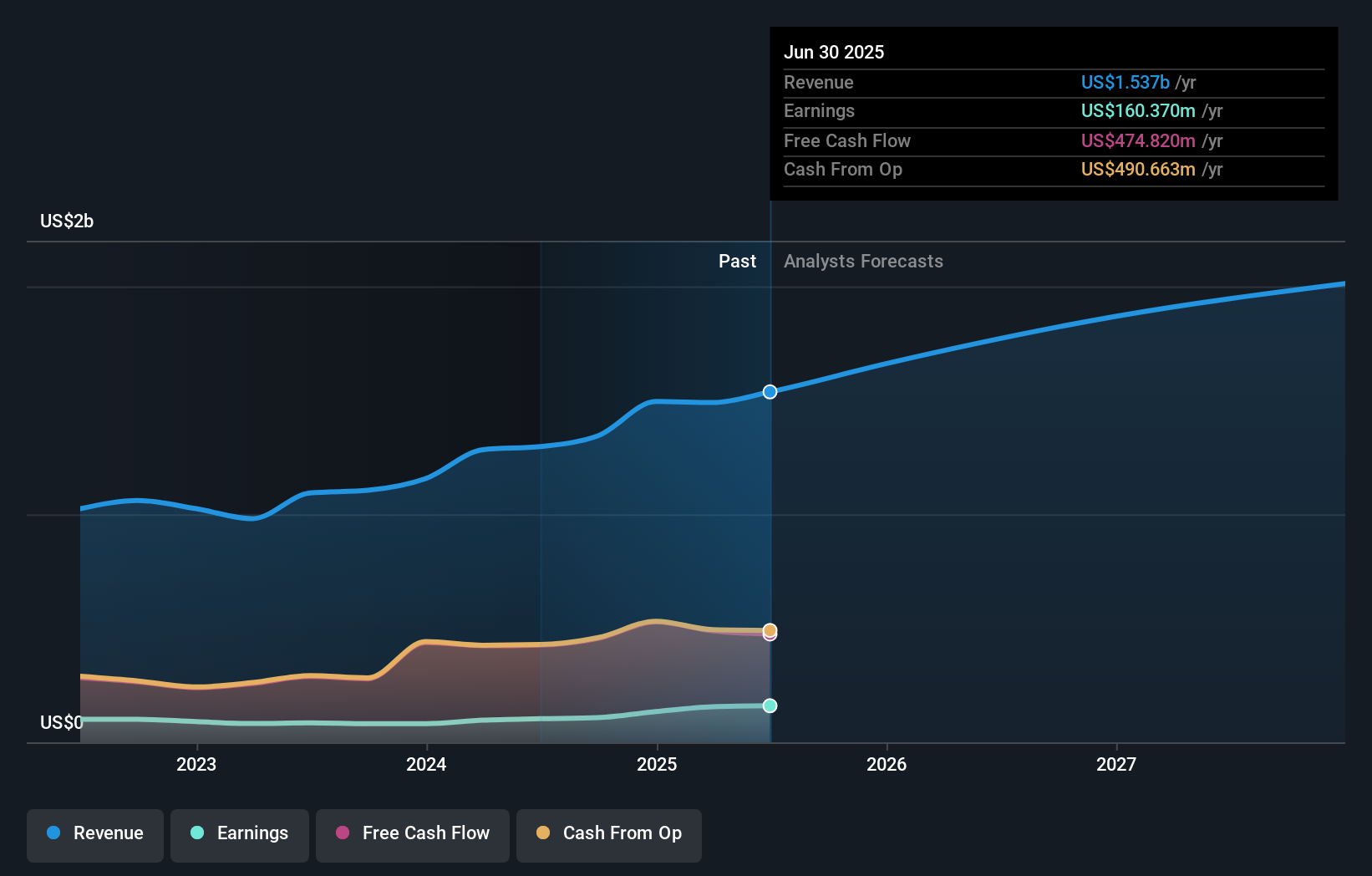

An investment in PJT Partners often reflects confidence in its cycle-resilient advisory platform, experienced management team, and ongoing initiatives to expand its regional reach, such as the recent deNovo Partners acquisition. The news of Peter Currie's appointment strengthens board expertise and enhances audit oversight at a time of sustained revenue and earnings momentum, suggesting a steady approach to governance. However, the complete exit by the General Counsel, alongside a year of no insider buying, may touch investor nerves and reignite focus on valuation, especially with shares trading above consensus targets and a premium to sector averages. While the executive change is unlikely to materially shift the most pressing short-term catalysts, it does highlight board renewal and the processes that aim to safeguard shareholder interests amid high expectations. On the risk side, investors should track any signs that management transitions could unsettle insider confidence or cloud short-term direction.

But some big insider moves may carry implications for confidence, be sure you don’t miss this. PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal