How Valmont Industries’ $434 Million Share Buyback May Shape Capital Allocation Priorities for VMI Investors

- Valmont Industries recently completed two significant share buyback programs, retiring a combined total of 1,721,023 shares and spending approximately US$433.94 million between March and June 2025.

- This substantial reduction in share count highlights management’s approach to capital allocation and may reinforce perceptions of underlying business confidence among investors.

- We will now explore how these completed share repurchases could influence Valmont Industries’ investment narrative, particularly regarding management's capital deployment priorities.

Find companies with promising cash flow potential yet trading below their fair value.

Valmont Industries Investment Narrative Recap

To be a Valmont Industries shareholder today, you likely believe in the company’s long-term exposure to global infrastructure and agricultural investment, especially as energy transition and water efficiency remain top priorities worldwide. The recent completion of substantial buybacks signals management focus on shareholder returns, but is not expected to materially mitigate the immediate headwinds highlighted by June’s disappointing earnings, particularly the one-off net loss and potential for margin pressure from commodity price volatility and demand fluctuations.

Among the recent developments, the opening of Valmont’s new sustainably-focused concrete utility pole facility in July is particularly relevant. This expansion underlines ongoing efforts to pivot toward infrastructure products that align with decarbonization and utility growth catalysts, offering some offset to near-term agricultural cyclicality and positioning the company to potentially unlock incremental revenue as industry backlogs persist.

However, it’s important for investors to recognize that despite these positive signals, persistent risks remain around supply chain and raw material costs, which could significantly impact results if...

Read the full narrative on Valmont Industries (it's free!)

Valmont Industries' outlook anticipates $4.5 billion in revenue and $462.5 million in earnings by 2028. This scenario assumes annual revenue growth of 3.5% and an earnings increase of $244.8 million from current earnings of $217.7 million.

Uncover how Valmont Industries' forecasts yield a $393.33 fair value, a 4% upside to its current price.

Exploring Other Perspectives

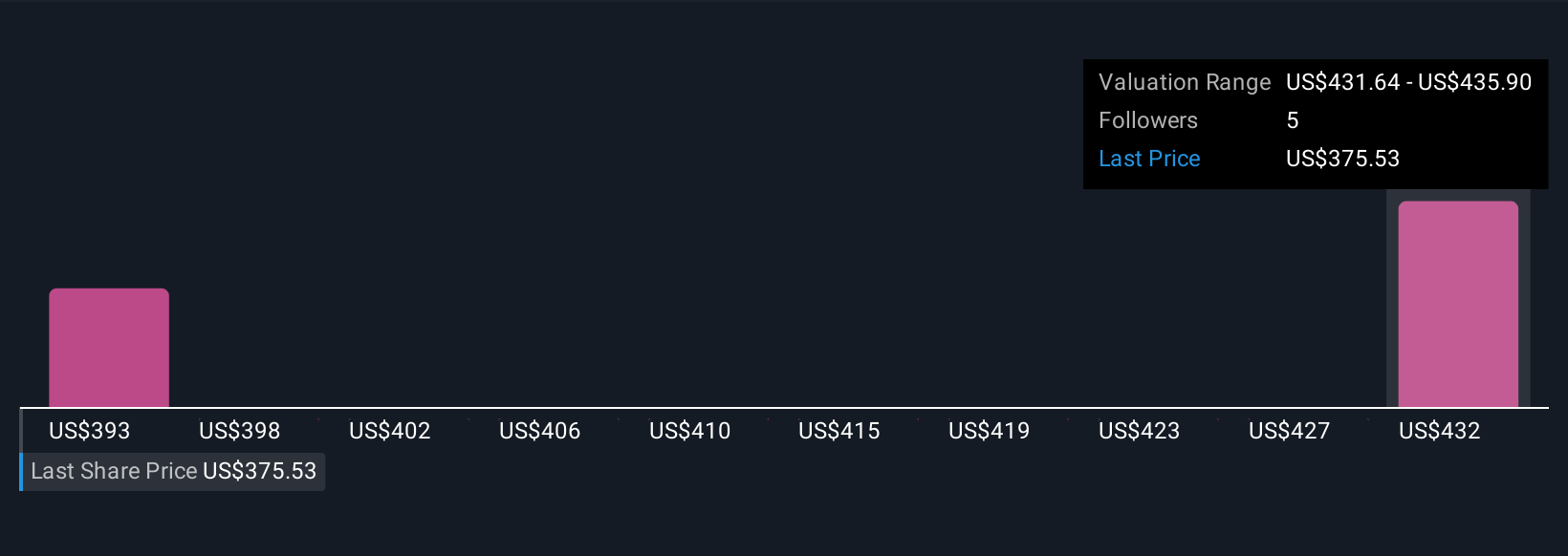

Two Simply Wall St Community member estimates for Valmont’s fair value range from US$393.33 to US$432.44, reflecting distinct individual views. While many anticipate upside from infrastructure-linked demand, ongoing volatility in steel and zinc pricing could challenge earnings, prompting a closer look at multiple scenarios.

Explore 2 other fair value estimates on Valmont Industries - why the stock might be worth as much as 14% more than the current price!

Build Your Own Valmont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Valmont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmont Industries' overall financial health at a glance.

No Opportunity In Valmont Industries?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal