Is Graham Holdings' (GHC) Return to Profitability Shifting the Company’s Long-Term Investment Case?

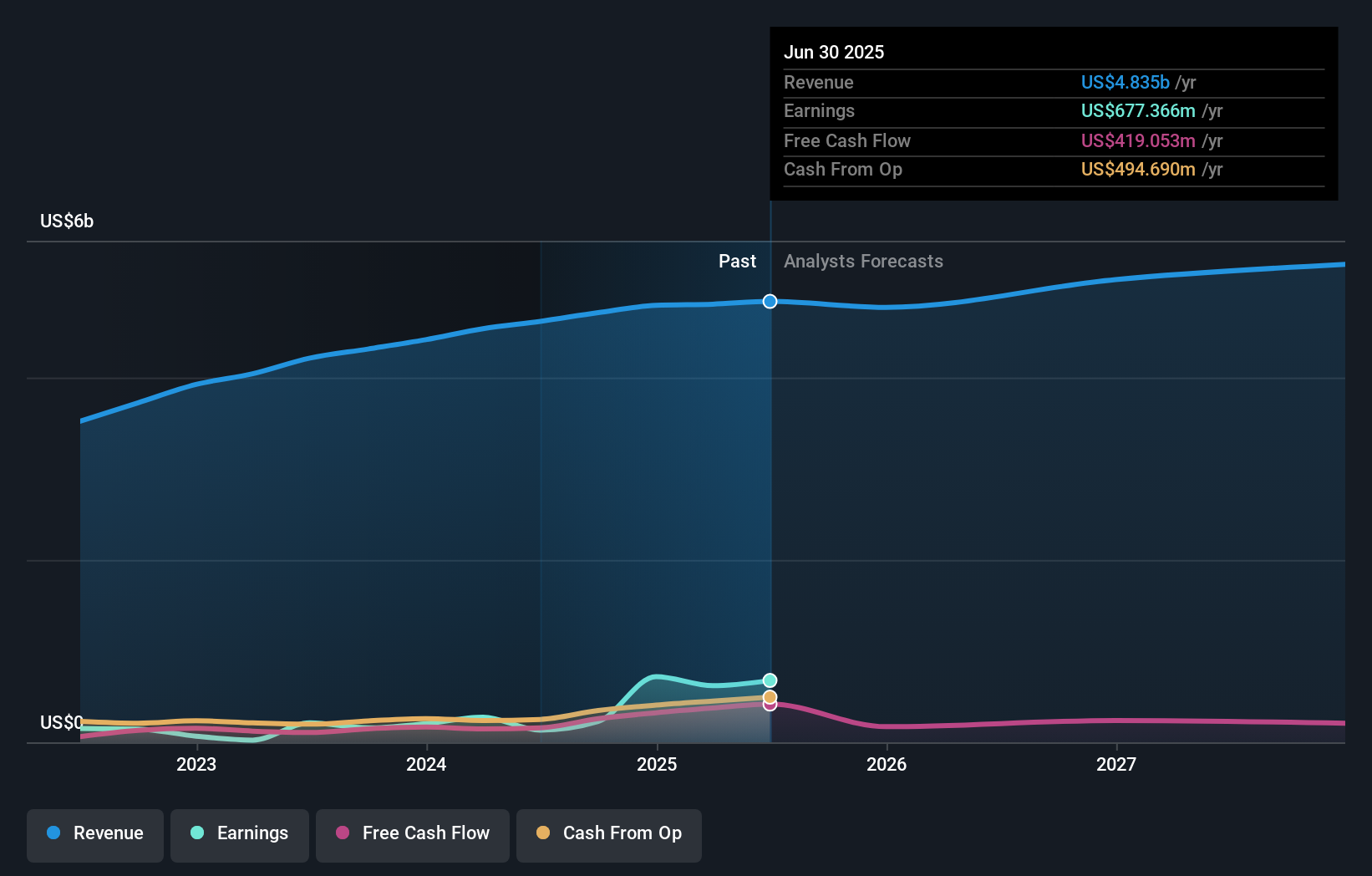

- Graham Holdings Company recently reported its earnings results for the second quarter and first half of 2025, highlighting a return to profitability with second-quarter net income of US$36.75 million compared to a net loss of US$21.04 million a year earlier.

- While revenue grew and earnings rebounded for the quarter, the company's six-month net income was lower than last year's, reflecting varying performance across periods.

- We'll examine how Graham Holdings' shift back to profitability in the second quarter shapes its broader investment narrative going forward.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Graham Holdings' Investment Narrative?

Anyone considering Graham Holdings stock is typically buying into a belief in resilience and disciplined capital allocation, often highlighted by its blend of diversified business segments, reliable dividends, and an opportunistic buyback history. The company’s return to profitability in the second quarter stands out as a welcome rebound, confirming management’s ability to restore earnings even as net income for the half year lags last year’s levels. This bounce removes a potential overhang on near-term sentiment, though it may have limited impact on the bigger picture: the biggest short-term catalyst is still the company’s execution on acquisitions, while current risks relate to patchy earnings growth and modest revenue expansion compared to broader market trends. With the stock price up slightly after results, the announcement supports cautious optimism but doesn’t fundamentally shift the risk profile, earnings volatility and growth consistency remain central questions. On the flip side, ongoing shifts in profit trends could surprise cautious investors.

Graham Holdings' shares are on the way up, but they could be overextended by 29%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Graham Holdings - why the stock might be worth as much as $785.00!

Build Your Own Graham Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graham Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graham Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graham Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal