Should Raised Revenue Guidance and Growing Childcare Demand Prompt Action From Bright Horizons (BFAM) Investors?

- Bright Horizons Family Solutions recently reported second quarter 2025 results, delivering US$731.57 million in sales and raising its full-year revenue guidance to between US$2.9 billion and US$2.92 billion.

- Strong growth in Back-up Care services and ongoing investments to enhance enrollment and operational efficiency are fueling the company’s improved outlook.

- We’ll explore how the raised earnings guidance reflects growing demand for employer-sponsored childcare and impacts the company’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bright Horizons Family Solutions Investment Narrative Recap

To be a shareholder in Bright Horizons Family Solutions, you have to believe employer-sponsored childcare will continue gaining traction among corporate clients, supporting steady enrollment and recurring revenue despite sector headwinds. The raised full-year guidance following a strong second quarter adds confidence to near-term demand trends, but the ongoing net closures of underperforming centers remain the most important risk, potentially limiting how much margin expansion can be unlocked; this news does not materially change that key tension right now.

Of the recent announcements, the addition of McKesson as a Back-up Care client stands out. This partnership highlights how more large employers are turning to Bright Horizons to enhance their benefit offerings, reinforcing the current demand catalyst, even as net center openings still lag due to ongoing rationalization.

However, investors should not overlook the underlying occupancy and center closure risks that could challenge the pace of recovery if…

Read the full narrative on Bright Horizons Family Solutions (it's free!)

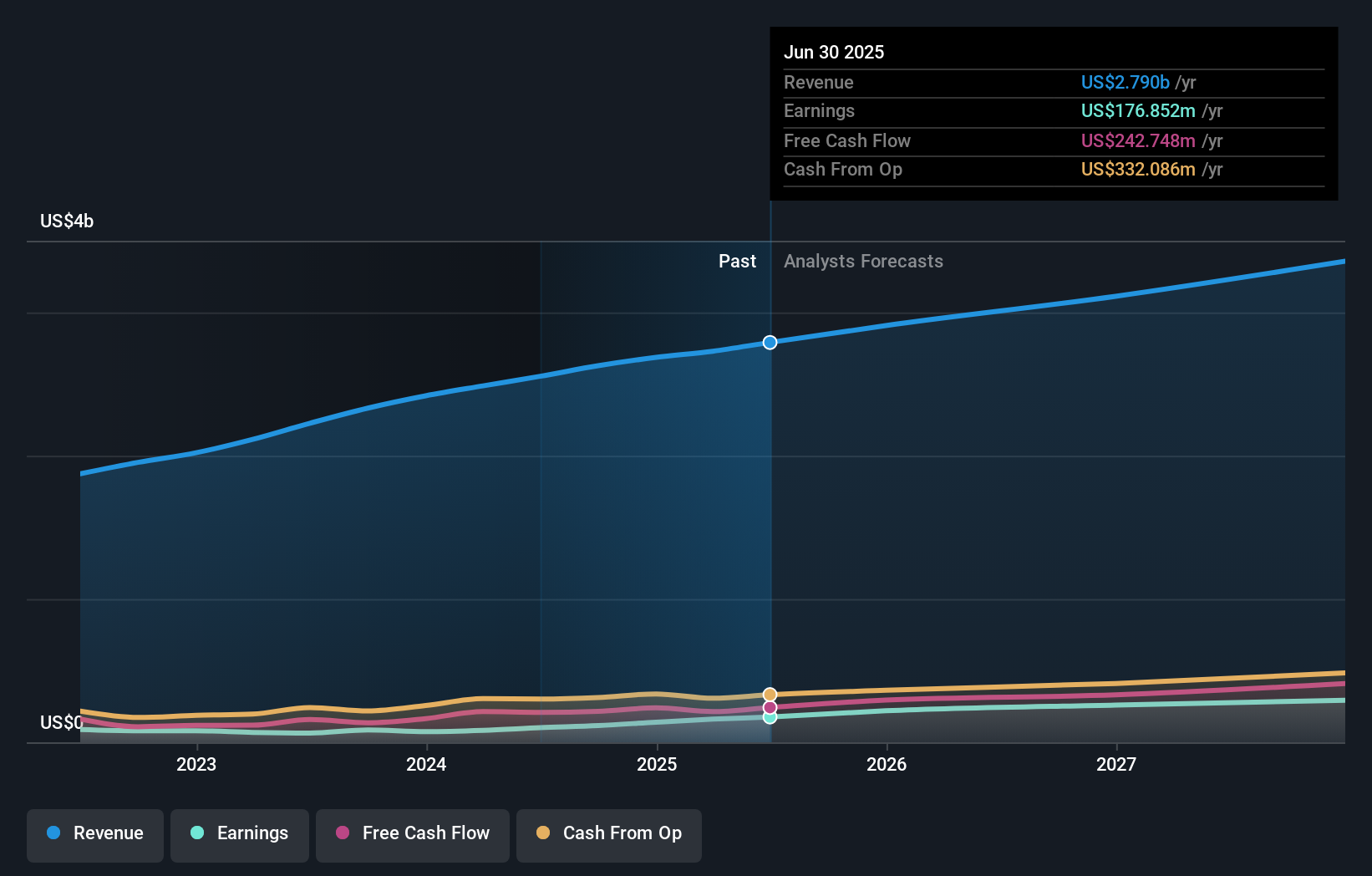

Bright Horizons Family Solutions is projected to reach $3.5 billion in revenue and $331.7 million in earnings by 2028. This outlook assumes annual revenue growth of 7.5% and an increase in earnings of $154.8 million from the current $176.9 million.

Uncover how Bright Horizons Family Solutions' forecasts yield a $140.89 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors value Bright Horizons between US$88.59 and US$202.71 across four distinct fair value estimates. While enthusiasm centers on expanding employer partnerships, persistent net closures highlight the operational pressures that could affect both earnings quality and future growth potential.

Explore 4 other fair value estimates on Bright Horizons Family Solutions - why the stock might be worth 26% less than the current price!

Build Your Own Bright Horizons Family Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bright Horizons Family Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Horizons Family Solutions' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal