Does WMK’s Steady Net Income Amid Rising Sales Reveal a Strategic Shift at Weis Markets?

- Weis Markets recently reported its second quarter and half-year earnings for the period ended June 28, 2025, highlighting year-over-year increases in both quarterly sales and revenue, with quarterly net income remaining steady.

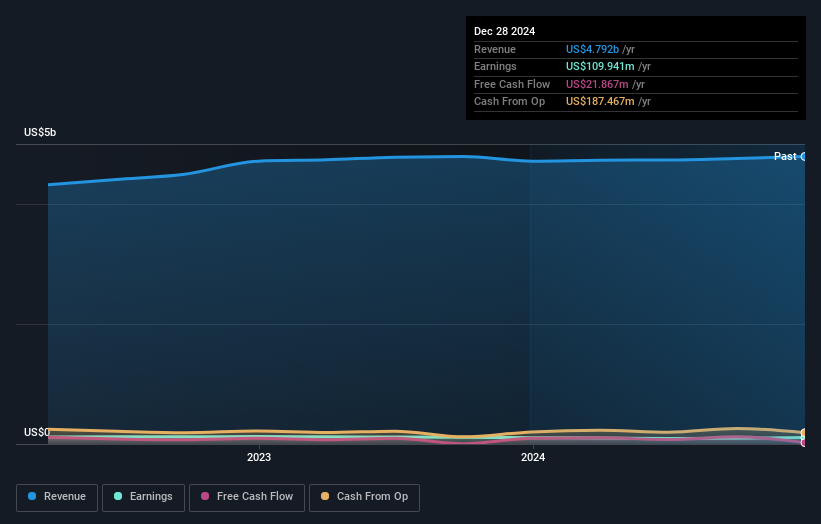

- An interesting trend from the announcement is that while the company grew sales for both the quarter and the six-month period, its net income for the first half of the year edged down slightly compared to the prior year.

- We'll explore how ongoing sales growth, despite slightly lower year-to-date net income, informs Weis Markets' current investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Weis Markets' Investment Narrative?

To be a shareholder in Weis Markets, you have to believe in the company’s ability to deliver steady growth in a highly competitive grocery sector. The recent earnings announcement, showing year-over-year sales and revenue increases alongside relatively stable quarterly net income, offers evidence of ongoing demand for Weis Markets’ offerings. Yet, with net income for the first half of 2025 dipping slightly versus last year, the earnings update puts a spotlight on cost pressures and margin management, key short-term catalysts that may attract further attention. However, with shares moving sharply higher following the results, it seems that the market viewed the news positively and may not consider the income dip as a major new risk for now. Investors are still likely to keep a close eye on future profit trends, as cost management remains central to the story.

But margins could come under pressure from rising costs, which is something investors should watch. Weis Markets' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Weis Markets - why the stock might be worth less than half the current price!

Build Your Own Weis Markets Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weis Markets research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Weis Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weis Markets' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal