Did Strong Q2 Results and Debt Redemption Just Shift Buenaventura’s (BVN) Investment Narrative?

- Compañía de Minas Buenaventura S.A.A. announced the full redemption of its 5.500% Senior Notes due 2026 and reported second-quarter 2025 results with revenue of US$369.48 million and net income of US$91.3 million, both higher than the previous year.

- The company’s strong operational performance not only resulted in improved financial outcomes but also reflected enhanced financial flexibility following the recent debt redemption.

- We’ll now examine how this combination of robust earnings and successful debt reduction impacts Buenaventura’s investment narrative and future outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Compañía de Minas BuenaventuraA Investment Narrative Recap

For shareholders in Compañía de Minas Buenaventura S.A.A., the key belief centers on the company’s ability to grow gold and copper output, deliver operational stability, and protect margins while investing in expansion projects like San Gabriel. The recent full redemption of Senior Notes and robust Q2 earnings reinforce confidence in the company’s financial flexibility and earnings quality. However, these developments do not fundamentally change the immediate importance of production stability or the ongoing risk of delays at major projects, especially San Gabriel.

The headline announcement of redeeming all outstanding 5.500% Senior Notes due 2026 on July 23, 2025, is especially relevant. This action directly strengthens the company’s liquidity position ahead of critical capital commitments for the San Gabriel ramp-up, supporting the most important near-term growth catalyst while helping buffer some financing-related risks.

Yet, despite these improvements, investors should not overlook that risks remain if technical or permitting setbacks arise at new projects like San Gabriel, since...

Read the full narrative on Compañía de Minas BuenaventuraA (it's free!)

Compañía de Minas BuenaventuraA's outlook anticipates $1.4 billion in revenue and $490.9 million in earnings by 2028. This projection is based on 2.8% annual revenue growth and a $15.5 million decrease in earnings from the current $506.4 million.

Uncover how Compañía de Minas BuenaventuraA's forecasts yield a $17.65 fair value, in line with its current price.

Exploring Other Perspectives

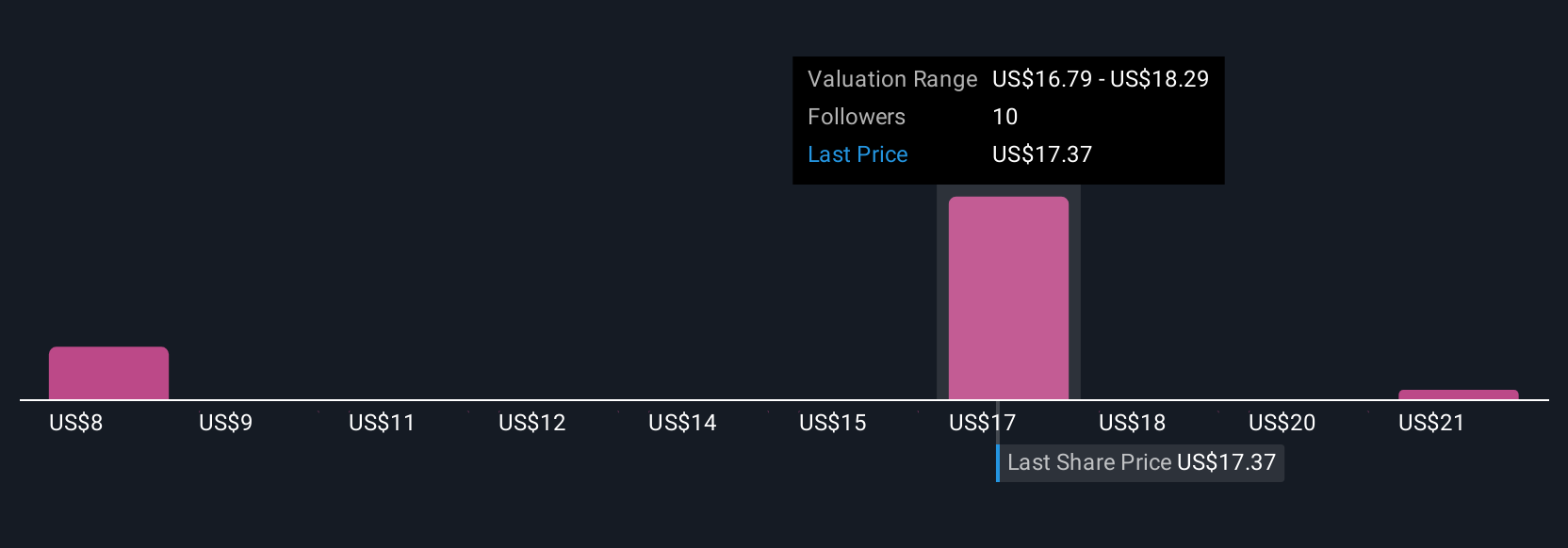

Fair value estimates from the Simply Wall St Community span a wide range, from US$8.00 to US$22.78, with four distinct perspectives contributing. While production growth plans anchor many expectations, the challenge of timely project delivery continues to shape debate among market participants.

Explore 4 other fair value estimates on Compañía de Minas BuenaventuraA - why the stock might be worth less than half the current price!

Build Your Own Compañía de Minas BuenaventuraA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compañía de Minas BuenaventuraA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compañía de Minas BuenaventuraA's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal