Is Buenaventura’s (BVN) Revenue and Earnings Surge Shifting Its Investment Narrative?

- Compañía de Minas BuenaventuraA released its second quarter and first-half 2025 results, reporting increases in both revenue and net income over the previous year, supported by higher production and sales across gold, silver, lead, zinc, and copper.

- The company's operational execution and expanded output underscore its ability to capture benefits from favorable market conditions and sustain earnings momentum.

- We'll examine how these strong earnings results and higher metal production volumes shape the outlook for Buenaventura's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Compañía de Minas BuenaventuraA Investment Narrative Recap

To be a shareholder in Compañía de Minas Buenaventura, you need to believe in its ability to convert strong operational performance and rising output into sustained financial growth, especially as it moves closer to bringing the San Gabriel project online. The latest earnings release, featuring increased revenue and net income, adds weight to this narrative, though potential cost pressures and risks tied to San Gabriel's development remain the most significant concerns for the short term, which this announcement does not materially change.

Among recent company announcements, the confirmation of 2025 production guidance for gold, silver, lead, zinc, and copper stands out as especially relevant. This guidance not only demonstrates management's focus on operational targets but also provides context for how near-term production performance could impact investor confidence in the company's ability to deliver on its main catalyst, the San Gabriel project ramp-up.

However, against this backdrop of earnings strength, investors should be aware that risks tied to the successful and timely completion of San Gabriel could...

Read the full narrative on Compañía de Minas BuenaventuraA (it's free!)

Compañía de Minas BuenaventuraA is projected to reach $1.4 billion in revenue and $478.0 million in earnings by 2028. This forecast is based on expected annual revenue growth of 5.5% and a decrease in earnings of $4.8 million from current earnings of $482.8 million.

Uncover how Compañía de Minas BuenaventuraA's forecasts yield a $17.28 fair value, in line with its current price.

Exploring Other Perspectives

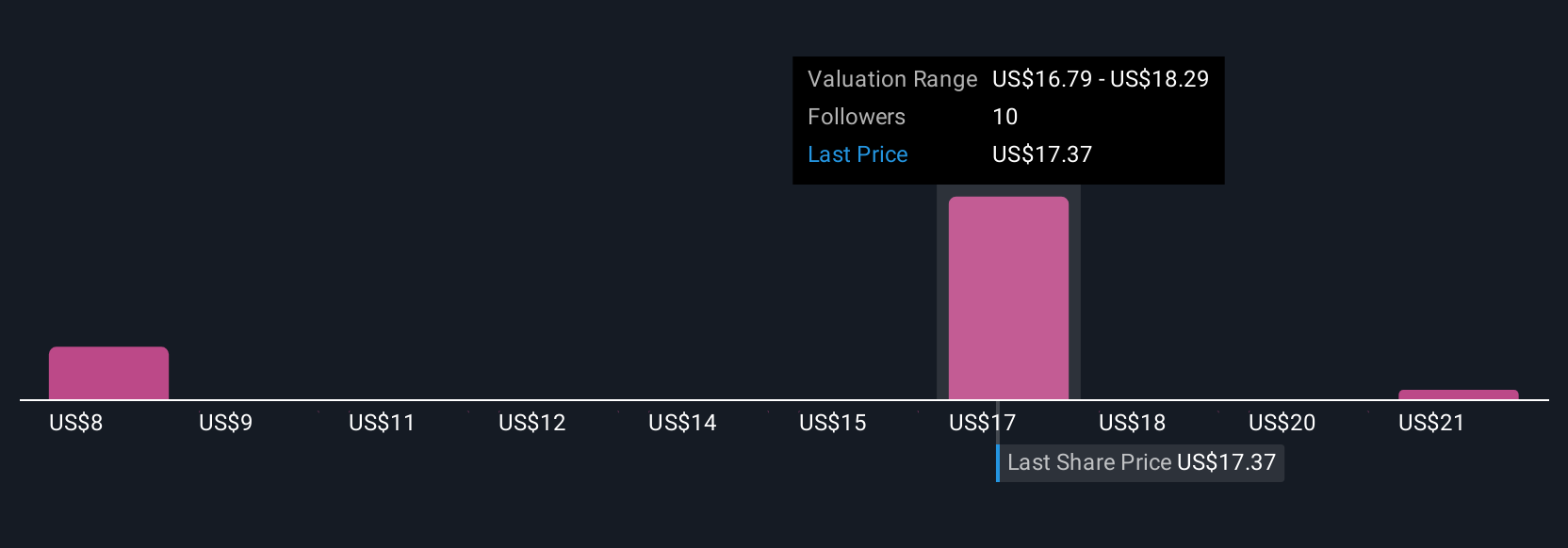

Simply Wall St Community members estimate BVN’s fair value from US$7.81 to US$22.78 across four perspectives. While the San Gabriel project is seen as a key catalyst, opinions about future performance differ, so it’s worth exploring a variety of viewpoints.

Explore 4 other fair value estimates on Compañía de Minas BuenaventuraA - why the stock might be worth less than half the current price!

Build Your Own Compañía de Minas BuenaventuraA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compañía de Minas BuenaventuraA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compañía de Minas BuenaventuraA's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal