How Strong Earnings and Board Changes at St. Joe (JOE) Are Shaping Its Investment Narrative

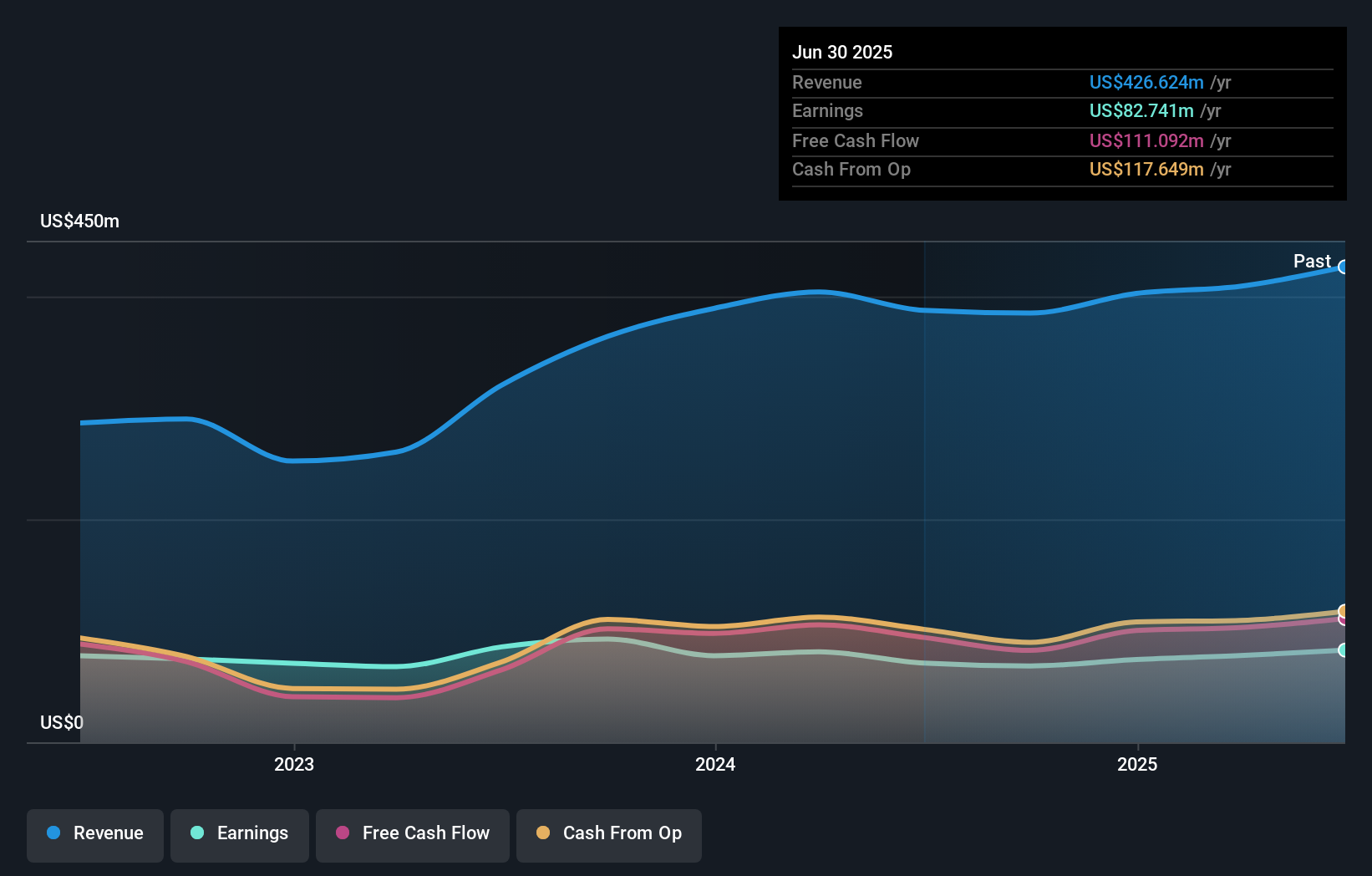

- The St. Joe Company recently reported strong second quarter earnings, with year-over-year increases in sales, revenue, and net income, appointed Elizabeth Dantin Franklin as an independent director, declared a US$0.14 per share dividend, and updated shareholders on its ongoing share repurchase program.

- These combined actions highlight not only operational growth but also the company’s consistent focus on shareholder returns and enhanced board oversight.

- We’ll explore how St. Joe’s improved earnings and addition of financial expertise to its board influence the company’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is St. Joe's Investment Narrative?

To be a St. Joe shareholder today, you need to believe in the continued strength of its core real estate, land development, and hospitality operations, along with management’s ability to translate that growth into tangible returns. The latest results reinforce some confidence, revenue and net income both moved higher year-over-year in the second quarter, and up-to-date dividend payments, as well as an ongoing buyback program, offer visible signals of consistent capital returns. The addition of Elizabeth Franklin, an experienced audit veteran, could enhance oversight and governance and may help with financial discipline going forward. These updates help support important near-term catalysts, like occupancy gains and expansion projects, even as the largest risk, high valuation metrics relative to peers, remains front and center. The news flow does not appear to shift the short-term risk calculus in a material way, but it adds useful reassurance for those focused on execution. On the other hand, keep in mind that St. Joe’s price remains well above many fair value estimates.

St. Joe's shares are on the way up, but they could be overextended by 13%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth 12% less than the current price!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal