Do RPC's (RES) Steady Dividends Signal Strategic Focus Amid Profitability Shifts?

- RPC, Inc. recently reported its second quarter 2025 results, with sales rising to US$420.81 million but net income and earnings per share declining sharply year-over-year; the company also affirmed its regular quarterly cash dividend of US$0.04 per share, payable in September.

- An interesting detail is that despite substantial bottom-line pressure, RPC maintained its shareholder capital return commitment amid changing profitability trends and did not execute any new share repurchases during the period.

- We'll examine how the combination of higher revenue and ongoing dividends influences RPC's longer-term investment narrative and outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

RPC Investment Narrative Recap

To be an RPC shareholder right now, you need to believe in the company’s ability to translate its operational scale and modernized service offerings into resilient margins and cash flow, even as North American energy markets remain highly competitive. While the latest earnings report showcased revenue growth, the sharp fall in net income and EPS is a reminder that near-term pricing power and margin recovery, two crucial catalysts, remain elusive, and the update does not meaningfully shift these challenges or their associated risks.

The reaffirmed quarterly cash dividend of US$0.04 per share stands out following earnings pressure, reinforcing RPC’s capital return focus. However, this commitment is set against a backdrop of lower profitability, intensifying the tension between rewarding shareholders and preserving financial flexibility as sector pricing pressures persist.

But with RPC’s heavy revenue concentration in the Permian Basin, investors should pay close attention if ...

Read the full narrative on RPC (it's free!)

RPC's outlook anticipates $1.7 billion in revenue and $59.8 million in earnings by 2028. This reflects a 7.1% annual revenue growth rate but an earnings decrease of $14.9 million from current earnings of $74.7 million.

Uncover how RPC's forecasts yield a $6.01 fair value, a 21% upside to its current price.

Exploring Other Perspectives

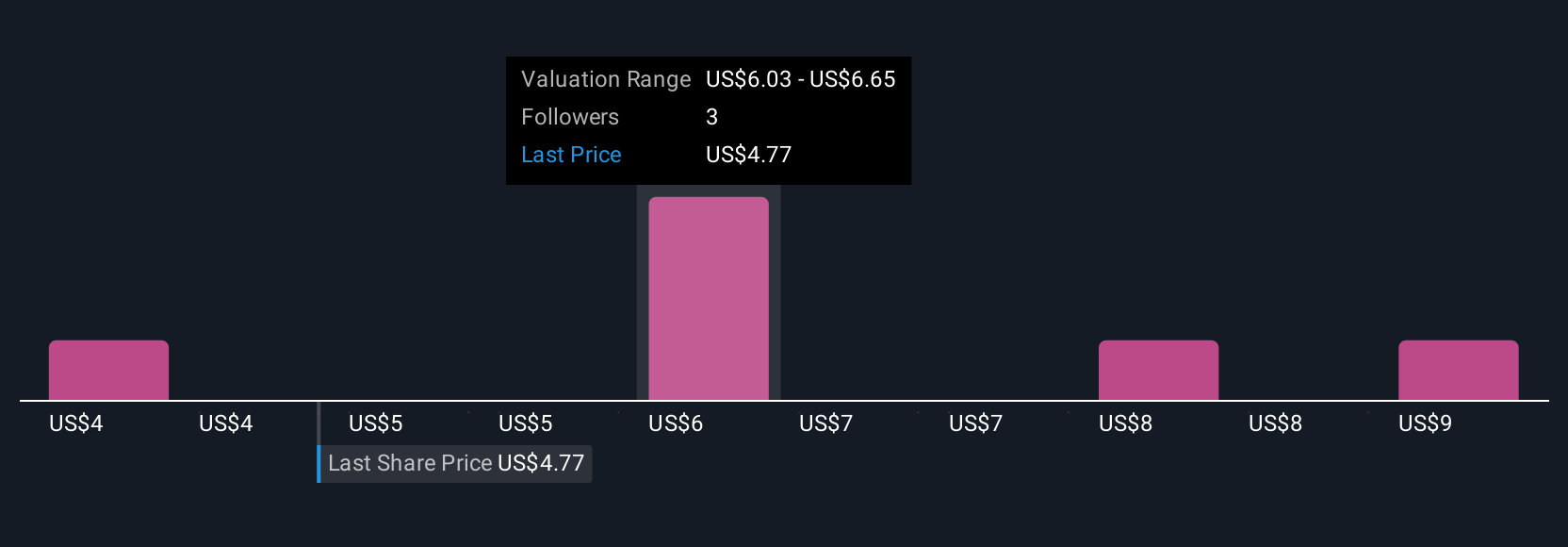

The Simply Wall St Community submitted four fair value estimates for RPC stock ranging from US$0.41 to US$9.72. These wide-ranging views contrast with current analyst concerns around margin pressures and competition, underscoring just how varied expectations for the company can be.

Explore 4 other fair value estimates on RPC - why the stock might be worth as much as 96% more than the current price!

Build Your Own RPC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RPC research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free RPC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RPC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal