The performance of AI infrastructure is divided: CoreWeave (CRWV.US) soars, Nebius (NBIS.US) waits

The Zhitong Finance App learned that since April, the stock price of artificial intelligence (AI) infrastructure company Nebius (NBIS.US) has soared by about 125%. However, there is still a big gap compared to another AI infrastructure company, CoreWeave (CRWV.US), which increased about 369% during the same period. They are also participants in the AI infrastructure market, and there is a significant difference in trends between the two. The key question is, is Nebius just being overlooked — despite strong fundamentals? Or is the sharp rise in CoreWeave's stock price just market hype?

Why does Nebius lag behind CoreWeave?

Despite Nebius's steady performance, it was clearly overshadowed by CoreWeave's explosive rise. There are multiple reasons behind this. The first is scale and the perception of “pure AI targets”: CoreWeave far exceeds Nebius in terms of revenue and contract size, which provides strong support for investment enthusiasm. According to the data, in the first quarter of 2025, CoreWeave's revenue increased 420% year-on-year to US$982 million, while Nebius' revenue was about US$55 million. CoreWeave has signed large-scale contracts with companies such as OpenAI and IBM, and has $25.9 billion of pending orders. By contrast, Nebius is still in its early stages. Although it is growing rapidly, it has a small base and has yet to disclose any major multi-billion dollar contracts.

Furthermore, CoreWeave is viewed as a “purer” AI infrastructure target because the company focuses on undertaking large-scale AI computing power tasks. Nebius, on the other hand, is viewed as a slightly fragmented technology company due to its diverse Yandex background. This difference prompted investors to view Coreweave as a representative of AI cloud computing, giving it a higher valuation and support.

CoreWeave also has a very low ratio of outstanding shares, which amplifies price increases when demand rises. Analysts at Arete Research pointed out, “CoreWeave is a purer target in the AI field, and it has fewer tradable shares, which may amplify the bullish sentiment in the market.” In contrast, Nebius is undervalued despite strong fundamentals. According to reports, Arete has given Nebius a “buy” rating and set a target price of 84 US dollars. He is relatively more optimistic about Nebius, believing that its backwardness is not due to poor quality, but rather the result of not yet being hyped up. If market sentiment changes, it may release upward space.

Furthermore, the differences between the two companies in choosing a large-scale path were significant, which also affected investor sentiment. CoreWeave has adopted an aggressive capital strategy — raised $1.1 billion through Series C financing, raised another $1.5 billion through the IPO, totaling $2.6 billion, and received over $12 billion in credit through GPU collateral financing. By the end of 2024, about 8 billion US dollars had been used passively, reflecting a period of heavy capital investment, and the need for high gross profit throughput in the future to support repayment.

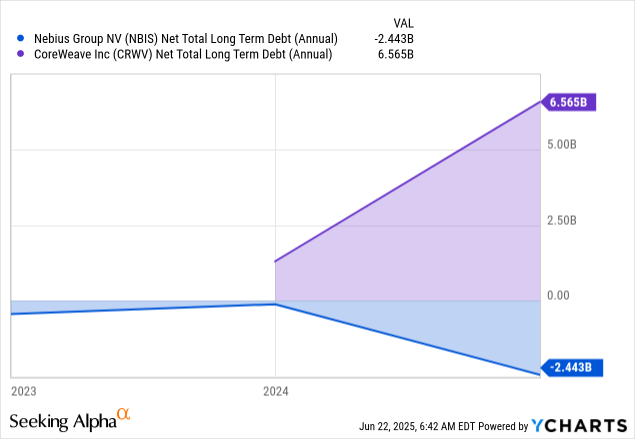

This highly leveraged expansion model allows CoreWeave to quickly obtain large GPUs and revenue, but it also brings a highly leveraged balance sheet. In contrast, Nebius received $5.4 billion from the sale of Yandex's Russian assets and began with healthy cash reserves and nearly zero liabilities. Nebius favors moderate growth and relies on cash and small-scale equity financing rather than extensive borrowing. Nebius had net cash of $1.4 billion in the first quarter of 2025 and recently issued $1 billion in convertible bonds to support growth.

However, CoreWeave currently has net debt of about 6.2 billion US dollars, and needs to maintain high gross profit to support interest and principal repayment. Value-oriented investors may appreciate CoreWeave's aggressive growth strategy, but others think Nebius' lightweight balance sheet will bring stronger pricing power and wider profit margins. However, in the short term, Nebius's slow growth rate and relatively poor revenue and customer expansion also contributed to relatively poor stock price performance.

In terms of customer structure, CoreWeave relies on a very small number of large customers. In 2024, 77% of CoreWeave's revenue came from two customers, of which Microsoft (MSFT.US) alone contributed 62%. This shows that it is closely tied to Mingstar AI projects (such as the GPT model that supports OpenAI), making investors optimistic that it has an “indispensable” position.

Nebius, on the other hand, deliberately spread its customers across more than 20 industries. Although no major contracts like OpenAI have been disclosed, there are partners including Genentech, AstraZeneca (AI deployment in the healthcare field), Krisp (AI noise reduction), Chatfuel (chatbot), and telecommunications and robotics companies. Although customer revenue is smaller, they are more diverse and have lower risk, despite the lack of “star contracts” that can set off the market.

Geographic factors also influence mood. CoreWeave is headquartered in the US, is deeply tied to the US AI Laboratory, and claims to be the “computing power pillar of GPT-5”, etc. Although Nebius has entered the US market, it hasn't attracted the attention of US investors until recently. In the past, geopolitical concerns brought about by its Yandex background also dragged down investor sentiment for a while. However, Nebius has completely moved its headquarters to the Netherlands and received support from Western institutional investors including Nvidia and Accel — such as a $700 million private equity round completed by the end of 2024.

Surprisingly, despite heavy capital investment, CoreWeave has achieved a positive adjusted profit before interest, tax, depreciation and amortization (EBITDA). In the first quarter of 2025, the company achieved an adjusted EBITDA of $606 million on revenue of US$978 million, with a profit margin of 62%. Although it is slightly lower than the market's assumption of an overvaluation of AI infrastructure, it shows that it has been able to achieve efficient use and profit in the context of a shortage of GPUs.

Nebius, on the other hand, is still in the heavy investment phase. The adjusted EBITDA for the first quarter of 2025 was -62.6 million US dollars, with a net loss of US$113.6 million. Operating cash flow was negative, and cash reserves fell 41% during the quarter as capital expenditure exceeded $500 million, mainly for hardware purchases. Simply put, Nebius is currently “burning money to expand,” while CoreWeave has a first-mover advantage and ultra-profitable contracts.

This execution gap has caused some investors to take a wait-and-see attitude towards Nebius, waiting for it to reach breakeven. The company expects EBITDA to remain negative for the full year of 2025, but it will be positive in the second half of the year. If this inflection point can be achieved and profit margins continue to be expanded, the valuation gap is expected to close. In the short term, its continued losses and high capital expenditure still limited market sentiment, and its stock price performance lagged behind CoreWeave as a result.

The catalyst driving the revaluation of Nebius

Although it currently lags behind CoreWeave in terms of valuation metrics, Nebius has a number of short-term catalysts that could drive its share price revaluation over the next few quarters. First, the break-even point is imminent. The company's management expects an adjusted EBITDA correction in the second half of 2025, even if only partially achieved, which will be enough to reverse market sentiment.

Second, Nebius' recently issued $1 billion convertible bonds, plus the $1.45 billion in cash, provided it with sufficient growth ammunition without resorting to dilution financing or usury loans, in stark contrast to CoreWeave's high leverage.

Third, Nebius' product roadmap indicates that AI infrastructure customized for specific industries will be released in the future, such as dedicated GPU clusters for bioinformatics, fintech, and telecommunications, which may help it stand out from general cloud vendors.

Furthermore, the company continues to expand in the US market, and a $700 million private placement supported by Nvidia and Accel has strengthened its ecological position and credibility. Winning a large corporate contract from an AI lab or cloud-native company would be an important sign of a reversal of sentiment.

Finally, with no single customer dependency and a layout in more than 20 industries, Nebius is moving towards an increasingly diverse and resilient AI infrastructure platform. If implemented, the market may gradually view it as a “steady compound interest grower” rather than a laggard, releasing a valuation premium.

summed

Nebius has a rare combination of undervalued assets, ample cash reserves, and ongoing execution, making it an “invisible winner” on the AI circuit. As profit inflection points approach and strategic contracts gradually emerge, those patient investors who insist on holding Nebius even after market hype may reap excessive returns.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal