PepsiCo Grapples With Soaring Debt, Negative Cash Flow: 'Nice Activist' Isn't Enough, Says GimmeCredit

PepsiCo Inc. (NASDAQ:PEP) is struggling with deteriorating financial health, marked by rising debt and weak cash flow, and the recent arrival of activist investor Elliott Investment Management is unlikely to provide a near-term solution, according to a research note from GimmeCredit.

Check out PEP’s stock price here.

PepsiCo's Debts Soar Amid Slew Of Acquisitions

The core of the issue lies in PepsiCo’s strained balance sheet. The company has taken on over $6 billion in new debt in the first half of this year alone to fund a series of acquisitions, including deals for poppi, Siete Family Foods, and an increased stake in Celsius.

This follows a $5.5 billion debt increase over the previous two years. According to the report, this spending has far outpaced the company’s ability to generate cash.

Free cash flow was negative in 2022 and 2024 and is projected to be less than $300 million this year—a fraction of the $7.6 billion it expects to pay in dividends. GimmeCredit projects this combination of higher debt and weaker earnings will push PepsiCo’s leverage to 3.0 times its EBITDA by year-end, up from 2.6x.

A ‘Nice Activist’ Is Not Enough?

Elliott, which has taken a $4 billion stake in PepsiCo, is advocating for strategic changes, including the refranchising of its bottling operations and the divestment of underperforming assets.

However, PepsiCo’s management has already indicated it does not see the value in a bottling overhaul, a move Gimme Credit notes could be disruptive and costly in the short term. The firm views Elliott’s push to sell off weaker assets as a more “constructive and a much more likely path.”

See Also: Activist Investor Elliott’s Massive Stake Puts PepsiCo Under Pressure To Break Out Of Slump

GimmeCredit Confirms ‘Underperform’ Rating

These financial pressures are compounded by lackluster operational performance. The report highlights that PepsiCo’s sales volumes have dropped consistently over the past two and a half years, forcing a reliance on price hikes that may become more challenging.

Operating margins have also declined in the last two quarters due to higher marketing expenses, leading Gimme Credit to forecast a modest decline in EBITDA for 2025.

The credit analysis firm confirmed its “underperform” recommendation on the beverage and snack giant, citing fundamental challenges that the activist’s “seemingly friendly position” may not resolve.

Price Action

The stock fell 0.35% on Thursday and rose 0.18% in after-hours. It was down 6.31% year-to-date and 19.43% over the year.

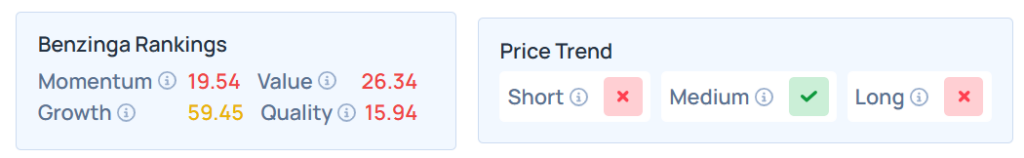

Benzinga’s Edge Stock Rankings indicate that PEP maintains a weaker price trend in the short and long terms but a stronger trend in the medium term. However, the stock’s growth ranking is relatively moderate. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY was up 0.47% at $662.26, while the QQQ advanced 0.90% to $595.32, according to Benzinga Pro data.

On Friday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Wall Street Journal

Wall Street Journal