If You'd Invested $1,000 in BigBear.ai Stock 5 Years Ago, Here's How Much You'd Have Today

Key Points

BigBear.ai benefited immensely from interest in artificial intelligence (AI)-powered stocks.

As a result, the company now trades at high multiples.

Investors may or may not have done well with the stock, depending on when they invested.

BigBear.ai (NYSE: BBAI) is an artificial intelligence (AI)-driven company that specializes in gathering and analyzing data for both national security but also commercial uses. Some of the company's main solutions include cyber threat detection, digital identification, modeling and simulation, and enhanced modeling and screening.

BigBear.ai has captivated investors thanks to its association with the AI revolution and the market's desire to find companies that could benefit from what some are calling the fourth industrial revolution.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

BigBear.ai also has some similarities to another red-hot AI company, Palantir Technologies, so some investors are likely gravitating toward it due to Palantir's incredible returns, and Palantir's financials are much more attractive.

Image source: Getty Images.

If you'd invested $1,000 five years ago

BigBear.ai has received plenty of AI hype, but its financials leave much to be desired. The company has a roughly $1.9 billion market cap, but only reported about $32.5 million of revenue in its most recent quarter and an operating loss of over $90 million.

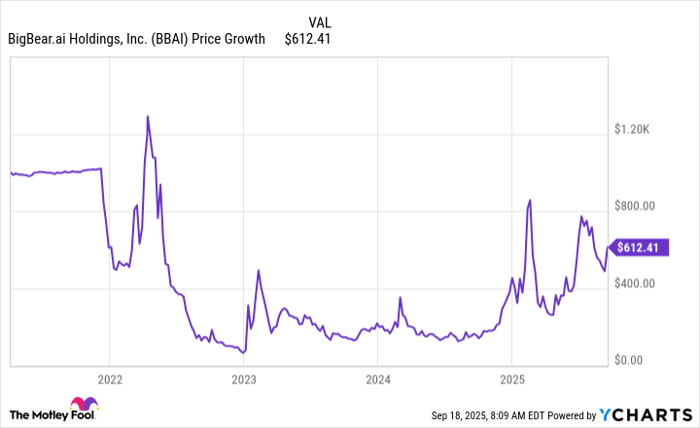

Still, AI enthusiasm over the past year has pushed the stock up over 276%, so a $1,000 investment one year ago would now be worth $3,763. But this article is looking at a five-year investment, which goes back before all the AI hype, when the stock traded more on fundamentals. While investors would have made great money on it if they bought in recent years, they would still be down significantly had they purchased $1,000 of the stock further back. A $1,000 investment made five years ago would be worth $612 right now.

Ultimately, BigBear.ai may keep moving higher if the broader AI sector continues to do well, but the valuation certainly looks stretched right now.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal