AtlasClear Holdings Surges 15% Pre-Market Following $3 Million Strategic Financing Round

AtlasClear Holdings Inc. (NYSE:ATCH) shares are trending on Thursday.

Check out the current price of ATCH stock here.

ATCH experienced explosive pre-market trading, jumping 15.43% to $1.87 per share after announcing the completion of a $3 million financing round from strategic investors.

Financing Details Drive Market Enthusiasm

The Floridan company issued promissory notes with a 20% discount, bringing the total principal amount to $3.6 million. The notes will mature in six months or upon completion of a qualified $10 million equity financing. Dawson James Securities acted as the placement agent for the offering.

See Also: Why Is D-Wave Quantum Stock Spiking After Hours

Strategic Investor Participation

Sixth Borough Capital Management has invested $500,000, marking its second investment following the purchase of a $500,000 debenture last month. “The AtlasClear opportunity has considerably more upside in a shorter period than originally expected,” said Robert D. Keyser Jr., CEO of Dawson James and board director of AtlasClear.

Growth Strategy Implementation

Executive Chairman John Schaible highlighted the need for expansion due to the performance of subsidiary Wilson Davis & Co. “Business growth demands expansion of our capital base to absorb more correspondent clearing business,” Schaible said. The company aims to improve operational efficiency while seeking larger investment opportunities.

Volatile Performance

AtlasClear Holdings has lost 81.03% over the past year but has gained 710.00% in the last month.

The fintech solution has traded between $0.14 and $26.94 over the past year. It has a market cap of $25.40 million and an average daily trading volume of 34.95 million shares.

Price Action: According to Benzinga Pro data, ATCH closed Wednesday at $1.62, marking an 87.37% increase.

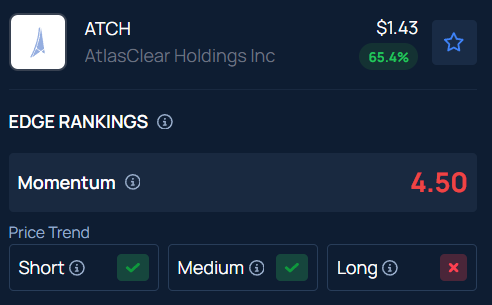

Benzinga’s Edge Stock Rankings indicate that ATCH is experiencing long-term consolidation along with medium and short-term upward movement. Know how its momentum lines up with other well-known names.

Read Next:

Photo: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Wall Street Journal

Wall Street Journal