Will Coca-Cola’s (KO) Digital Push Offset Investor Skepticism About Its Growth Trajectory?

- In the past week, Coca-Cola experienced a period of underperformance compared to broader market indexes, as investors reassessed its valuation and growth prospects amid a lack of significant headline events.

- This renewed focus has highlighted both skepticism over the company's recent momentum and optimism around its ongoing digital transformation and emerging markets initiatives.

- We'll explore how Coca-Cola's increased emphasis on technology and data-driven operations could impact its long-term growth thesis.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Coca-Cola Investment Narrative Recap

To own Coca-Cola, an investor typically needs confidence in its global brand strength, resilient cash flows, and capacity for incremental growth, particularly in emerging markets. The recent period of underperformance does not materially shift the biggest short-term catalyst, ongoing digital transformation and expansion in developing economies, nor the prevailing risk: evolving global health trends and regulatory scrutiny around sugar-sweetened beverages.

Among recent announcements, Coca-Cola’s reaffirmed commitment to digital transformation and technology-driven operations is especially relevant, as it ties directly to the company’s principal growth drivers. This increased use of data and AI in operations and consumer engagement could help support long-term growth targets, although near-term sentiment remains cautious with technical support levels being monitored by institutional investors.

Yet, in contrast to these growth initiatives, investors should be aware that key challenges like consumer health trends and potential regulatory changes could still...

Read the full narrative on Coca-Cola (it's free!)

Coca-Cola's narrative projects $55.1 billion in revenue and $14.8 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $2.6 billion earnings increase from $12.2 billion currently.

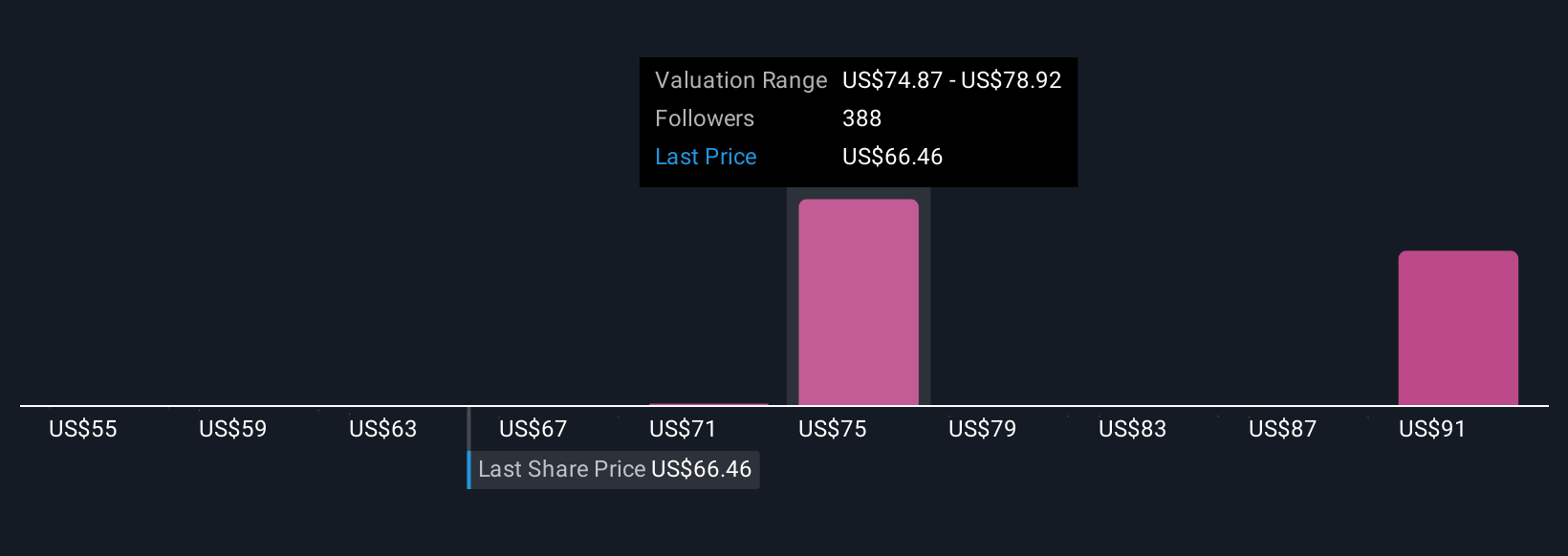

Uncover how Coca-Cola's forecasts yield a $78.70 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 24 fair value estimates for Coca-Cola ranging from US$54.61 to US$95.13 per share. While many believe digital innovation will drive expansion, opinions vary on how regulatory risks might affect future returns, so consider reviewing multiple viewpoints before making any decisions.

Explore 24 other fair value estimates on Coca-Cola - why the stock might be worth as much as 44% more than the current price!

Build Your Own Coca-Cola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Coca-Cola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal